Name

多种技术指标动量趋向策略Momentum-Trend-Strategy

Author

ChaoZhang

Strategy Description

该策略综合运用移动平均线、相对强弱指标(RSI)、量变动指标(VFI)以及真实强度指数(TSI)等多种技术指标,判断市场的总体动量和趋向,以捕捉中长线的价格走势。

-

计算快速线RSI(7日)、正常线RSI(14日)、慢速线RSI(50日)的移动平均线,判断RSI的多空趋势和动量。

-

计算VFI和VFI的移动平均线EMA(25日)、SMA(25日),判断市场的资金流入流出情况。

-

计算TSI的长期均线和短期均线的比值,判断市场的趋势强度。

-

将RSI、VFI和TSI的结果进行整合,得出市场的总体动量方向。

-

当判断到市场存在向下的动量时,做空;当判断到市场动量反转时,将空单平仓。

-

多种指标结合,判断市场总体动量和趋势更为全面和准确。

-

VFI反映市场资金流入流出情况,避免交易反向。

-

TSI过滤震荡市,使得信号更可靠。

-

整体来看,该策略可靠性较高,胜率较好。

-

多指标结合,参数设置复杂,需要反复测试取得最优参数。

-

Entry和Exit策略简单,无法充分利用指标提供的信息,可能出现超短线反转亏损。

-

盘整震荡市中,容易产生错误信号和反向小亏损。

-

优化指标参数组合,找到最佳参数。

-

增加Exit规则,利用指标情况判断反转退出。

-

增加盈利保护机制,减少盘整小亏损。

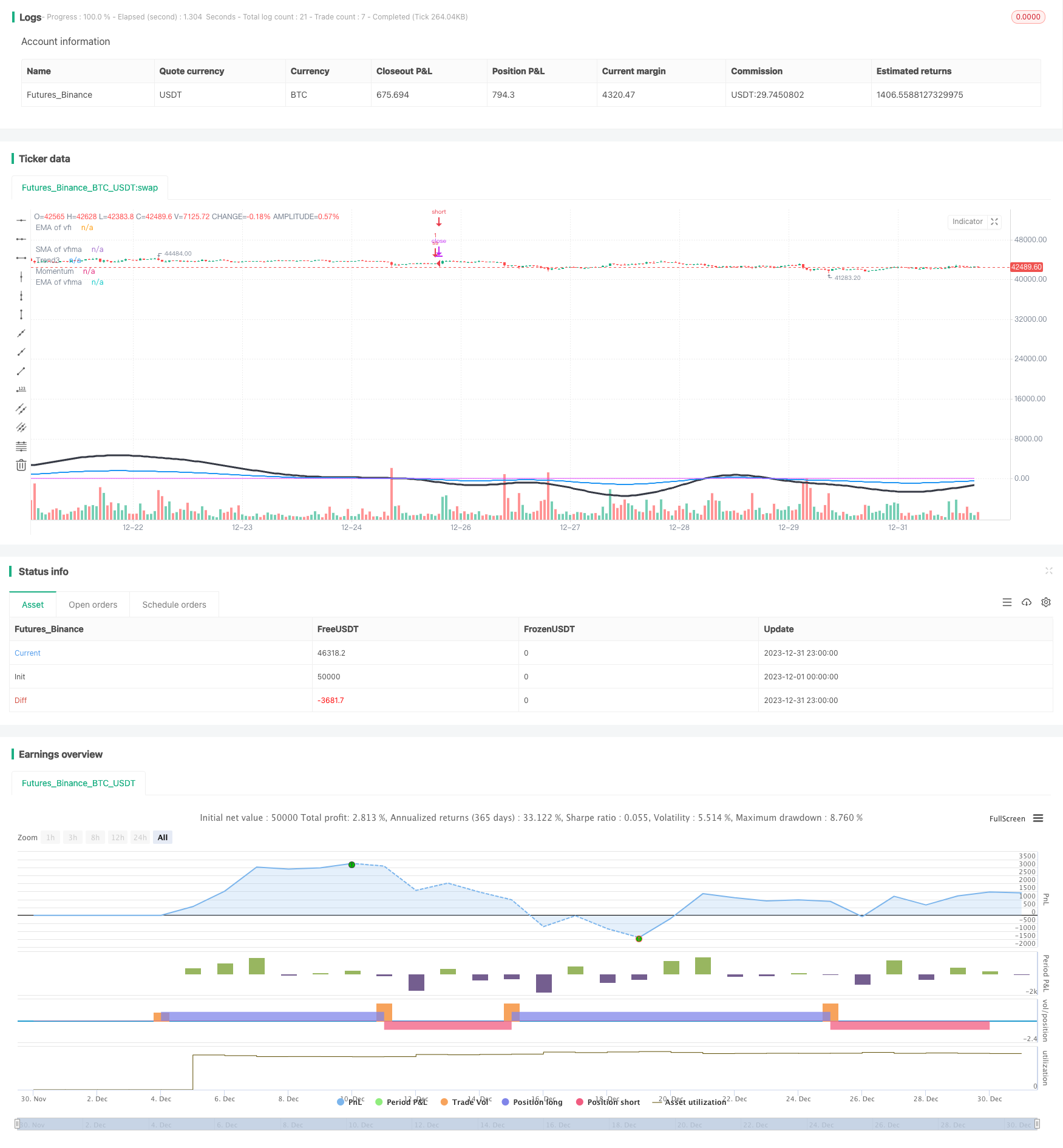

本策略综合运用多种指标判断市场总体动量,在判断到市场存在向下动量时做空获利。该策略可靠性较高,但Entry和Exit机制较简单,指标信息没有得到充分利用。通过不断优化参数和增强Exit规则,可进一步提高策略稳定性和盈利能力。

