Name

定期追踪低谷均价策略Dollar-Cost-Averaging-After-Downtrend-Strategy

Author

ChaoZhang

Strategy Description

该策略的主要思想是在短期下跌结束后定期追踪低位均价。具体来说,策略会在每月底识别短期下跌结束的时机,于是定期追加仓位;同时在最后一个K线收盘时清仓离场。

- 定期追踪信号判定:每过24*30根K线(表示一个月)后,判定为到达定期追踪点,输出首个信号。

- 短期下跌结束判定:使用MACD指标判断趋势,当MACD背离并下穿信号线时,认为短期下跌结束。

- 入场规则:同时满足定期追踪信号和短期下跌结束信号时,释放追踪信号,开仓做多。

- 出场规则:当最后一个K线收盘时,清仓全部头寸。

以上就是策略的基本交易流程和原理。值得注意的是,策略默认使用1000美元的资金追踪每月,在 backtest 中将扩展至33个月,即总共投入33000美元。

该策略最大的优势在于能够在低位定期建仓,从长期来看能获得比较优惠的买入成本,产生比较高的收益率。另外使用MACD指标识别短期买点也比较可靠和清晰,不会误入死胡同,这也可以在一定程度上避免损失。

总的来说,这是一种成本均价的策略,比较适合中长线持有者定期分批买入,可以获得比较满意的回报收益。

策略的主要风险在于无法准确判断短期下跌的结束点,MACD指标判断下跌结束的时机可能有滞后,这会导致成本无法在最优点买入。另外资金分散投入也增加了操作成本。

可以考虑加入更多指标以判断趋势,如布林线,KDJ等,这些指标可以提前判断反转的时机。同时可以优化每月投入资金的数额,来降低操作成本对收益的影响。

可以从以下几个方向进一步优化该策略:

-

优化定期追踪的时间周期,如改为每两个月定期追踪一次等,减少过于频繁交易的问题。

-

结合更多指标判断短期下跌结束的时机,使买入点更加接近最低点。

-

对每月投入资金数量进行优化,找到最优配置。

-

尝试将止损策略融入其中,避免下跌过深造成损失。

-

测试不同持仓周期对收益的影响,找到最优持仓天数。

该定期追踪低谷均价策略整体思路清晰易懂,通过定期追加和短期判断结合,可以获得较优惠的成本价。中长线持有该策略可以获得稳定的收益,适合追求长期投资价值的投资者。同时也存在一些可以优化的方向,投入注意力从而进一步完善该策略,使其业绩能够更上一层楼。

||

The main idea of this strategy is to regularly track low average prices after short-term declines end. Specifically, the strategy will identify the end of a short-term decline at the end of each month, so as to regularly add positions; at the same time, clear positions when the last K-line closes.

-

Regular tracking signal judgment: after 24*30 K-lines (representing one month), it is determined that the regular tracking point has been reached and the first signal is output.

-

End of short-term decline judgment: use the MACD indicator to determine the trend. When MACD divergence occurs and MACD goes below the signal line, it is determined that the short-term decline has ended.

-

Entry rules: when the regular tracking signal and the end of the short-term decline signal are triggered at the same time, a tracking signal is released and long positions are opened.

-

Exit rules: when the last K-line closes, clear all positions.

The above is the basic trading flow and principles of the strategy. It is worth noting that the strategy defaults to tracking $1,000 per month in backtests, which will be expanded to 33 months, that is, a total investment of $33,000.

The biggest advantage of this strategy is that it can regularly build positions at low levels. From a long-term perspective, it can obtain a relatively affordable average cost price to generate high returns. In addition, using the MACD indicator to identify short-term buying points is also quite reliable and clear, which can avoid getting into a dead end to some extent, and this can also avoid losses to some extent.

In general, this is a cost averaging strategy that is more suitable for medium and long term holders to regularly purchase batches to obtain satisfactory returns.

The main risk of the strategy is the inability to accurately determine the end of the short-term decline. The MACD indicator's judgment of the end of the decline may lag, which will lead to the failure to enter at the optimal point. In addition, the dispersed investment of funds also increases operating costs.

Consider adding more indicators to determine trends, such as Bollinger Bands, KDJ, etc. These indicators can anticipate reversal timing in advance. At the same time, the amount of funds invested each month can be optimized to reduce the impact of operating costs on returns.

The strategy can be further optimized in the following directions:

-

Optimize the regular tracking cycle, such as tracking once every two months, to reduce the problem of excessive frequent trading.

-

Incorporate more indicators to determine the end of a short-term decline, making the entry point closer to the lowest point.

-

Optimize the amount of funds invested each month to find the optimal configuration.

-

Try to incorporate stop loss strategies to avoid excessive losses when prices fall too deep.

