Name

动量随机平滑移动平均策略Stochastic-Moving-Average-Strategy

Author

ChaoZhang

Strategy Description

该策略将指数移动平均线(EMA)与随机指标(Stochastic Oscillator)相结合,采用趋势追随与延续方式,同时还具有一些很酷的功能。我专门为交易替代币设计了这个策略,但它同样适用于比特币本身和一些外汇交易对。

该策略有4个开启交易信号的必要条件。以下是开启做多交易的条件(平仓信号刚好相反):

- 快速EMA高于慢速EMA

- 随机K线处于超买区域

- 随机K线向上穿过随机D线

- 价格收盘于慢速EMA和快速EMA之间

一旦所有条件为真,下一根K线开盘时就会开仓。

该策略结合EMA和随机指标的优势,能够有效地捕捉趋势的开始和延续,适合中长线操作。同时策略提供多种可自定义的参数,用户可以根据自己的交易风格和市场特征进行调整。

具体来说,策略的优势有:

- EMA交叉判断趋势方向,增强信号的稳定性和可靠性

- 随机指标判断是否超买超卖,寻找反转机会

- 结合两种指标,既有趋势跟随,又有逆势交易

- ATR自动计算止损距离,止损随市场波动性调整

- 可自定义风险回报比,满足不同用户需求

- 提供多种参数自定义,用户可根据市场调整

该策略主要的风险来源于:

- EMA交叉形成的信号可能出现假突破,从而产生错误信号

- 随机指标本身有滞后性,可能错过价格反转的最佳时机点

- 单一策略无法完全适应市场多变的环境

为降低上述风险,可采取以下措施:

- 适当调整EMA周期参数,避免产生过多假信号

- 结合更多指标判断趋势和支撑位,确保交易信号可靠性

- 制定清晰的资金管理策略,控制每次交易的风险敞口

- 采用复合策略,不同策略可以互相验证信号,提高稳定性

该策略可以从以下几个方面进一步优化:

- 增加基于波动率的持仓调整模块。当市场波动加剧时,适当减小头寸;当波动减弱,可放大头寸。

- 增加对大级别趋势的判断,避免逆势操作。例如结合每日或每周K线判断趋势方向。

- 增加机器学习模型判断买卖信号。可以针对历史数据训练分类模型,辅助产生交易信号。

- 优化资金管理策略模块,使止损和 Position Size 更加智能。

该策略整合了趋势跟随和反转交易的优点,既考虑大级别的市场环境,又关注当下价格行为,是一款值得长期跟踪实盘的有效策略。通过持续优化参数设置、增加趋势判断模块等手段,策略的表现还具有很大提升空间,值得投入更多研发精力。

||

This strategy combines Exponential Moving Average (EMA) with Stochastic Oscillator in a trend following and continuation manner, along with some cool functionalities. I designed this strategy especially for trading altcoins, but it works just as good on Bitcoin itself and some Forex pairs.

The strategy has 4 mandatory conditions to unlock a trading signal. Find these conditions for a long trade below (works the exact other way round for shorts)

- Fast EMA must be higher than Slow EMA

- Stochastic K% line must be in overbought territory

- Stochastic K% line must cross over Stochastic D% line

- Price as to close between slow EMA and fast EMA Once all the conditions are true, a trade will start at the opening of the next candle.

The strategy combines the advantages of EMA and Stochastic to effectively capture the start and continuation of trends, suitable for medium and long term operations. At the same time, the strategy provides many customizable parameters for users to adjust based on their trading style and market characteristics.

Specifically, the advantages of the strategy include:

- EMA crossings judge trend direction and enhance signal stability and reliability

- Stochastic judges overbought and oversold levels to find reversal opportunities

- Combining two indicators, it has both trend following and mean reversion

- ATR automatically calculates stop loss distance, adjusting stops based on market volatility

- Customizable risk reward ratio to meet needs of different users

- Provides multiple customizable parameters for users to adjust based on markets

The main risks of this strategy come from:

- EMA crossings may have false breaks, thus generating incorrect signals

- Stochastic itself has lagging properties, may miss best timing for price reversals

- A single strategy cannot fully adapt to constantly changing market environments

To mitigate above risks, we can take following measures:

- Adjust EMA period parameters to avoid too many false signals

- Incorporate more indicators to judge trends and support levels to ensure reliable signals

- Define clear money management strategies to control risk exposure per trade

- Adopt combinational strategies so different strategies can verify signals and improve stability

The strategy can be further optimized in following aspects:

- Add volatility based position adjustment module. Reduce size when volatility surges and increase when calms down.

