Name

华金斯蛇吻风云量化策略Byron-Serpent-Cloud-Quant-Strategy

Author

ChaoZhang

Strategy Description

华金斯蛇吻风云量化策略主要结合一云图指标和随机指标RSI,通过对二者指标信号判断的加权,构建量化交易策略信号,实现对证券品种的自动化交易。该策略综合考虑了不同强度一云图指标信号和StochRSI指标信号,通过设定权重,使交易决策更加平滑和稳定。

该策略使用一云图中的转换线、基准线、先行1和先行2等指标与StochRSI中的K线和D线进行组合。一云图部分,如果转換线高于基准线且先行1高于先行2为强势做多信号,如果转換线低于基准线且先行1低于先行2为强势做空信号。此外,转換线高于或低于基准线也可产生做多或做空的弱势信号。StochRSI部分,如果K线高于D线且K线低于超买线且D线低于超买线为StochRSI做多信号,如果K线低于D线且K线高于超卖线且D线高于超卖线为StochRSI做空信号。通过给不同强度的一云图信号和StochRSI信号设定不同的权重,并与一个决策权重值进行比较,当超过决策权重值时形成最终的做多或做空信号。

该策略结合使用一云图和StochRSI两个指标,能够同时判断趋势方向和超买超卖情况,信号更加全面和可靠。相较于单一使用某一个指标,能够减少错误信号的产生。一云图指标对中长线趋势判断比较准确,StochRSI指标可以测量短期的超买超卖现象,二者相结合使策略适用于不同周期。加入决策权重的设计也使策略信号更加平稳可靠。总体来说,该策略可以自动判断市场趋势转变点,并产生交易信号,具有操作简单,适用面广,信号稳定等优点。

该策略最大的风险在于一云图和StochRSI指标都可能产生错误信号,特别是在震荡行情中,会增加不必要的交易次数。此外,权重和参数值的设定也会对策略的效果产生很大影响。如果权重设定不当,可能会错过重要信号或者产生过多错误信号。一些关键参数如RSI长度、Stoch长度等也需要针对不同品种和市场环境进行测试和优化,否则会影响策略效果。最后,数据问题也可能成为策略风险,如果数据质量不佳,也会使指标和信号产生偏差。

该策略还具有很大的优化空间。第一,可以考虑加入更多指标,如布林线,KD指标等,使信号判断更加全面。第二,可以使用机器学习或遗传算法等方法自动优化参数,而不是使用固定参数,使策略更加智能化和适应性强。第三,可以研究如何改进指标算法,以减少错误信号的产生。第四,权重设定机制也可以进一步优化,如加大强势信号的权重。第五,可以针对更多品种或子市场进行参数和规则优化,以适应不断变化的市场环境。

华金斯蛇吻风云量化策略结合使用了一云图和StochRSI两个指标,通过加权和参数设计形成交易信号,能够自动捕捉市场的趋势转变,对不同品种和周期都具有很好的适应性,是一套值得深入研究和应用的量化策略。该策略也具有进一步扩展和优化的潜力,如引入更多指标和技术手段等,有望获得更好的交易效果。

||

Byron Serpent Cloud Quant Strategy mainly combines Ichimoku indicators and the random indicator RSI to construct quantitative trading strategy signals by weighting the judgments of the two indicators, thereby achieving automated trading of securities varieties. This strategy comprehensively considers Ichimoku indicator signals and StochRSI signals of different intensities, and smooths and stabilizes trading decisions by setting weights.

This strategy uses indicators such as conversion lines, base lines, lead 1 and lead 2 in Ichimoku, combined with K lines and D lines in StochRSI. On the Ichimoku side, if the conversion line is above the baseline and lead 1 is above lead 2, it is a bullish signal. If the conversion line is below the baseline and lead 1 is below lead 2, it is a strong bearish signal. In addition, if the conversion line is above or below the baseline, it can also generate weak bullish or bearish signals. On the StochRSI side, if K line is above D line and K line is below the overbought line and D line is below the overbought line, it is a StochRSI buy signal. If K line is below D line and K line is above oversold line and D line is above oversold line, it is a StochRSI sell signal. By setting different weights for Ichimoku signals and StochRSI signals of different strengths, and comparing them with a decision weight value, final buy or sell signals are generated when exceeding the decision weight value.