-

Test the impact of different holding periods on returns to find the optimal holding days.

The overall idea of this dollar cost averaging after downtrend strategy is clear and easy to understand. By combining regular replenishment and short-term judgment, it can obtain a more affordable average cost price. Medium and long-term holdings of this strategy can generate stable returns and is suitable for investors pursuing long-term investment value. At the same time, there are some directions that can be optimized to further improve the strategy so that its performance can move up one level.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | 2017 | Start year |

| v_input_2 | true | Start month |

| v_input_3 | true | Start day |

| v_input_4 | 2050 | end year |

| v_input_5 | true | end month |

| v_input_6 | true | end day |

Source (PineScript)

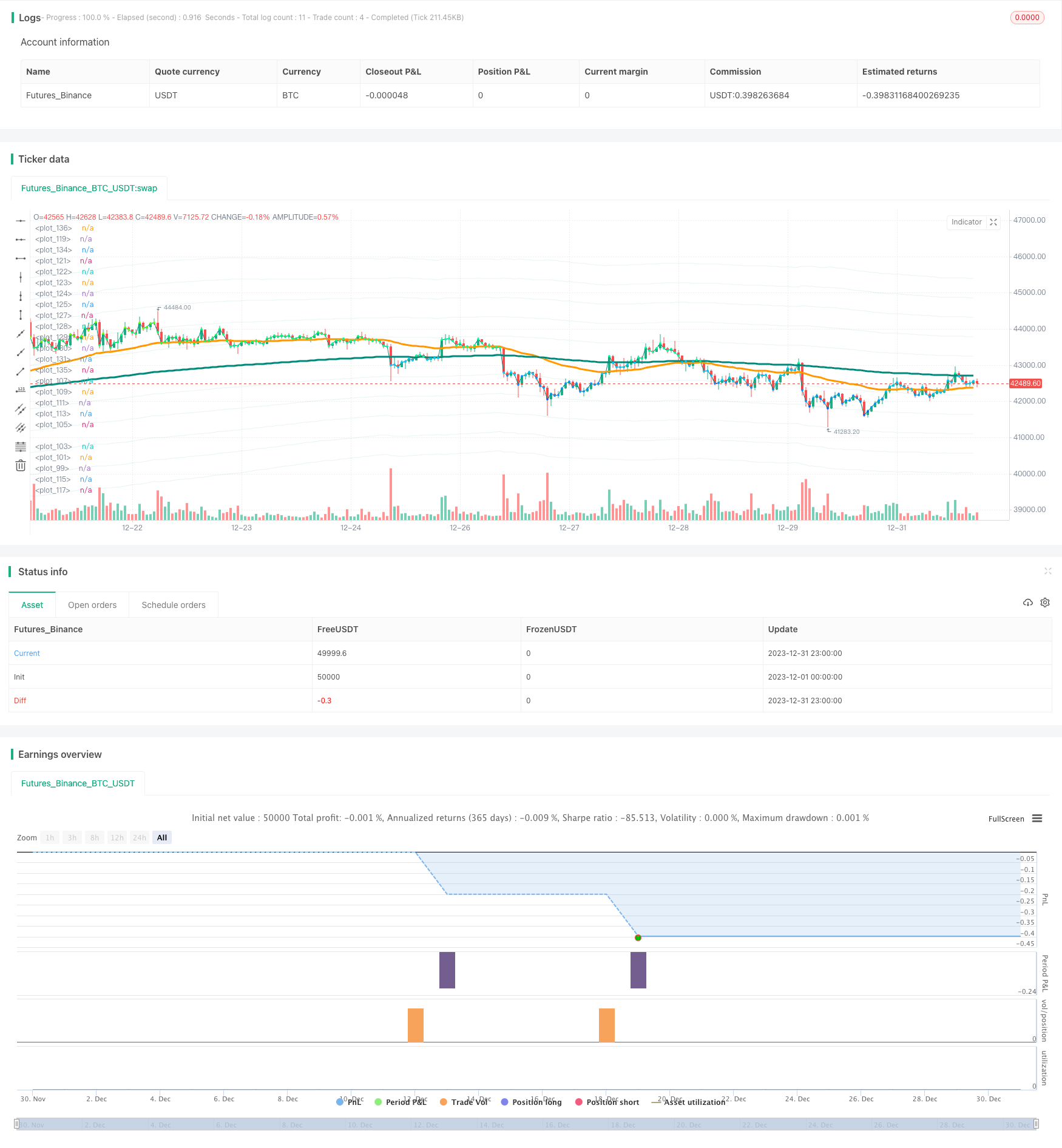

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © BHD_Trade_Bot

// @version=5

strategy(

shorttitle = 'DCA After Downtrend v2',

title = 'DCA After Downtrend v2 (by BHD_Trade_Bot)',

overlay = true,

calc_on_every_tick = false,

calc_on_order_fills = false,

use_bar_magnifier = false,

pyramiding = 1000,

initial_capital = 0,

default_qty_type = strategy.cash,

default_qty_value = 1000,

commission_type = strategy.commission.percent,

commission_value = 1.1)