||

This strategy combines various technical indicators such as moving average, relative strength index (RSI), volume fluctuation indicator (VFI), and true strength index (TSI) to determine the overall momentum and trend of the market and capture mid-to-long term price movements.

-

Calculate moving averages of fast line RSI (7-day), normal line RSI (14-day), and slow line RSI (50-day) to determine RSI trend and momentum.

-

Calculate VFI and moving averages VFI EMA (25-day) and VFI SMA (25-day) to gauge funds inflow and outflow.

-

Calculate ratio of long term moving average and short term moving average of TSI to determine strength of market trend.

-

Integrate RSI, VFI and TSI results to derive overall market momentum direction.

-

Take short position when downward momentum is identified. Cover short when momentum reversal is detected.

-

Combination of multiple indicators allows more comprehensive and accurate measurement of overall market momentum and trend.

-

VFI reflects market funds flow, avoiding trading against trend.

-

TSI filters out market choppiness, making signals more reliable.

-

Overall, the strategy has high reliability and good win rate.

-

Complex parameter tuning required for optimal results from multi-indicator setup.

-

Simple entry and exit rules unable to fully capitalize indicator information, prone to short term reversal losses.

-

Susceptible to false signals and small pullback losses in ranging, choppy markets.

-

Optimize indicator combinations to find best parameters.

-

Enhance exit rules based on indicator conditions to catch reversals.

-

Build profit protection mechanisms to reduce losses from choppiness.

This strategy combines multiple indicators to gauge overall market momentum and takes short positions when downward momentum identified. It has relatively high reliability but simple entry/exit rules unable to fully utilize indicator information. Further enhancements to parameters and exit logic can improve stability and profitability.

[/trans]]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | 50 | length |

| v_input_2 | 50 | overSold |

| v_input_3 | 65 | overBought |

| v_input_4 | 12 | fastLength |

| v_input_5 | 26 | slowlength |

| v_input_6 | 9 | MACDLength |

| v_input_7 | 7 | v_input_7 |

| v_input_8 | 14 | v_input_8 |

| v_input_9 | 50 | v_input_9 |

| v_input_10 | true | Exponential MA |

| v_input_11 | true | Exponential MA |

| v_input_12 | true | Exponential MA |

| v_input_13 | 130 | VFI length |

| v_input_14 | 0.2 | coef |

| v_input_15 | 2.5 | Max. vol. cutoff |

| v_input_16 | 10 | signalLength |

| v_input_17 | 100 | signalLength2 |

| v_input_18 | false | smoothVFI |

| v_input_19 | 24 | Long Length |

| v_input_20 | 7 | Short Length |

| v_input_21 | 13 | Signal Length |

Source (PineScript)

//@version=2

//credit to LazyBear, Lewm444, and others for direct and indirect inputs/////////////////////////////////

//script is very rough, publishing more for collaborative input value than as a finished product/////////

strategy("Momo", overlay=true)

length = input( 50 )

overSold = input( 50 )

overBought = input( 65 )

price = ohlc4

/////////////////////////////////////////////////////macd/////////////////////////////////////////////////

fastLength = input(12)

slowlength = input(26)

MACDLength = input(9)

fast = 12, slow = 26

fastMA = ema(close, fast)

slowMA = ema(close, slow)

MACD = (fastMA - slowMA)

Msignal = (sma(MACD, 9))*40

//plot(Msignal, color=blue, linewidth=3)

/////////////////////////////////////////////////rsi spread/////////////////////////////////////////////////

source = price

RSIFast = rsi(source, input(7))

RSINorm = rsi(source, input(14))

RSISlow = rsi(source, input(50))

//plot(RSIFast, color=silver, style=area, histbase=50)

//plot(RSINorm, color=#98b8be, style=area, histbase=50)

//plot(RSISlow, color=#be9e98, style=area, histbase=50)

//plot(RSIFast, color=gray, style=line, linewidth=1)

//plot(RSINorm, color=purple, style=line, linewidth=2)

