Name

双指标量化策略Dual-Indicator-Quantitative-Strategy

Author

ChaoZhang

Strategy Description

该策略通过结合123反转指标和RAVI指标来产生交易信号。其中,123反转属于反转型策略,利用股票价格连续两天走势判断未来价格走势。RAVI指标则判断价格是否进入超买超卖区间。策略通过两者信号的综合判断来决定做多做空。

该指标基于随机指标K值。具体来说,当前日收盘价低于前两日,且9日随机慢线低于50时做多。当前日收盘价高于前两日,且9日随机快线高于50时做空。这样通过反转点确认进场。

该指标通过快线和慢线的离差来判断买卖。具体为,7日均线和65日均线离差,当大于某一参数时做多,小于某一参数时做空。通过快慢线金叉死叉来判断超买超卖区间。

当123反转和RAVI同向做多做空时产生信号。做多信号为两指标同为1,做空信号为两指标同为-1。这样通过双重指标确认,避免单一指标的错误信号。

- 利用两种指标进行组合,可以提高信号准确性,避免错误信号

- 123反转采用K线信息,RAVI采用均线信息,多角度判断市场

- RAVI参数可调,可以针对不同品种和市场环境优化

- 反转加趋势,既可以捕捉反转也可以跟随趋势

- 双重指标组合,容易产生信号不一致。可以考虑价差参数,当两指标价差在某参数内也可出信号

- 123反转属于高频策略,需要 Combine 与其他低频策略,降低交易频率

- RAVI擅长捕捉中长线趋势, Combine 短线指标可提高策略抗风险能力

该策略综合考虑反转因素和趋势因素,通过双指标确认减少错误信号发出概率。下一步,可以引入机器学习算法,实现自适应参数优化。或考虑策略组合,与其他策略类型形成组合,在保持收益的同时降低最大回撤。

||

This strategy generates trading signals by combining the 123 Reversal indicator and the RAVI indicator. The 123 Reversal belongs to the reversal type strategy, using the price movement in the last two days to determine future price trends. The RAVI indicator determines whether the price has entered the overbought or oversold zone. The strategy decides to go long or short based on the combined signals from both indicators.

This indicator is based on the K value of the Stochastic indicator. Specifically, it goes long when the close price today is lower than the previous two days and the 9-day slow stochastic line is lower than 50. It goes short when the close price today is higher than the previous two days and the 9-day fast stochastic line is higher than 50. So it enters based on reversal points confirmation.

This indicator generates signals by calculating the difference between fast and slow moving averages. Specifically, the difference between 7-day MA and 65-day MA. It goes long when the difference is greater than a threshold and goes short when lower than a threshold. So overbought and oversold areas can be identified when fast and slow MAs crossover.

A signal is generated when 123 Reversal and RAVI agree on the direction. The long signal is triggered when both indicators show 1 and the short signal is triggered when both show -1. This dual confirmation avoids wrong signals from a single indicator.

- Combining two indicators improves signal accuracy and avoids false signals

- 123 Reversal uses price data and RAVI uses moving average data to determine trends from multiple perspectives

- The parameters of RAVI are adjustable and can be optimized for different products and market environments

- The combination of reversal and trend allows catching both reversals and trends

- Dual indicators combination can sometimes lead to conflicting signals. A price deviation parameter can be introduced to trigger signals when the price deviation between the two indicators is within a threshold

- 123 Reversal is a high frequency strategy. It should be combined with other low frequency strategies to lower trading frequency

- RAVI is good at catching medium to long term trends. Combining with short-term indicators can enhance risk management

The strategy considers both reversal and trend factors. Dual confirmation helps avoid false signals. Next steps could be introducing machine learning algorithms for adaptive parameter optimization. Or combining this strategy with other strategy types to achieve portfolio diversification while maintaining profits and reducing maximum drawdowns.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | true | ---- 123 Reversal ---- |

| v_input_2 | 14 | Length |

| v_input_3 | true | KSmoothing |

| v_input_4 | 3 | DLength |

| v_input_5 | 50 | Level |

| v_input_6 | true | ---- Range Action Verification Index (RAVI) ---- |

| v_input_7 | 7 | Length MA Fast |

| v_input_8 | 65 | Length MA Slow |

| v_input_9 | 0.14 | TradeLine |

| v_input_10 | false | Trade reverse |

Source (PineScript)

