Name

基于多策略集成的反转与重心线交易策略Reversal-and-Center-of-Gravity-Integrated-Trading-Strategy-Based-on-Multi-strategy

Author

ChaoZhang

Strategy Description

本策略通过集成双重交易信号的方式实现更稳定更高效的交易决策。其一是结合价格反转信号和随机指标的反转策略,其二是中心线与价格通道的突破策略。两种策略的交易信号会做逻辑与运算,即两策略同时发出同向信号时才会开仓。这种多策略集成方式可以过滤掉部分无效信号,实现更可靠的交易决策。

反转策略部分,是在价格出现连续两个交易日的反转形态,且随机指标已经进入超买超卖区域时,产生交易信号。这样可以同时利用价值反转信号和超买超卖信号双重确认。中心重心线部分,是围绕价格的线性回归中心线构建价格上下通道,通道突破产生交易信号。通道突破信号同时意味着价格开始发生趋势性的方向性运动。

两种策略分别捕捉价值与趋势性机会。通过策略信号的逻辑与,即两策略同时发出同向信号时才开仓。这可以有效过滤掉部分无效Signals,使最终策略更加可靠。

本策略最大优势是信号的稳定可靠。反转策略与趋势策略的组合,同时兼顾反转与趋势两大交易机会,不会错过任何大的行情。而逻辑与运算过滤掉了部分无效信号,使最终策略更加可靠,避免被噪声欺骗。

此外,反转策略与趋势策略的组合,也实现了多时间框架下的稳定操作。反转策略利用短期超买超卖产生信号,中心重心线策略基于中长线均线,时间框架互补,可以产生持续稳定的交易机会。

本策略最大风险在于双重策略信号无法匹配,导致无法产生足够的交易信号。这种情况可能发生在股票横盘整理的时候。当价格长时间处于震荡,没有明显方向性的时候,反转信号和趋势信号都不容易产生,会造成交易机会减少。

此外,双重策略逻辑与运算也可能错过部分单一策略的机会。当只有单一策略产生有效交易信号时,也不会开仓。这可能导致一定程度的机会成本。

为降低风险,可以适当放宽部分参数,使策略信号更容易匹配从而开仓。也可以考虑引入选股机制,选择更加趋势明显的标的来交易,以获得更多交易机会。

本策略后续主要可以从两个维度进行优化:

首先是参数优化。包括stoch随机指标的参数,中心线通道的参数等都可以继续测试优化,以获得更加匹配的信号。这可以通过更多回测来实现。

其次是引入类似选股操作的机制。因为本策略更适合有明显趋势的标的。所以如果能根据一定指标来选择符合条件的标的来交易,也可以显著提高策略整体表现。这需要结合行业轮动性,均线系统等方法来设计选股模块。

本策略通过反转策略与趋势策略的集成,实现了交易决策的双重确认与多时间框架匹配。同时也存在信号匹配困难导致交易机会减少的问题。下一步的优化可以从参数与模块组合两个层面入手,以获得更强更稳定的策略表现。

||

This strategy realizes more stable and efficient trading decisions by integrating dual trading signals. One is the reversal strategy combining price reversal signals and stochastic indicators, and the other is the breakout strategy of centerline and price channel. The trading signals of the two strategies will be logically ANDed, that is, the position will be opened only when the two strategies issue signals in the same direction at the same time. This kind of multi-strategy integration can filter out some invalid signals and achieve more reliable trading decisions.

The reversal strategy part generates trading signals when the price shows a reversal pattern for two consecutive trading days and the stochastic indicator has entered the overbought or oversold area. This allows the use of both price reversal signals and overbought/oversold signals for double confirmation. The center of gravity part builds upper and lower channels around the linear regression centerline of the price to generate trading signals when the channel is broken. Channel breakout signals also imply that prices are beginning to experience directional trending movements.

The two strategies capture value and trend opportunities respectively. By logically ANDing the strategy signals, the position is opened only when the two strategies issue signals in the same direction at the same time. This can effectively filter out some invalid signals and make the final strategy more reliable.

The biggest advantage of this strategy is the stability and reliability of signals. The combination of reversal and trend strategies captures both reversal and trend trading opportunities at the same time without missing any major moves. Meanwhile, logical AND operation filters out some invalid signals, making the final strategy more reliable and avoids being fooled by noise.

In addition, the combination of reversal and trend strategies also achieves stable operations under multiple time frames. The reversal strategy utilizes short-term overbought/oversold signals while the center of gravity strategy is based on medium and long term moving averages. The complementary time frames can generate sustained and steady trading opportunities.