- Add judgement of higher timeframe trends to avoid counter trend operations, e.g. combining daily or weekly trends.

- Add machine learning models to aid signal generation. Train classification models based on historical data.

- Optimize money management modules to make stops and sizes more intelligent.

This strategy integrates the pros of both trend following and mean reversion, considering both higher timeframe market environments and current price behaviors. It is an effective strategy worth real time tracking and testing. Through continuous optimization on parameters, adding trend judgement modules etc, there is still large room for performance improvement, worth pouring in more research efforts.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_bool_1 | true | (? Trade Setup)Long Trades |

| v_input_bool_2 | true | Short Trades |

| v_input_float_1 | true | Risk : Reward |

| v_input_bool_3 | false | Risk = % Equity |

| v_input_float_2 | true | riskPrctEqui |

| v_input_bool_4 | false | Risk = $ Amount |

| v_input_float_3 | 1000 | riskUSD |

| v_input_float_4 | true | (? Stop Loss)ATR Multiplier |

| v_input_int_1 | 14 | ATR Lookback |

| v_input_int_2 | 14 | (? Stochastic)K% |

| v_input_int_3 | 3 | D% |

| v_input_int_4 | 80 | OB |

| v_input_int_5 | 20 | OS |

| v_input_int_6 | false | Stoch. OB/OS lookback |

| v_input_bool_5 | false | All must be OB/OS |

| v_input_color_1 | #00ffff | |

| v_input_color_2 | #333333 | |

| v_input_int_7 | 50 | |

| v_input_int_8 | 21 | (? Exp. Moving Average)Fast EMA |

| v_input_int_9 | 50 | Slow EMA |

| v_input_color_3 | #0066ff | |

| v_input_color_4 | #0000ff | |

| v_input_bool_6 | false | (? Reference Market)Reference Market Filter |

| v_input_1 | BTC_USDT:swap | Market |

| v_input_timeframe_1 | 30 | Timeframe |

| v_input_int_10 | 50 | EMA Length |

Source (PineScript)