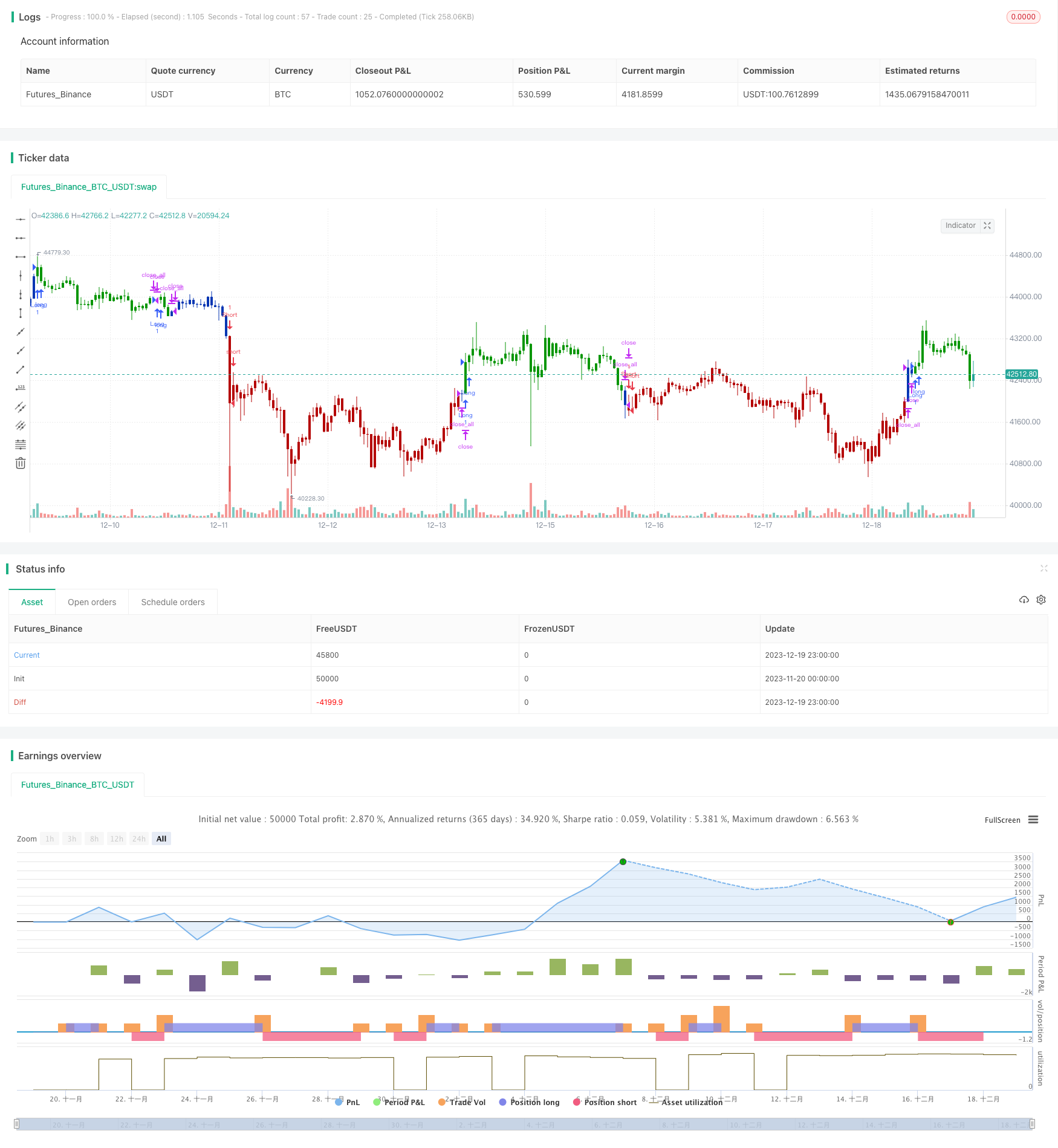

/*backtest

start: 2023-11-20 00:00:00

end: 2023-12-20 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 31/05/2021

// This is combo strategies for get a cumulative signal.

//

// First strategy

// This System was created from the Book "How I Tripled My Money In The

// Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

// The strategy buys at market, if close price is higher than the previous close

// during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

// The strategy sells at market, if close price is lower than the previous close price

// during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

//

// Second strategy

// The indicator represents the relative convergence/divergence of the moving

// averages of the financial asset, increased a hundred times. It is based on

// a different principle than the ADX. Chande suggests a 13-week SMA as the

// basis for the indicator. It represents the quarterly (3 months = 65 working days)

// sentiments of the market participants concerning prices. The short moving average

// comprises 10% of the one and is rounded to seven.

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

Reversal123(Length, KSmoothing, DLength, Level) =>

vFast = sma(stoch(close, high, low, Length), KSmoothing)

vSlow = sma(vFast, DLength)

pos = 0.0

pos := iff(close[2] < close[1] and close > close[1] and vFast < vSlow and vFast > Level, 1,

iff(close[2] > close[1] and close < close[1] and vFast > vSlow and vFast < Level, -1, nz(pos[1], 0)))

pos

RAVI(LengthMAFast, LengthMASlow, TradeLine) =>

pos = 0.0

xMAF = sma(close, LengthMAFast)

xMAS = sma(close, LengthMASlow)

xRAVI = ((xMAF - xMAS) / xMAS) * 100

pos:= iff(xRAVI > TradeLine, 1,

iff(xRAVI < TradeLine, -1, nz(pos[1], 0)))

pos

strategy(title="Combo Backtest 123 Reversal & Range Action Verification Index (RAVI)", shorttitle="Combo", overlay = true)

line1 = input(true, "---- 123 Reversal ----")

Length = input(14, minval=1)

KSmoothing = input(1, minval=1)

DLength = input(3, minval=1)

Level = input(50, minval=1)

//-------------------------

line2 = input(true, "---- Range Action Verification Index (RAVI) ----")

LengthMAFast = input(title="Length MA Fast", defval=7)

LengthMASlow = input(title="Length MA Slow", defval=65)

TradeLine = input(0.14, step=0.01)

reverse = input(false, title="Trade reverse")

posReversal123 = Reversal123(Length, KSmoothing, DLength, Level)

posRAVI = RAVI(LengthMAFast, LengthMASlow, TradeLine)

pos = iff(posReversal123 == 1 and posRAVI == 1 , 1,

iff(posReversal123 == -1 and posRAVI == -1, -1, 0))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1 , 1, pos))

if (possig == 1 )

strategy.entry("Long", strategy.long)

if (possig == -1 )

strategy.entry("Short", strategy.short)

if (possig == 0)

strategy.close_all()

barcolor(possig == -1 ? #b50404: possig == 1 ? #079605 : #0536b3 )

Detail

https://www.fmz.com/strategy/436094

Last Modified

2023-12-21 10:59:16