This strategy combines Ichimoku and StochRSI indicators to simultaneously determine trend direction and overbought/oversold conditions for more comprehensive and reliable signals. Compared to using a single indicator, it can reduce the generation of false signals. The Ichimoku indicator is quite accurate in judging medium and long term trends, while the StochRSI indicator can measure short-term overbought/oversold phenomena, allowing the strategy to be suitable for different cycles. The design of adding decision weights also makes the strategy signals smoother and more reliable. Overall, this strategy can automatically determine turning points in market trends and generate trading signals with advantages such as easy operation, wide applicability and stable signals.

The biggest risk of this strategy is that both Ichimoku and StochRSI indicators may generate false signals, especially in range-bound markets, which will increase unnecessary trades. In addition, the setting of weights and parameter values will also have a great impact on the effectiveness of the strategy. If the weights are set improperly, important signals may be missed or too many false signals may be generated. Some key parameters such as RSI length and Stoch length also need to be tested and optimized for different varieties and market environments, otherwise it will affect the strategy. Finally, data problems can also become risks to the strategy. If the data quality is not good, it will also cause deviations in indicators and signals.

This strategy also has great optimization potential. First, consider adding more indicators such as Bollinger Bands and KD to make signal judgment more comprehensive. Second, use machine learning or genetic algorithms to automatically optimize parameters instead of using fixed parameters to make strategies more intelligent and adaptive. Third, research how to improve the indicator algorithms to reduce the generation of false signals. Fourth, the weight setting mechanism can also be further optimized, such as increasing the weight of strong signals. Fifth, parameters and rules can be optimized for more varieties or submarkets to adapt to the ever changing market environment.

Byron Serpent Cloud Quant Strategy combines Ichimoku and StochRSI indicators to form trading signals through weighting and parameter design, which can automatically capture the trend changes of the market and has good adaptability to different varieties and cycles. It is a set of quantitative strategies worth in-depth research and application. The strategy also has the potential for further expansion and optimization, such as introducing more indicators and techniques, and is expected to achieve better trading results.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | 50 | BUY/SELL decision weight |

| v_input_2 | 35 | Ichimoku strong weight |

| v_input_3 | 20 | Ichimoku standard weight |

| v_input_4 | 20 | Ichimoku weak weight |

| v_input_5 | 30 | Stoch RSI weight |

| v_input_6 | 9 | Conversion Line Periods |

| v_input_7 | 26 | Base Line Periods |

| v_input_8 | 52 | Lagging Span 2 Periods |

| v_input_9 | 5 | Displacement |

| v_input_10 | 8 | lengthRSI |

| v_input_11 | 5 | lengthStoch |

| v_input_12 | 3 | smoothK |

| v_input_13 | 3 | smoothD |

| v_input_14 | 20 | OverSold |

| v_input_15 | 80 | OverBought |

Source (PineScript)

