Name

牛市追踪系统Bull-Market-Tracking-System

Author

ChaoZhang

Strategy Description

牛市追踪系统是一个基于趋势跟踪的机械交易系统。它利用4小时图形的趋势指标来过滤交易信号,而入场则根据15分钟图形的指标来判断。主要的指标包括RSI、随机指标和MACD。该系统的优点是多时间框架的组合可以有效过滤假信号,同时利用更低时间框架的指标来获取较精确的入场时机。但该系统也存在一些风险,比如容易产生过度交易和假突破的问题。

该系统的核心逻辑是结合不同时间框架的指标来识别趋势方向和入场时机。具体来说,4小时图形的RSI、随机指标和EMA均要符合条件,来判断总体趋势方向。这可以有效过滤掉多数的噪音。同时15分钟图形的RSI、随机指标、MACD和EMA也要同向看涨或看跌,来确定具体的入场时机。这样可以找到较好的买入卖出点位。当4小时和15分钟的判断都符合时,该系统才会发出交易信号。

- 多时间框架组合,可以有效过滤假信号,识别主要趋势

- 15分钟细节指标,可以获取比较精确的入场时机

- 指标组合使用RSI、随机指标、MACD等主流技术指标,容易理解,also易于优化

- 采用mStop盈、止损、追踪止损等严格的风险管理手段,可以有效控制单笔交易的风险

- 过度交易风险。该系统对短期时间框架比较敏感,可能会产生大量的交易信号,导致过度交易

- 假突破风险。短期指标判断可能会发生误判,产生假突破信号

- 指标失效风险。技术指标本身存在一定的局限性,在极端行情中可能会失效

对应地,可以从以下几个方面来优化该系统:

- 调整指标参数,使之更适合不同市场环境

- 增加过滤条件,以减少交易频率,防止过度交易

- 优化止盈止损策略,使之更符合市场波动范围

- 测试不同的指标组合方案,寻找最优解

牛市追踪系统整体来说是一个非常实用的趋势跟踪机械交易系统。它利用多时间框架的组合指标来识别行情趋势和关键入场时机。通过合理的参数设置和持续的优化测试,该系统可以适应大部分行情环境,达到稳定盈利的效果。但我们也要意识到其中的一些潜在风险,采取积极的措施来防范和化解这些风险。

||

The Bull Market Tracking System is a mechanical trading system based on trend tracking. It uses trend indicators on the 4-hour chart to filter trading signals, while entry decisions are made based on indicators from the 15-minute chart. The main indicators include RSI, Stochastics, and MACD. The advantage of this system is that the combination of multiple timeframes can effectively filter out false signals, while the shorter timeframe indicators can pinpoint more precise entry timing. However, there are also some risks with this system, such as overtrading and false breakout issues.

The core logic of this system is to combine indicators from different timeframes to identify trend direction and entry timing. Specifically, the RSI, Stochastics, and EMA on the 4-hour chart need to align to determine the overall trend direction. This can effectively filter out most of the noise. At the same time, the RSI, Stochastics, MACD and EMA on the 15-minute chart also need to agree on either bullish or bearish bias to determine the precise entry timing. This allows us to find good entry and exit points. Only when the judgments on both the 4-hour and 15-minute timeframes meet the criteria will the system generate trading signals.

- Multiple timeframe combinations can effectively filter out false signals and identify major trends

- 15-minute detailed indicators can capture relatively precise entry timing

- The combination of indicators including RSI, Stochastics, MACD and other mainstream technical indicators is easy to understand and optimize

- Strict risk management methods are adopted such as take profit, stop loss, trailing stop loss etc. to effectively control the risk of individual trades

- Overtrading risk. The system is quite sensitive to short-term timeframes, which may generate a lot of trading signals, leading to overtrading

- False breakout risk. Short-term indicator judgments may be wrong, resulting in false breakout signals

- Indicator failure risk. Technical indicators themselves have certain limitations and may fail in extreme market conditions

Accordingly, the system can be optimized from the following aspects:

- Adjust indicator parameters to make them more suitable for different market environments

- Increase filter conditions to reduce trading frequency and prevent overtrading

- Optimize stop profit and stop loss strategies to better fit market fluctuation ranges

- Test different combinations of indicators to find the optimal solution

Overall, the Bull Market Tracking System is a very practical trend following mechanical trading system. It uses a combination of multi-timeframe indicators to identify market trends and key entry timing. With reasonable parameter settings and continuous optimization testing, the system can adapt to most market environments and achieve steady profits. However, we also need to be aware of some of the potential risks, and take proactive measures to prevent and mitigate these risks.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | 162 | 4h StochLength |

| v_input_2 | 48 | 4h StochK |

| v_input_3 | 48 | 4h StochD |

| v_input_4 | 10 | 15min StochLength |

| v_input_5 | 3 | 15min StochK |

| v_input_6 | 3 | 15min StochD |

| v_input_7 | 240 | 4H RSI Length |

| v_input_8 | 9 | 15M RSI Length |

| v_input_9 | 12 | MACD Fast |

| v_input_10 | 26 | MACD Slow |

| v_input_11 | 9 | MACD Signal |

| v_input_12 | 1000 | Take Profit |

| v_input_13 | false | Stop Loss |

| v_input_14 | 400 | Trailing Stop |

| v_input_15 | false | Trailing Stop Offset |

| v_input_16 | 0500-1600 | My Defined Hours |

Source (PineScript)

