Name

极端的Noro趋势均线策略Extreme-version-of-Noros-Trend-Moving-Averages-Strategy

Author

ChaoZhang

Strategy Description

该策略运用两个均线指标来识别趋势方向和做多做空时机。其中慢速均线(蓝线)用于判断整体趋势方向,快速均线(红线)与价格通道结合,用于发现做多做空时机。

-

计算快慢两个均线。慢速均线周期为21,用于判断整体趋势;快速均线周期为5,与价格通道结合,用于发现交易时机。

-

计算当前价格是否突破上一个周期的价格通道。如果价格突破通道,我们认为是一个交易机会。

-

计算K线的方向和数量。如果最后N根K线都是阴线,则可能为做多时机;如果最后N根K线都是阳线,则可能为做空时机。N的数量通过Bars参数设置。

-

综合以上几个因素,发出做多做空信号。如果行情与慢速均线方向一致,且快速均线或价格通道发出信号,同时K线也符合条件,则发出交易信号。

-

使用双均线系统,能够有效跟踪趋势方向。

-

快速均线与价格通道的结合,能够提早发现突破点,把握交易时机。

-

发信号时还考虑K线方向和数量,避免被反转市场套牢。

-

可自由调整均线参数,适用于不同品种和周期。

-

双均线容易在横盘时发出错误信号。可通过价差指标或ATR指标辅助判断,避免在震荡行情中交易。

-

在异常行情下也可能被套。可设置适当的止损点,降低单笔亏损。

-

无法完美避免被反转所套。我们将继续优化机制和参数,使策略更加稳定。

-

增加辅助指标判断,如ADX,MACD等,避免震荡行情的错误交易。

-

动态调整止损点。可以根据ATR来计算风险预期,设置合理的止损比率。

-

优化参数自适应能力。可以使用机器学习方法,让系统自动优化参数。

-

根据品种特性进行参数细调。比如加密货币适合更短周期的参数。

该策略整体来说非常适合跟踪趋势行情。同时也增加了一定的突破交易机会。通过合理优化,可使策略在更多市场中稳定运行。我们将继续改进,努力把它打造成一个商业级的高质量量化策略。

||

This strategy uses two moving average indicators to identify trend direction and long/short opportunities. The slower moving average (blue line) is used to determine the overall trend direction, while the faster moving average (red line) combined with the price channel is used to discover trading opportunities.

-

Calculate two moving averages - a slower MA with period 21 to determine the overall trend, and a faster MA with period 5 that combines with price channel to find trading opportunities.

-

Check if the current price breaks through the price channel formed in the previous period. A breakout signals a potential trading opportunity.

-

Count the number and direction of recent candlesticks. For example, several consecutive bearish candlesticks may signal a long opportunity, while consecutive bullish candlesticks may signal a short opportunity. The number of candlesticks is configurable via the Bars parameter.

-

Combine all the above factors to generate long/short signals. A signal is triggered when price move aligns with slower MA trend direction, fast MA or price channel produces signal, and candlestick move matches condition.

-

The dual moving average system effectively tracks trend direction.

-

Faster MA and price channel combined detects early breakout points to catch trading opportunities.

-

Also considers candlestick direction and counts to avoid being trapped by market reversals.

-

Customizable MA parameters work for different products and timeframes.

-

Dual MAs can produce false signals during sideways markets. Can add oscillators or ATR to avoid trading choppy markets.

-

Still risks getting trapped in exceptional market moves. Can set proper stop loss to limit downside.

-

Impossible to fully avoid reversals. Will keep improving logic and parameters to make strategy more robust.

-

Add supporting indicators like ADX, MACD to avoid wrong trades in choppy markets.

-

Dynamic stop loss calculation, e.g. based on ATR and risk preference.

-

Parameter optimization via machine learning for adaptive capability.

-

Fine tune parameters based on instrument characteristics, e.g. shorter periods for crypto.