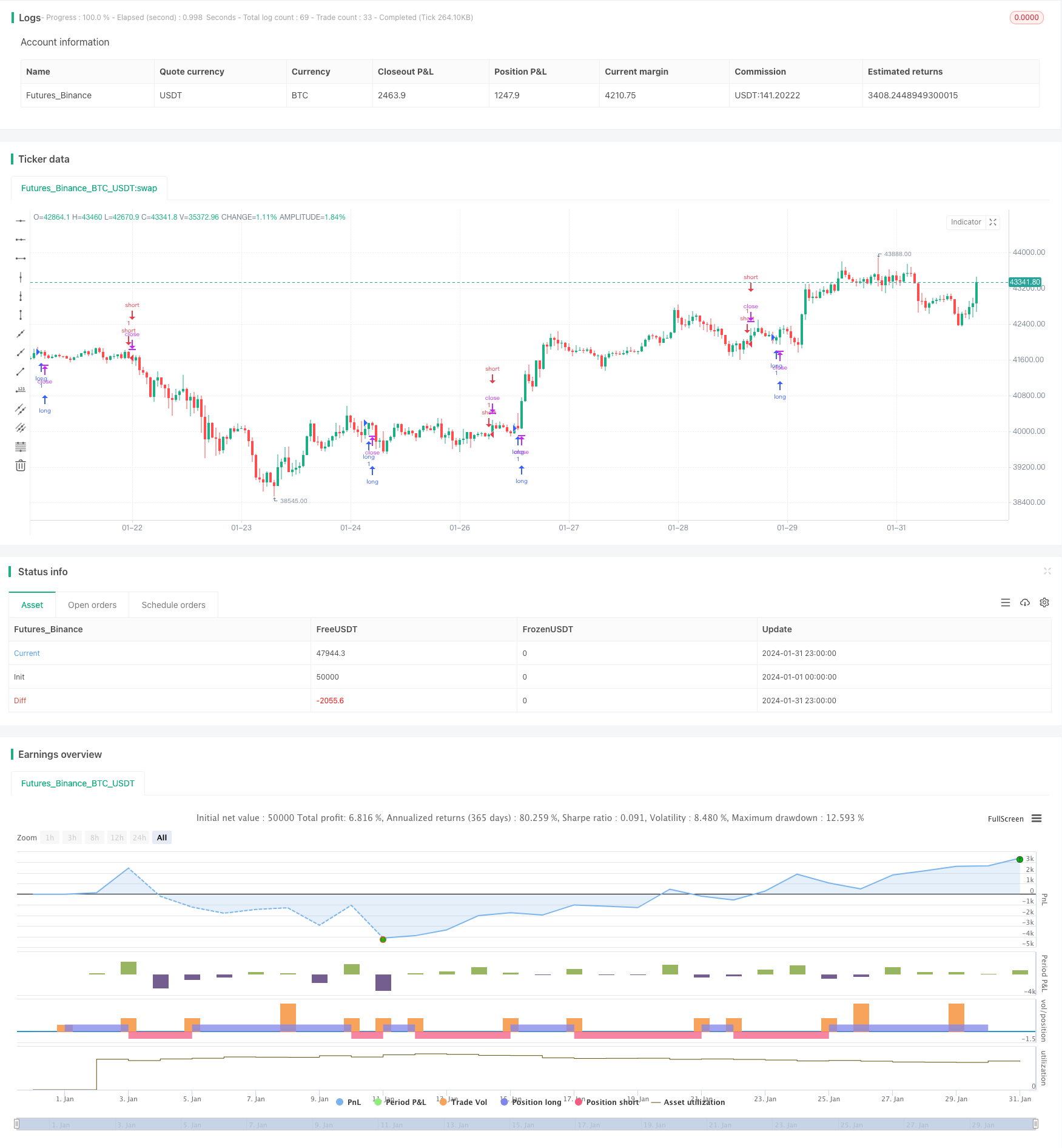

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

strategy("Baracuda Ichimoku/StochRSI Strategy", overlay=true)

DecisionWeight = input(50, minval = 0, title="BUY/SELL decision weight")

ichimokuStrong = input(35, minval = 0, title="Ichimoku strong weight")

ichimokuStandard = input(20, minval = 0, title="Ichimoku standard weight")

ichimokuWeak = input(20, minval = 0, title="Ichimoku weak weight")

stochRSIWweak = input(30, minval = 0, title="Stoch RSI weight")

conversionPeriods = input(9, minval=1, title="Conversion Line Periods")

basePeriods = input(26, minval=1, title="Base Line Periods")

laggingSpan2Periods = input(52, minval=1, title="Lagging Span 2 Periods")

displacement = input(5, minval=1, title="Displacement")

donchian(len) => avg(lowest(len), highest(len))

conversionLine = donchian(conversionPeriods)

baseLine = donchian(basePeriods)

leadLine1 = avg(conversionLine, baseLine)

leadLine2 = donchian(laggingSpan2Periods)

lengthRSI = input(8, minval=8) //14

lengthStoch = input(5, minval=5)//14

smoothK = input(3,minval=3)

smoothD = input(3,minval=3)

OverSold = input(20)

OverBought = input(80)

rsi1 = rsi(close, lengthRSI)

k = sma(stoch(rsi1, rsi1, rsi1, lengthStoch), smoothK)

d = sma(k, smoothD)

stronglong = conversionLine > baseLine and leadLine1 > leadLine2

strongshort = conversionLine < baseLine and leadLine1 < leadLine2

weaklong = conversionLine > baseLine

weakshort = conversionLine < baseLine

RSIlong = k > d and k < OverSold and d < OverSold

RSIshort = k < d and k > OverBought and d > OverBought

long=(((stronglong ? 1:0)*ichimokuStrong) + ((weaklong? 1:0)*ichimokuWeak) + ((RSIlong? 1:0)*stochRSIWweak)) > DecisionWeight

short=(((strongshort? 1:0)*ichimokuStrong) + ((weakshort? 1:0)*ichimokuWeak) + ((RSIshort? 1:0)*stochRSIWweak)) > DecisionWeight

strategy.entry("long", strategy.long, when=long)

strategy.entry("short", strategy.short, when=short)

Detail

https://www.fmz.com/strategy/442006

Last Modified

2024-02-18 15:36:22