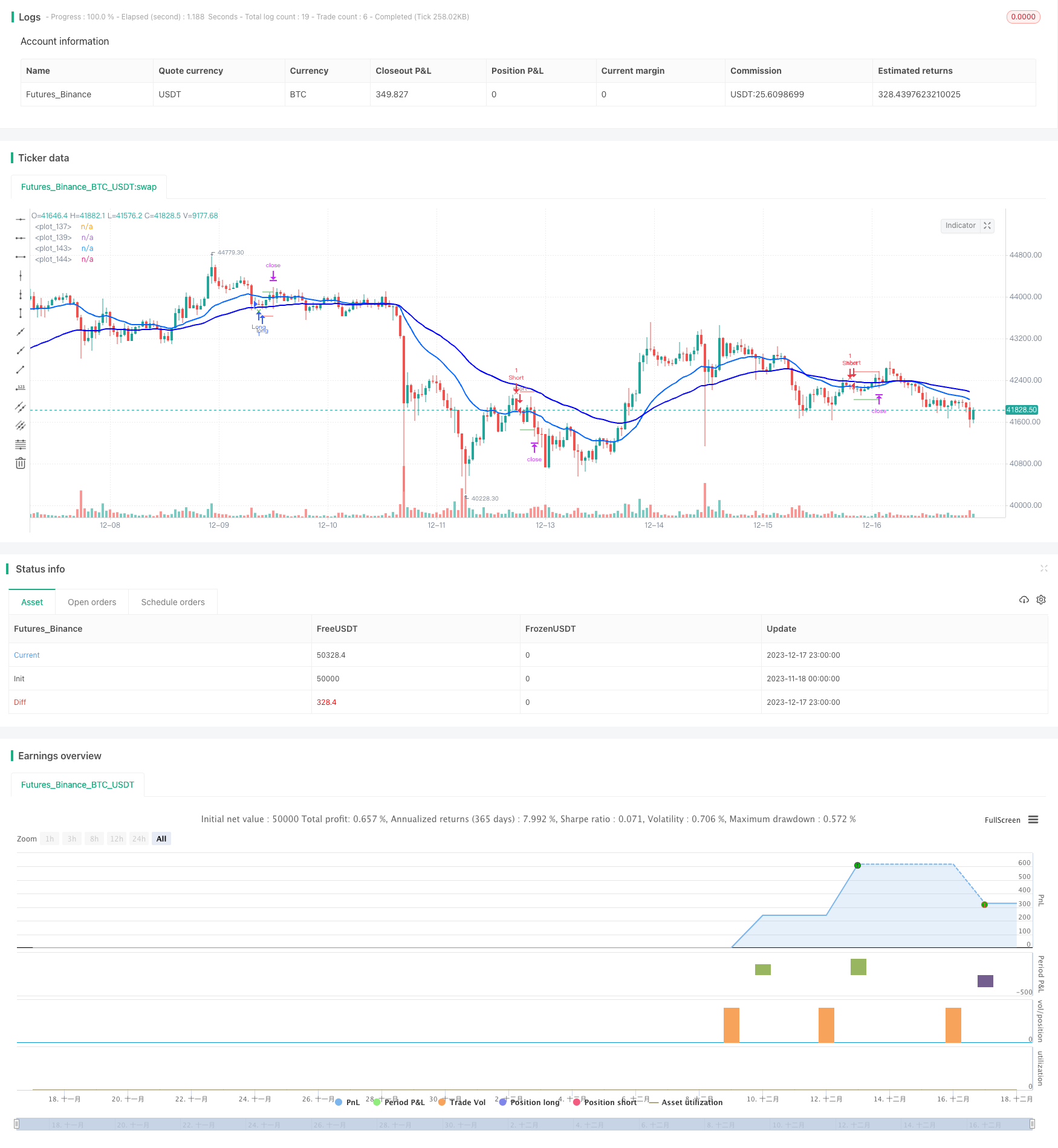

/*backtest

start: 2023-11-18 00:00:00

end: 2023-12-18 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © LucasVivien

// Since this Strategy may have its stop loss hit within the opening candle, consider turning on 'Recalculate : After Order is filled' in the strategy settings, in the "Properties" tabs

//@version=5

strategy("Stochastic Moving Average", shorttitle="Stoch. EMA", overlay=true, default_qty_type= strategy.cash, initial_capital=10000, default_qty_value=100)

//==============================================================================

//============================== USER INPUT ================================

//==============================================================================

var g_tradeSetup = " Trade Setup"

activateLongs = input.bool (title="Long Trades" , defval=true , inline="A1", group=g_tradeSetup, tooltip="")

activateShorts = input.bool (title="Short Trades" , defval=true , inline="A1", group=g_tradeSetup, tooltip="")

rr = input.float(title="Risk : Reward" , defval=1 , minval=0, maxval=100 , step=0.1, inline="" , group=g_tradeSetup, tooltip="")

RiskEquity = input.bool (title="Risk = % Equity ", defval=false , inline="A2", group=g_tradeSetup, tooltip="Set stop loss size as a percentage of 'Initial Capital' -> Strategy Parameter -> Properties tab (Low liquidity markets will affect will prevent to get an exact amount du to gaps)")

riskPrctEqui = input.float(title="" , defval=1 , minval=0, maxval=100 , step=0.1, inline="A2", group=g_tradeSetup, tooltip="")

