Name

旗型突破策略Bull-Flag-Breakout-Strategy

Author

ChaoZhang

Strategy Description

旗型突破策略是一种技术分析策略,它通过识别旗型图形并在突破点入场,目标是捕捉趋势的开始。该策略使用平均真实波动范围(ATR)指标辅助判断,在明确的旗杆后判断旗帜范围,从而筛选入场机会。

该策略主要分为以下几个步骤:

- 确定旗杆:需要满足价格创新高和突破ATR通道。

- 确定旗杆高度:测量旗杆顶点与前期SMA的距离。

- 确定旗帜范围:旗帜低点为旗杆高度的33%,作为旗帜的最小范围。

- 判定旗型:判断前3根K线是否全部处于旗帜范围内。

- 入场:出现旗型时做多。

- 出场:固定持有6根K线后清仓。

在判断旗杆和旗帜时,策略巧妙地利用ATR指标判断明显突破,并且严格限定旗帜高度在旗杆高度33%以内,避免过多假信号。此外,判断连续3根K线构成旗帜,可靠性较高。总体来说,该策略规则设计严谨,在捕捉趋势初期突破上确实有一定优势。

该策略主要具有以下几个优势:

- 利用旗型结构判定趋势开始,是技术分析中较经典的方法,成功率较高。

- ATR指标和严格范围限制可避免大量假信号,提高入场准确率。

- 固定6根K线出场可锁定部分利润,避免走势反转风险。

- 策略规则清晰易实现,容易掌握和遵循。

- 可在各类行情中寻找机会,灵活性较好。

该策略的主要风险包括:

- 旗型无法完全判断趋势,也存在失败的情况。

- 6根K线出场过于武断,可能会过早离场。

- 行情过于震荡时,容易产生假旗型。

- 无法有效控制单笔损失。

针对以上风险,我们可以设置止损策略,或者优化出场机制,在盈利达到一定比例时及时获利了结。此外,我们也可以结合其它指标进行过滤,避免行情过于震荡时产生假信号。

该策略可以从以下几个方向进行优化:

- 利用MACD、KD等指标结合,避免震荡行情下假信号。

- 根据市场类别参数化ATR倍数、出场周期等,使策略更具适应性。

- 设置移动止损或考虑收益回撤比来动态出场。

- 尝试machine learning方法寻找更准确的特征判定旗帜高度。

- 评估实际胜率和盈亏比,动态调整仓位规模。

总体而言,旗型突破策略利用技术形态判断趋势开始,是一种较为经典的方法,该策略在入场规则设计上确实严谨,可过滤大量假信号。但风险控制和出场机制仍有优化空间,我们可以从整体角度考量,使策略在不同市场中都能稳定运行。如果经过充分验证和优化,该策略可以成为量化交易体系中的一个有价值的组成部分。

||

The bull flag breakout strategy is a technical analysis strategy that identifies bull flag chart patterns and enters at the breakout point, aiming to capture the start of a trend. The strategy uses the Average True Range (ATR) indicator to assist in determining the flag range after a clear flagpole, filtering entry opportunities.

The main steps of this strategy are:

- Determine the flagpole: Requires new high in price and breakout of ATR channel.

- Determine pole height: Measure distance between pole top and previous SMA.

- Determine flag range: Flag bottom is 33% of pole height as minimum range.

- Identify flag pattern: Judge if last 3 bars all within flag range.

- Entry: Go long when flag pattern emerges.

- Exit: Close position after fixed 6 bars.

When judging the flagpole and flag, the strategy cleverly uses the ATR indicator to determine significant breakouts and strictly limits the flag height within 33% of the pole height to avoid excessive false signals. In addition, requiring 3 consecutive bars to form the flag improves reliability. Overall, the strategy rules are rigorously designed and has some advantage in capturing early trend breakouts.

The main advantages of this strategy include:

- Using flag patterns to determine trend starts is a classic technical analysis method with high success rate.

- ATR and strict range limitations avoid lots of false signals and improve entry accuracy.

- Fixed 6 bar exit locks in some profits and avoids reversal risks.

- Clear rules easy to implement, grasp and follow.

- Can find opportunities in various market conditions, flexible.

The major risks of this strategy are:

- Flags cannot fully determine trends, failures still exist.

- 6 bar exit may be premature and exit too early.

- Choppy markets can produce false flags easily.

- Unable to effectively control single loss amount.

To address the above risks, we can set stop losses, optimize exit mechanisms to lock profits when reaching certain profit ratio. We can also filter with other indicators to avoid false signals in choppy markets.

Some directions to optimize the strategy:

- Combine indicators like MACD, KD to avoid false signals in choppy markets.

- Parameterize ATR multiplier, exit period based on market regime to improve adaptivity.