Overall this strategy works very well in tracking trending markets, with additional breakout opportunities. With proper enhancements it can be made into a commercially viable high quality quant strategy. We will continue improving it to trade more markets stably. [/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | true | long |

| v_input_2 | true | short |

| v_input_3 | false | stops |

| v_input_4 | 5 | Stop, % |

| v_input_5 | false | Use OHLC4 |

| v_input_6 | true | Use fast MA Filter |

| v_input_7 | 5 | fast MA Period |

| v_input_8 | 21 | slow MA Period |

| v_input_9 | 2 | Bars Q |

| v_input_10 | false | Need trend Background? |

| v_input_11 | false | Need entry arrows? |

| v_input_12 | true | Need extreme? (crypto/fiat only!!!) |

Source (PineScript)

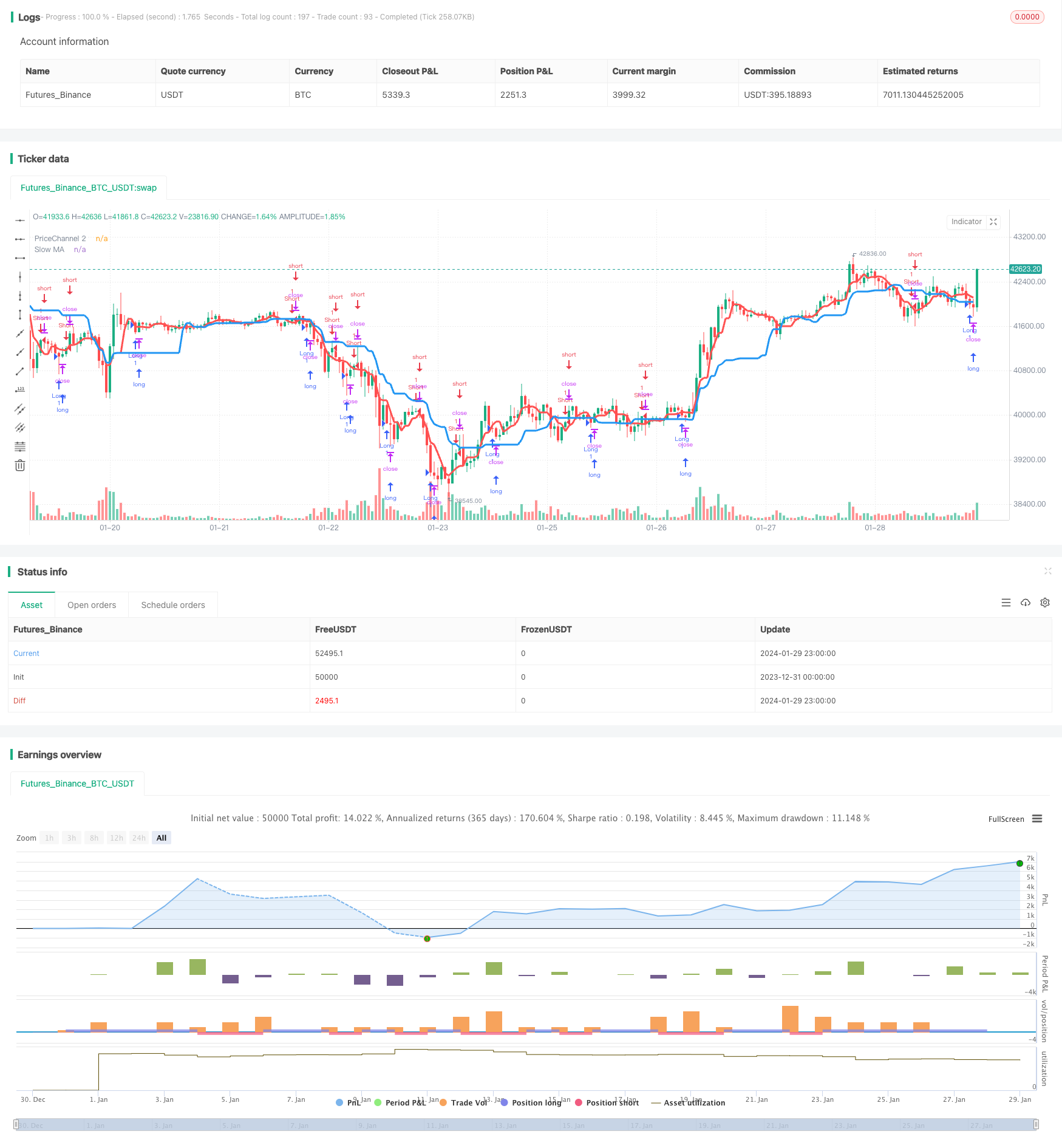

/*backtest

start: 2023-12-31 00:00:00

end: 2024-01-30 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

strategy(title = "Noro's Trend MAs Strategy v1.9 Extreme", shorttitle = "Trend MAs str 1.9 extreme", overlay=true, default_qty_type = strategy.percent_of_equity, default_qty_value=100.0, pyramiding=0)