RiskUSD = input.bool (title="Risk = $ Amount " , defval=false , inline="A3", group=g_tradeSetup, tooltip="Set stop loss size as a fixed Base currency amount (Low liquidity markets will affect will prevent to get an exact amount du to gaps)")

riskUSD = input.float(title="" , defval=1000, minval=0, maxval=1000000000, step=100, inline="A3", group=g_tradeSetup, tooltip="")

var g_stopLoss = " Stop Loss"

atrMult = input.float(title="ATR Multiplier", defval=1 , minval=0, maxval=100 , step=0.1, tooltip="", inline="", group=g_stopLoss)

atrLen = input.int (title="ATR Lookback" , defval=14, minval=0, maxval=1000, step=1 , tooltip="", inline="", group=g_stopLoss)

var g_stochastic = " Stochastic"

Klen = input.int (title="K%" , defval=14, minval=0, maxval=1000, step=1, inline="S2", group=g_stochastic, tooltip="")

Dlen = input.int (title=" D%" , defval=3 , minval=0, maxval=1000, step=1, inline="S2", group=g_stochastic, tooltip="")

OBstochLvl = input.int (title="OB" , defval=80, minval=0, maxval=100 , step=1, inline="S1", group=g_stochastic, tooltip="")

OSstochLvl = input.int (title=" OS" , defval=20, minval=0, maxval=100 , step=1, inline="S1", group=g_stochastic, tooltip="")

OBOSlookback = input.int (title="Stoch. OB/OS lookback", defval=0 , minval=0, maxval=100 , step=1, inline="" , group=g_stochastic, tooltip="This option allow to look 'x' bars back for a value of the Stochastic K line to be overbought or oversold when detecting an entry signal (if 0, looks only at current bar. if 1, looks at current and previous and so on)")

OBOSlookbackAll = input.bool (title="All must be OB/OS" , defval=false , inline="" , group=g_stochastic, tooltip="If turned on, all bars within the Stochastic K line lookback period must be overbought or oversold to return a true signal")

entryColor = input.color(title=" " , defval=#00ffff , inline="S3", group=g_stochastic, tooltip="")

baseColor = input.color(title=" " , defval=#333333 , inline="S3", group=g_stochastic, tooltip="Will trun to designated color when stochastic gets to opposite extrem zone of current trend / Number = transparency")

transp = input.int (title=" " , defval=50, minval=0, maxval=100, step=10, inline="S3", group=g_stochastic, tooltip="")

var g_ema = " Exp. Moving Average"

ema1len = input.int (title="Fast EMA ", defval=21, minval=0, maxval=1000, step=1, inline="E1", group=g_ema, tooltip="")

ema2len = input.int (title="Slow EMA ", defval=50, minval=0, maxval=1000, step=1, inline="E2", group=g_ema, tooltip="")

ema1col = input.color(title=" " , defval=#0066ff , inline="E1", group=g_ema, tooltip="")

ema2col = input.color(title=" " , defval=#0000ff , inline="E2", group=g_ema, tooltip="")

var g_referenceMarket =" Reference Market"

refMfilter = input.bool (title="Reference Market Filter", defval=false , inline="", group=g_referenceMarket)

market = input (title="Market" , defval="BTC_USDT:swap", inline="", group=g_referenceMarket)

res = input.timeframe(title="Timeframe" , defval="30" , inline="", group=g_referenceMarket)

len = input.int (title="EMA Length" , defval=50 , inline="", group=g_referenceMarket)

//==============================================================================

//========================== FILTERS & SIGNALS =============================

//==============================================================================

//------------------------------ Stochastic --------------------------------

K = ta.stoch(close, high, low, Klen)

D = ta.sma(K, Dlen)

stochBullCross = ta.crossover(K, D)

stochBearCross = ta.crossover(D, K)

OSstoch = false

OBstoch = false

for i = 0 to OBOSlookback

if K[i] < OSstochLvl

OSstoch := true

else

if OBOSlookbackAll

OSstoch := false

for i = 0 to OBOSlookback

if K[i] > OBstochLvl

OBstoch := true

else

if OBOSlookbackAll

OBstoch := false

//---------------------------- Moving Averages -----------------------------

ema1 = ta.ema(close, ema1len)

ema2 = ta.ema(close, ema2len)

emaBull = ema1 > ema2

emaBear = ema1 < ema2

//---------------------------- Price source --------------------------------

bullRetraceZone = (close < ema1 and close >= ema2)

bearRetraceZone = (close > ema1 and close <= ema2)