- Set trailing stop loss or consider profit drawdown ratio for dynamic exits.

- Try machine learning approaches to find better features determining flag height.

- Evaluate actual win rate and profit ratio, dynamically adjust position sizing.

In conclusion, the bull flag breakout strategy utilizes technical pattern to determine trend starts, a rather classical method, and the entry rules are indeed rigorously designed to filter out many false signals. But there is room for improving risk control and exits holistically so that the strategy can operate steadily across different markets after sufficient verification and optimization. It can become a valuable component in a quantitative trading system.

[/trans]

Source (PineScript)

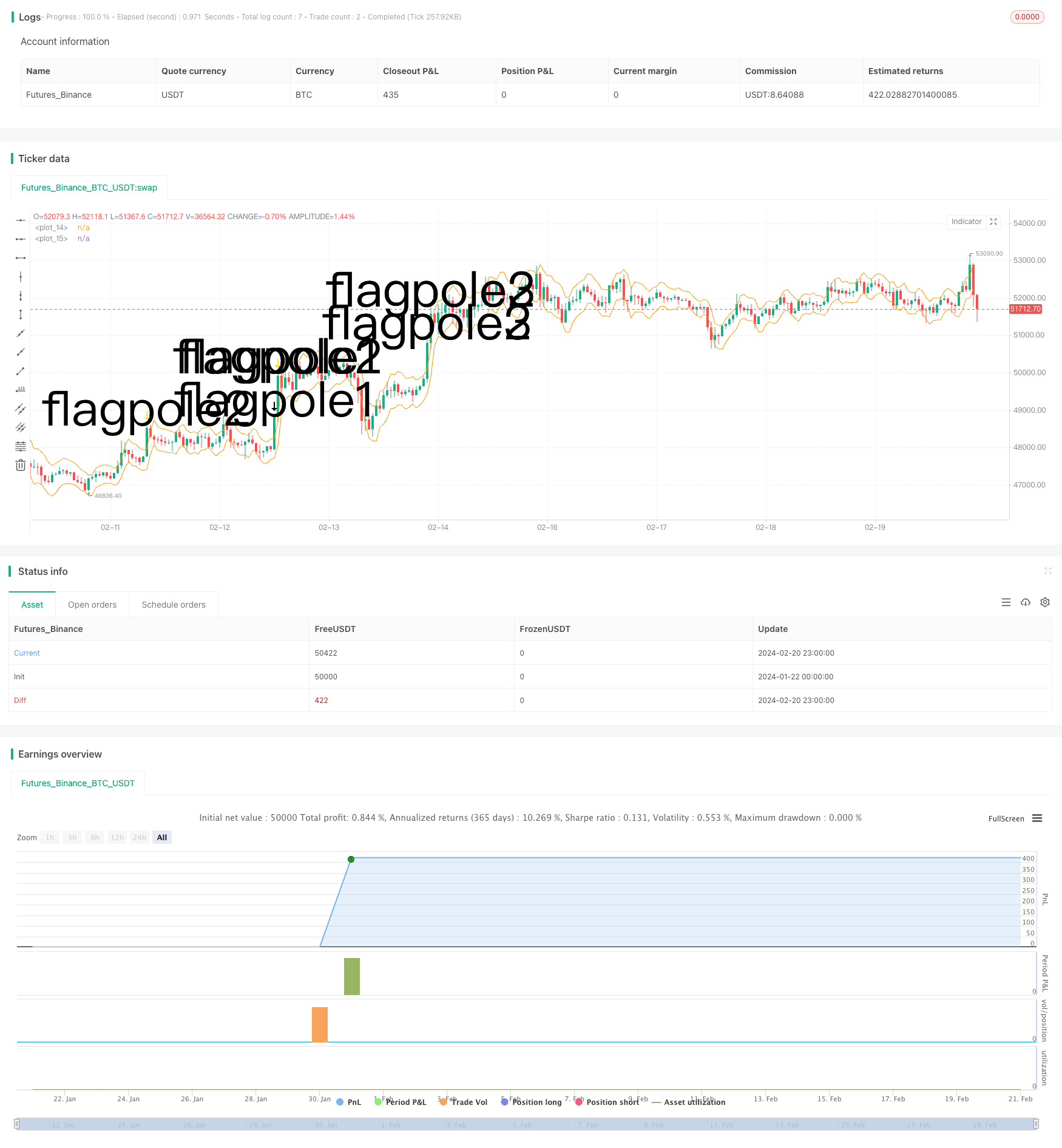

/*backtest

start: 2024-01-22 00:00:00

end: 2024-02-21 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// © smith26

//This strategy enters on a bull flag and closes position 6 bars later. Average true range is used instead of a moving average.