//Settings

needlong = input(true, "long")

needshort = input(true, "short")

needstops = input(false, "stops")

stoppercent = input(5, defval = 5, minval = 1, maxval = 50, title = "Stop, %")

useohlc4 = input(false, defval = false, title = "Use OHLC4")

usefastsma = input(true, "Use fast MA Filter")

fastlen = input(5, defval = 5, minval = 1, maxval = 50, title = "fast MA Period")

slowlen = input(21, defval = 20, minval = 2, maxval = 200, title = "slow MA Period")

bars = input(2, defval = 2, minval = 0, maxval = 3, title = "Bars Q")

needbg = input(false, defval = false, title = "Need trend Background?")

needarr = input(false, defval = false, title = "Need entry arrows?")

needex = input(true, defval = true, title = "Need extreme? (crypto/fiat only!!!)")

src = useohlc4 == true ? ohlc4 : close

//PriceChannel 1

lasthigh = highest(src, slowlen)

lastlow = lowest(src, slowlen)

center = (lasthigh + lastlow) / 2

//PriceChannel 2

lasthigh2 = highest(src, fastlen)

lastlow2 = lowest(src, fastlen)

center2 = (lasthigh2 + lastlow2) / 2

//Trend

trend = low > center and low[1] > center[1] ? 1 : high < center and high[1] < center[1] ? -1 : trend[1]

//Bars

bar = close > open ? 1 : close < open ? -1 : 0

redbars = bars == 0 ? 1 : bars == 1 and bar == -1 ? 1 : bars == 2 and bar == -1 and bar[1] == -1 ? 1 : bars == 3 and bar == -1 and bar[1] == -1 and bar[2] == -1 ? 1 : 0

greenbars = bars == 0 ? 1 : bars == 1 and bar == 1 ? 1 : bars == 2 and bar == 1 and bar[1] == 1 ? 1 : bars == 3 and bar == 1 and bar[1] == 1 and bar[2] == 1 ? 1 : 0

//Signals

up = trend == 1 and (low < center2 or usefastsma == false) and (redbars == 1) ? 1 : 0

dn = trend == -1 and (high > center2 or usefastsma == false) and (greenbars == 1) ? 1 : 0

up2 = high < center and high < center2 and bar == -1 ? 1 : 0

dn2 = low > center and low > center2 and bar == 1 ? 0 : 0

//Lines

plot(center, color = blue, linewidth = 3, transp = 0, title = "Slow MA")

plot(center2, color = red, linewidth = 3, transp = 0, title = "PriceChannel 2")

//Arrows

plotarrow(up == 1 and needarr == true ? 1 : 0, colorup = black, colordown = black, transp = 0)

plotarrow(dn == 1 and needarr == true ? -1 : 0, colorup = black, colordown = black, transp = 0)

//Background

col = needbg == false ? na : trend == 1 ? lime : red

bgcolor(col, transp = 90)

//Alerts

alertcondition(up == 1, title='buy', message='Uptrend')

alertcondition(dn == 1, title='sell', message='Downtrend')

//Trading

stoplong = up == 1 and needstops == true ? close - (close / 100 * stoppercent) : stoplong[1]

stopshort = dn == 1 and needstops == true ? close + (close / 100 * stoppercent) : stopshort[1]

longCondition = up == 1 or (up2 == 1 and needex == true)

if (longCondition)

strategy.entry("Long", strategy.long, needlong == false ? 0 : na)

strategy.exit("Stop Long", "Long", stop = stoplong)

shortCondition = dn == 1

if (shortCondition)

strategy.entry("Short", strategy.short, needshort == false ? 0 : na)

strategy.exit("Stop Short", "Short", stop = stopshort)

Detail

https://www.fmz.com/strategy/440559

Last Modified

2024-01-31 17:00:53