//--------------------------- Reference market -----------------------------

ema = ta.ema(close, len)

emaHTF = request.security(market, res, ema [barstate.isconfirmed ? 0 : 1])

closeHTF = request.security(market, res, close[barstate.isconfirmed ? 0 : 1])

bullRefMarket = (closeHTF > emaHTF or closeHTF[1] > emaHTF[1])

bearRefMarket = (closeHTF < emaHTF or closeHTF[1] < emaHTF[1])

//-------------------------- SIGNAL VALIDATION -----------------------------

validLong = stochBullCross and OSstoch and emaBull and bullRetraceZone

and activateLongs and (refMfilter ? bullRefMarket : true) and strategy.position_size == 0

validShort = stochBearCross and OBstoch and emaBear and bearRetraceZone

and activateShorts and (refMfilter ? bearRefMarket : true) and strategy.position_size == 0

//==============================================================================

//=========================== STOPS & TARGETS ==============================

//==============================================================================

SLdist = ta.atr(atrLen) * atrMult

longSL = close - SLdist

longSLDist = close - longSL

longTP = close + (longSLDist * rr)

shortSL = close + SLdist

shortSLDist = shortSL - close

shortTP = close - (shortSLDist * rr)

var SLsaved = 0.0

var TPsaved = 0.0

if validLong or validShort

SLsaved := validLong ? longSL : validShort ? shortSL : na

TPsaved := validLong ? longTP : validShort ? shortTP : na

//==============================================================================

//========================== STRATEGY COMMANDS =============================

//==============================================================================

if validLong

strategy.entry("Long", strategy.long,

qty = RiskEquity ? ((riskPrctEqui/100)*strategy.equity)/longSLDist : RiskUSD ? riskUSD/longSLDist : na)

if validShort

strategy.entry("Short", strategy.short,

qty = RiskEquity ? ((riskPrctEqui/100)*strategy.equity)/shortSLDist : RiskUSD ? riskUSD/shortSLDist : na)

strategy.exit(id="Long Exit" , from_entry="Long" , limit=TPsaved, stop=SLsaved, when=strategy.position_size > 0)

strategy.exit(id="Short Exit", from_entry="Short", limit=TPsaved, stop=SLsaved, when=strategy.position_size < 0)

//==============================================================================

//============================= CHART PLOTS ================================

//==============================================================================

//---------------------------- Stops & Targets -----------------------------

plot(strategy.position_size != 0 or (strategy.position_size[1] != 0 and strategy.position_size == 0) ? SLsaved : na,

color=color.red , style=plot.style_linebr)

plot(strategy.position_size != 0 or (strategy.position_size[1] != 0 and strategy.position_size == 0) ? TPsaved : na,

color=color.green, style=plot.style_linebr)

//--------------------------------- EMAs -----------------------------------

l1 = plot(ema1, color=#0066ff, linewidth=2)

l2 = plot(ema2, color=#0000ff, linewidth=2)

//-------------------------- Stochastic gradient ---------------------------

// fill(l1, l2, color.new(color.from_gradient(K, OSstochLvl, OBstochLvl,

// emaBull ? entryColor : emaBear ? baseColor : na,

// emaBull ? baseColor : emaBear ? entryColor : na), transp))

//---------------------------- Trading Signals -----------------------------

plotshape(validLong, color=color.green, location=location.belowbar, style=shape.xcross, size=size.small)

plotshape(validShort, color=color.red , location=location.abovebar, style=shape.xcross, size=size.small)

//---------------------------- Reference Market ----------------------------

bgcolor(bullRefMarket and refMfilter ? color.new(color.green,90) : na)

bgcolor(bearRefMarket and refMfilter ? color.new(color.red ,90) : na)

Detail

https://www.fmz.com/strategy/435848

Last Modified

2023-12-19 11:41:40