The biggest risk of this strategy is the failure in matching signals from the dual strategies, which leads to insufficient trading signals. This may happen when the price is range-bound and consolidating without a clear directional trend. When price oscillates in a sideways pattern for an extended period of time, it is difficult for reversal signals and trend signals to be generated, resulting in fewer trading opportunities.

In addition, the logical AND operation of the dual strategies may also miss some opportunities from a single strategy. When only one strategy generates a valid trading signal, no position will be opened. This could result in certain opportunity costs.

To mitigate risks, parameters could be moderately relaxed to make strategy signals easier to match and open positions. Stock selection mechanisms could also be introduced to trade more trending symbols and obtain more trading opportunities.

There are two main dimensions this strategy could be optimized:

First is parameter optimization. Parameters including those for the Stoch indicators and centerline channels can be further tested and optimized to obtain more aligned signals. This can be achieved through more backtests.

Second is to introduce mechanisms similar to stock selection operations. Because this strategy is more suitable for stocks with clear trends. Therefore, if stocks meeting certain conditions can be selected to trade based on specific indicators, it would significantly improve overall strategy performance. This requires the design of a stock selection module combined with industry rotation trends, moving average systems, etc.

This strategy achieves double confirmation and multi-timeframe matching of trading decisions by integrating reversal and trend strategies, while also facing the problem of reduced trading opportunities due to difficulty in signal matching. Next step optimization can be approached from both the parameter and modular perspectives to obtain stronger and more stable strategy performance.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | 14 | Length |

| v_input_2 | true | KSmoothing |

| v_input_3 | 3 | DLength |

| v_input_4 | 50 | Level |

| v_input_5 | 20 | LengthCoF |

| v_input_6 | 5 | m |

| v_input_7 | true | Percent |

| v_input_8 | true | Trade from line (1 or 2) |

| v_input_9 | false | Trade reverse |

Source (PineScript)