//The reason for ATR instead of MA is because with volatile securities, the flagpole must stand up a noticable "distance" above the trading range---which you can't determine with a MA alone.

//This is broken up into multiple parts: Defining a flagpole, defining the pole height, and defining the flag, which will be constrained to the top third (33%) of the pole height to be considered a flag.

//@version=4

strategy("Bull Flag v1.00", overlay=true)

ATR = atr(10) //Average True Range over last 10 bars.

upperATR = ohlc4[1] + ATR[1] //Open + High + Low + Close divided by 4, + prior ATR. Just used here for visually plotting the ATR upper channel.

lowerATR = ohlc4[1] - ATR[1] //Open + High + Low + Close divided by 4, - prior ATR. Just used here for visually plotting the ATR lower channel.

//uncomment these two lines to see ATR channels

plot(upperATR, color=color.orange)

plot (lowerATR, color=color.orange)

//Current close higher than previous close, and current close minus current open is greater than 3 times the previous ATR. "3x ATR" is chosen because any less was not a noticeable distance above the trading range.

flagpole1 = close>close[1] and (close-open) > (ATR[1] * 3)

plotshape(flagpole1, text="flagpole1", style=shape.arrowdown, size=size.huge) //Plots an arrow for flagpole1 for QA testing

//Two consecutive close higer than their previous close, and current close minus PREVIOUS open is greater than 3 times the previous ATR.

flagpole2 = close>close[1] and close[1]>close[2] and (close-open[1]) > (ATR[1] * 3)

plotshape(flagpole2, text="flagpole2", style=shape.arrowdown, size=size.huge, color=color.yellow) //Plots an arrow for flagpole2 for QA testing

//Three consecutive close higer than their previous close, and current close minus open from 2 bars ago is greater than 3 times the previous ATR.

flagpole3 = close>close[1] and close[1]>close[2] and close[2]>close[3] and (close-open[2]) > (ATR[1] * 3)

plotshape(flagpole3, text="flagpole3", style=shape.arrowdown, size=size.huge, color=color.white) //Plots an arrow for flagpole3 for QA testing

//A flagpole can be any of the three definitions of flagpole.

flagpole = flagpole1 or flagpole2 or flagpole3

//This will return the number of bars since "flagpole" was true. Not being used, but could be useful.

//since_flagpole = barssince(flagpole)

after_pole_1 = flagpole[1] //This marks the bar directly after a flagpole.

//plotshape(after_pole_1, text="after_pole_1", style=shape.cross, size=size.large, color=color.white) //Plots a cross for after_pole_1 for QA testing

after_pole_2 = flagpole[2] //This marks the bar two bars after a flagpole.

after_pole_3 = flagpole[3] //This marks the bar three bars after a flagpole.

//This returns the price at the "top" of the flagpole (using close price) at the most recent occurence, 0.

pole_top = valuewhen(flagpole, close, 0)

//plot(pole_top, trackprice=true) //plots a horizontal line at the most recent pole_top

//Measures the distance between last pole top and the previous SMA.

pole_height = pole_top - sma(close, 10)[1]

//plot(pole_height)

//This marks 33% below the pole_top, which will be the lowest point a flag can be.

flag_bottom = pole_top - (.33 * pole_height)

//plot(flag_bottom)

//The first, second, and third bars after the pole are considered part of a flag when open and close are between the pole_top and flag_bottom

flag1 = after_pole_1 and (open >= flag_bottom) and (open <= pole_top) and (close >= flag_bottom) and (close <= pole_top)

//plotshape(flag1, text="flag1", style=shape.flag, size=size.large, color=color.teal)

flag2 = after_pole_2 and (open >= flag_bottom) and (open <= pole_top) and (close >= flag_bottom) and (close <= pole_top)

//plotshape(flag2, text="flag2", style=shape.flag, size=size.large, color=color.teal)

flag3 = after_pole_3 and (open >= flag_bottom) and (open <= pole_top) and (close >= flag_bottom) and (close <= pole_top)

//plotshape(flag3, text="flag3", style=shape.flag, size=size.large, color=color.teal)

//When all three bars after a flagpole are a flag, the criteria are met and we have a "bull_flag"

//Specifically, when current bar is flag3, previous bar is flag2, and 2 bars ago is flag1, we have a bull_flag.

bull_flag = flag3 and flag2[1] and flag1[2]

plotshape(bull_flag, text="bull_flag", style=shape.flag, size=size.large, color=color.white) //Plots a flag for bull_flag for QA testing

if (bull_flag)

strategy.entry("Long", strategy.long)

if barssince(bull_flag) == 6 //close 6 bars after entry.

strategy.close("Long")

Detail

https://www.fmz.com/strategy/442543

Last Modified

2024-02-22 16:41:04