//plot(RSISlow, color=black, style=line, linewidth=3)

exponential = input(true, title="Exponential MA")

src = (RSIFast)

ma05 = exponential ? ema(src, 05) : sma(src, 05)

ma30 = exponential ? ema(src, 30) : sma(src, 30)

ma50 = exponential ? ema(src, 50) : sma(src, 50)

ma70 = exponential ? ema(src, 70) : sma(src, 70)

ma90 = exponential ? ema(src, 90) : sma(src, 90)

ma100 = exponential ? ema(src, 100) : sma(src, 100)

exponential1 = input(true, title="Exponential MA")

src1 = (RSINorm)

ma051 = exponential1 ? ema(src1, 05) : sma(src1, 05)

ma301 = exponential1 ? ema(src1, 30) : sma(src1, 30)

ma501 = exponential1 ? ema(src1, 50) : sma(src1, 50)

ma701 = exponential1 ? ema(src1, 70) : sma(src1, 70)

ma901 = exponential1 ? ema(src1, 90) : sma(src1, 90)

ma1001 = exponential1 ? ema(src1, 100) : sma(src1, 100)

exponential2 = input(true, title="Exponential MA")

src2 = (RSINorm)

ma052 = exponential2 ? ema(src2, 05) : sma(src2, 05)

ma302 = exponential2 ? ema(src2, 30) : sma(src2, 30)

ma502 = exponential2 ? ema(src2, 50) : sma(src2, 50)

ma702 = exponential2 ? ema(src2, 70) : sma(src2, 70)

ma902 = exponential2 ? ema(src2, 90) : sma(src2, 90)

ma1002 = exponential2 ? ema(src2, 100) : sma(src2, 100)

////////////////////////////////////////////////vfi by LazyBear, modified////////////////////////////////////

VFIlength = input(130, title="VFI length")

coef = input(0.2)

vcoef = input(2.5, title="Max. vol. cutoff")

signalLength=input(10)

signalLength2 = input(100)

smoothVFI=input(false, type=bool)

ma(x,y) => smoothVFI ? sma(x,y) : x

typical=hlc3

inter = log( typical ) - log( typical[1] )

vinter = stdev(inter, 30 )

cutoff = coef * vinter * close

vave = sma( volume, VFIlength )[1]

vmax = vave * vcoef

vc = iff(volume < vmax, volume, vmax) //min( volume, vmax )

mf = typical - typical[1]

vcp = iff( mf > cutoff, vc, iff ( mf < -cutoff, -vc, 0 ) )

vfi = ma(sum( vcp , VFIlength )/vave, 3)

vfima = ema( vfi, 25 )

vfimaS = (sma(vfima, 25))

zima = ema( vfima, signalLength2 )

d=vfi-vfima

vfi_avg = avg(vfi, vfima, vfimaS)

vfi_avgS = (sma(vfi_avg,5))

plot( zima, title="EMA of vfima", color=fuchsia, linewidth=1)

plot( vfimaS, title="SMA of vfima", color=blue, linewidth=1)

plot( vfima , title="EMA of vfi", color=black, linewidth=1)

//plot( vfi, title="vfi", color=green,linewidth=1)

//plot( vfi_avg, title="vfi_avg", color=blue, linewidth=2)

//plot( vfi_avgS, title="vfi_avgS", color=maroon, linewidth=2)

/////////////////////////////////////////////////////tsi////////////////////////////////////////////////

long2 = input(title="Long Length", defval=24)

short2 = input(title="Short Length", defval=7)

signal2 = input(title="Signal Length", defval=13)

pc = change(price)

double_smooth2(src, long2, short2) =>

fist_smooth2 = ema(src, long2)

ema(fist_smooth2, short2)

double_smoothed_pc2 = double_smooth2(pc, long2, short2)

double_smoothed_abs_pc2 = double_smooth2(abs(pc), long2, short2)

tsi_value2 = 60 * (double_smoothed_pc2 / double_smoothed_abs_pc2)

//plot( tsi_value2, title="tsi2", color=black, linewidth=1)

////////////////////////////////////////////////////////mjb////////////////////////////////////////////////

trendSignal = avg(tsi_value2, Msignal, vfi)*1.75

T1 = sma(trendSignal, 5)

T2 = ema(trendSignal, 25)

T3 = ema(T2, 25)

//plot( T1, title="Trend", color=red, linewidth=3)

plot( T3, title="Trend3", color=black, linewidth=3)

/////////////////////////////////////////////////////mjb////////////////////////////////////////////////

Momentum = avg (T3, vfimaS, vfima)

plot( Momentum, title="Momentum", color=blue, linewidth=2)

vrsi = rsi(price, length)

clearance = abs(zima - Msignal)

/////////////////////////////////////////////////////mjb////////////////////////////////////////////////

if (not na(vrsi))

if (zima > T3) and (clearance > 5) and (falling(zima, 1) == 1) and (zima > vfimaS) and (zima > vfima) and (falling(T3, 1) == 1) and (zima > 6)

strategy.entry("ss", strategy.short)

if (T3 > zima) and (rising(zima, 1) == 1)

strategy.entry("Zcover", strategy.long)

if (strategy.openprofit > 750) and (rising(T2, 1) == 1) and (T2 > 10)

strategy.entry("ProfitTake", strategy.long)

// strategy.risk.allow_entry_in(strategy.direction.short)

// strategy.risk.max_intraday_loss(2000, strategy.cash)

Detail

https://www.fmz.com/strategy/440064

Last Modified

2024-01-26 11:45:55