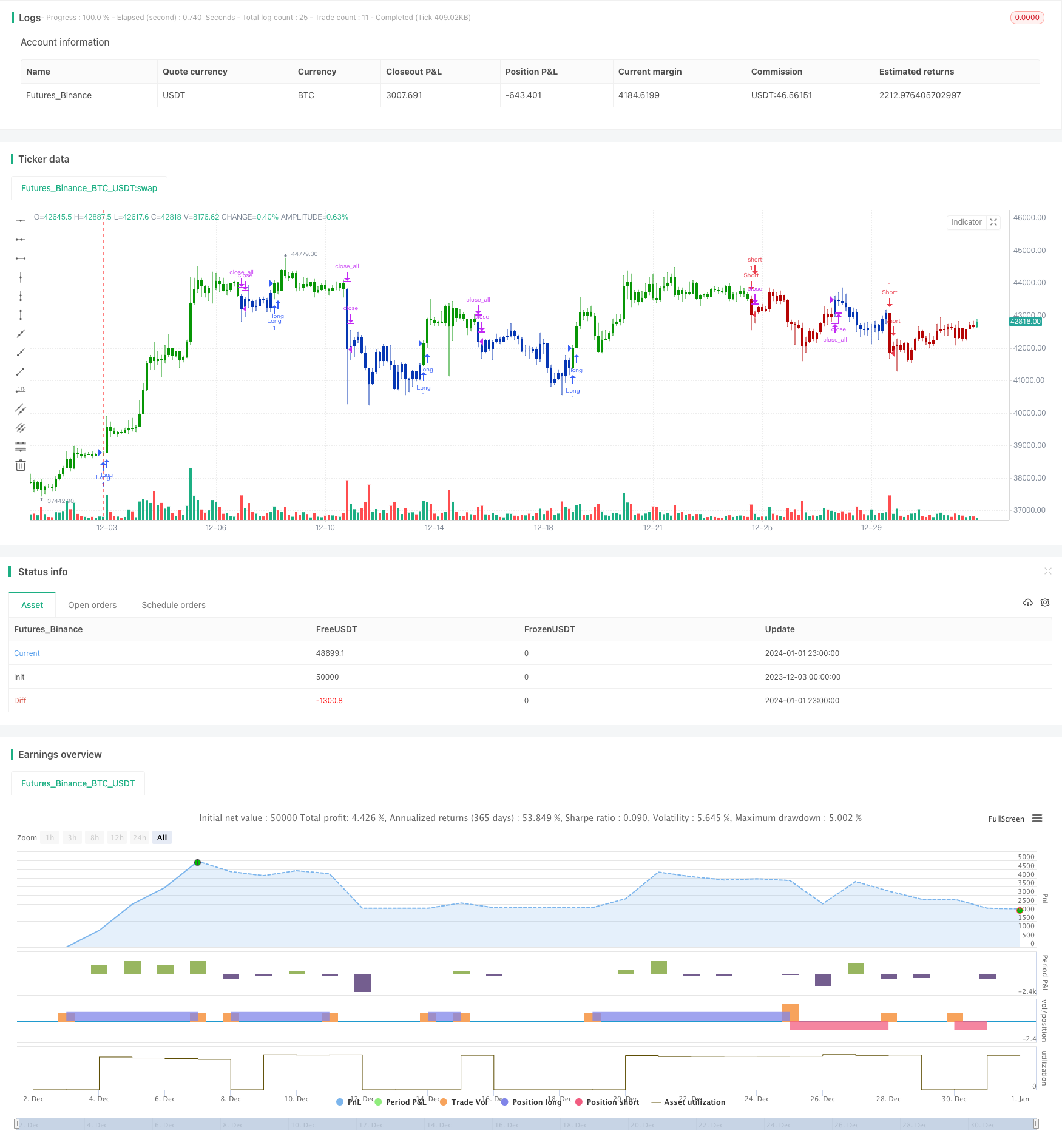

/*backtest

start: 2023-12-03 00:00:00

end: 2024-01-02 00:00:00

period: 3h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 18/07/2019

// This is combo strategies for get a cumulative signal.

//

// First strategy

// This System was created from the Book "How I Tripled My Money In The

// Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

// The strategy buys at market, if close price is higher than the previous close

// during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

// The strategy sells at market, if close price is lower than the previous close price

// during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

//

// Second strategy

// The indicator is based on moving averages. On the basis of these, the

// "center" of the price is calculated, and price channels are also constructed,

// which act as corridors for the asset quotations.

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

Reversal123(Length, KSmoothing, DLength, Level) =>

vFast = sma(stoch(close, high, low, Length), KSmoothing)

vSlow = sma(vFast, DLength)

pos = 0.0

pos := iff(close[2] < close[1] and close > close[1] and vFast < vSlow and vFast > Level, 1,

iff(close[2] > close[1] and close < close[1] and vFast > vSlow and vFast < Level, -1, nz(pos[1], 0)))

pos

CenterOfGravity(Length, m,Percent, SignalLine) =>

pos = 0

xLG = linreg(close, Length, m)

xLG1r = xLG + ((close * Percent) / 100)

xLG1s = xLG - ((close * Percent) / 100)

xLG2r = xLG + ((close * Percent) / 100) * 2

xLG2s = xLG - ((close * Percent) / 100) * 2

xSignalR = iff(SignalLine == 1, xLG1r, xLG2r)

xSignalS = iff(SignalLine == 1, xLG1s, xLG2s)

pos := iff(close > xSignalR, 1,

iff(close < xSignalS, -1, nz(pos[1], 0)))

pos

strategy(title="Combo Backtest 123 Reversal & Center Of Gravity", shorttitle="Combo", overlay = true)

Length = input(14, minval=1)

KSmoothing = input(1, minval=1)

DLength = input(3, minval=1)

Level = input(50, minval=1)

//-------------------------

LengthCoF = input(20, minval=1)

m = input(5, minval=0)

Percent = input(1, minval=0)

SignalLine = input(1, minval=1, maxval = 2, title = "Trade from line (1 or 2)")

reverse = input(false, title="Trade reverse")

posReversal123 = Reversal123(LengthCoF, KSmoothing, DLength, Level)

posCenterOfGravity = CenterOfGravity(Length, m,Percent, SignalLine)

pos = iff(posReversal123 == 1 and posCenterOfGravity == 1 , 1,

iff(posReversal123 == -1 and posCenterOfGravity == -1, -1, 0))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1, 1, pos))

if (possig == 1)

strategy.entry("Long", strategy.long)

if (possig == -1)

strategy.entry("Short", strategy.short)

if (possig == 0)

strategy.close_all()

barcolor(possig == -1 ? #b50404: possig == 1 ? #079605 : #0536b3 )

Detail

https://www.fmz.com/strategy/437553

Last Modified

2024-01-03 16:51:03