// Backtest Time Period

start_year = input(title='Start year' ,defval=2017)

start_month = input(title='Start month' ,defval=1)

start_day = input(title='Start day' ,defval=1)

start_time = timestamp(start_year, start_month, start_day, 00, 00)

end_year = input(title='end year' ,defval=2050)

end_month = input(title='end month' ,defval=1)

end_day = input(title='end day' ,defval=1)

end_time = timestamp(end_year, end_month, end_day, 23, 59)

window() => time >= start_time and time <= end_time ? true : false

h1_last_bar = (math.min(end_time, timenow) - time)/1000/60/60 < 2

// EMA

ema50 = ta.ema(close, 50)

ema200 = ta.ema(close, 200)

// EMA_CD

emacd = ema50 - ema200

emacd_signal = ta.ema(emacd, 20)

hist = emacd - emacd_signal

// BHD Unit

bhd_unit = ta.rma(high - low, 200) * 2

bhd_upper = ema200 + bhd_unit

bhd_upper2 = ema200 + bhd_unit * 2

bhd_upper3 = ema200 + bhd_unit * 3

bhd_upper4 = ema200 + bhd_unit * 4

bhd_upper5 = ema200 + bhd_unit * 5

bhd_lower = ema200 - bhd_unit

bhd_lower2 = ema200 - bhd_unit * 2

bhd_lower3 = ema200 - bhd_unit * 3

bhd_lower4 = ema200 - bhd_unit * 4

bhd_lower5 = ema200 - bhd_unit * 5

// Count n candles after x long entries

var int nPastCandles = 0

var int entryNumber = 0

if window()

nPastCandles := nPastCandles + 1

// ENTRY CONDITIONS

// 24 * 30 per month

entry_condition1 = nPastCandles > entryNumber * 24 * 30

// End of downtrend

entry_condition2 = emacd < 0 and hist < 0 and hist > hist[2]

ENTRY_CONDITIONS = entry_condition1 and entry_condition2

if ENTRY_CONDITIONS

entryNumber := entryNumber + 1

entryId = 'Long ' + str.tostring(entryNumber)

strategy.entry(entryId, strategy.long)

// CLOSE CONDITIONS

// Last bar

CLOSE_CONDITIONS = barstate.islast or h1_last_bar

if CLOSE_CONDITIONS

strategy.close_all()

// Draw

colorRange(src) =>

if src > bhd_upper5

color.rgb(255,0,0)

else if src > bhd_upper4

color.rgb(255,150,0)

else if src > bhd_upper3

color.rgb(255,200,0)

else if src > bhd_upper2

color.rgb(100,255,0)

else if src > bhd_upper

color.rgb(0,255,100)

else if src > ema200

color.rgb(0,255,150)

else if src > bhd_lower

color.rgb(0,200,255)

else if src > bhd_lower2

color.rgb(0,150,255)

else if src > bhd_lower3

color.rgb(0,100,255)

else if src > bhd_lower4

color.rgb(0,50,255)

else

color.rgb(0,0,255)

bhd_upper_line = plot(bhd_upper, color=color.new(color.teal, 90))

bhd_upper_line2 = plot(bhd_upper2, color=color.new(color.teal, 90))

bhd_upper_line3 = plot(bhd_upper3, color=color.new(color.teal, 90))

bhd_upper_line4 = plot(bhd_upper4, color=color.new(color.teal, 90))

bhd_upper_line5 = plot(bhd_upper5, color=color.new(color.teal, 90))

bhd_lower_line = plot(bhd_lower, color=color.new(color.teal, 90))

bhd_lower_line2 = plot(bhd_lower2, color=color.new(color.teal, 90))

bhd_lower_line3 = plot(bhd_lower3, color=color.new(color.teal, 90))

bhd_lower_line4 = plot(bhd_lower4, color=color.new(color.teal, 90))

bhd_lower_line5 = plot(bhd_lower5, color=color.new(color.teal, 90))

// fill(bhd_upper_line5, bhd_lower_line5, color=color.new(color.teal, 95))

plot(ema50, color=color.orange, linewidth=3)

plot(ema200, color=color.teal, linewidth=3)

plot(close, color=color.teal, linewidth=1)

plot(close, color=colorRange(close), linewidth=3, style=plot.style_circles)

Detail

https://www.fmz.com/strategy/439111

Last Modified

2024-01-17 17:57:58