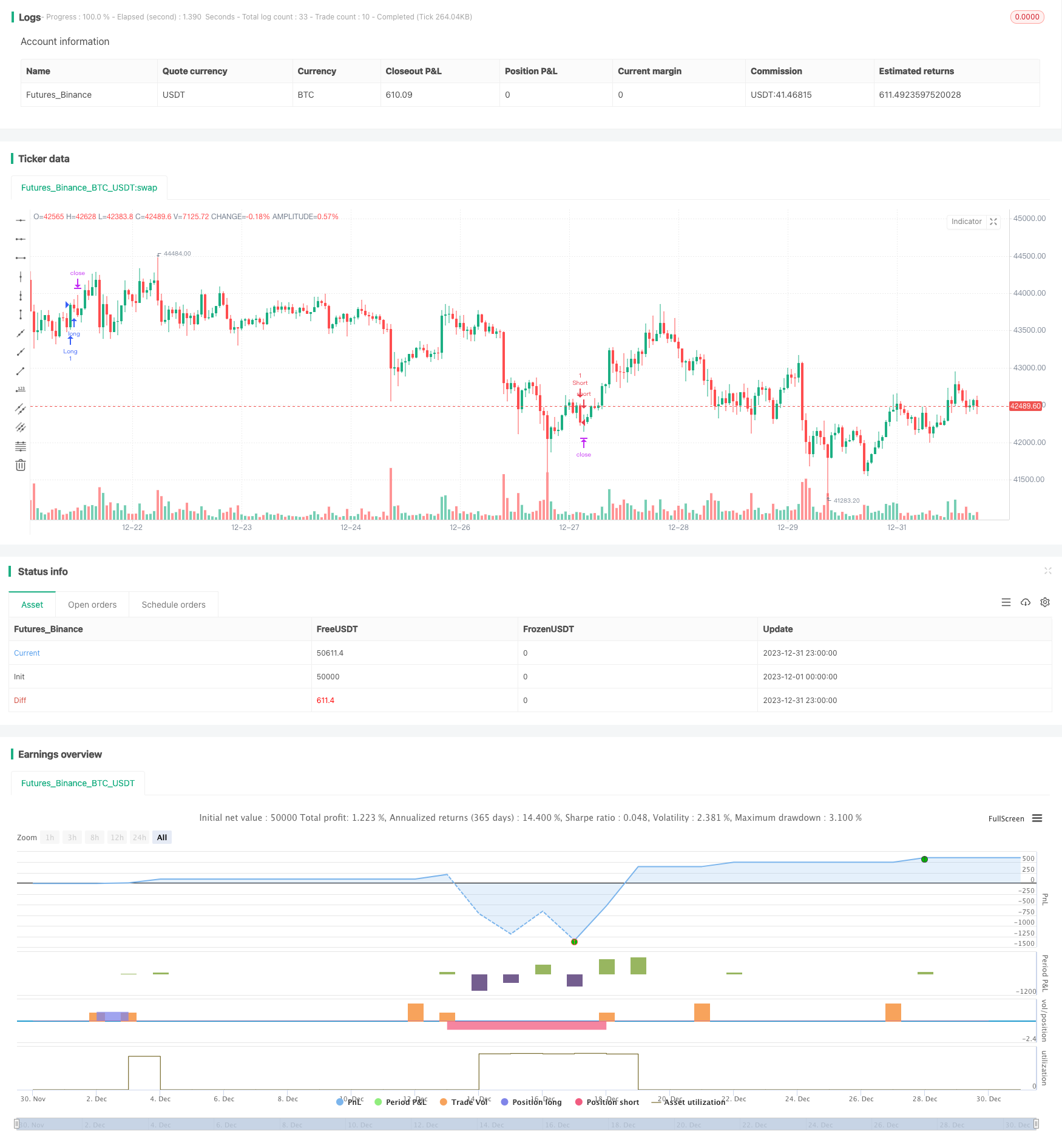

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("Cowabunga System from babypips.com", overlay=true)

// 4 Hour Stochastics

length4 = input(162, minval=1, title="4h StochLength"), smoothK4 = input(48, minval=1, title="4h StochK"), smoothD4 = input(48, minval=1, title="4h StochD")

k4 = sma(stoch(close, high, low, length4), smoothK4)

d4 = sma(k4, smoothD4)

//15 min Stoch

length = input(10, minval=1, title="15min StochLength"), smoothK = input(3, minval=1, title="15min StochK"), smoothD = input(3, minval=1, title="15min StochD")

k = sma(stoch(close, high, low, length), smoothK)

d= sma(k, smoothD)

//4 hour RSI

src1 = close, len1 = input(240, minval=1, title="4H RSI Length")

up1 = rma(max(change(src1), 0), len1)

down1 = rma(-min(change(src1), 0), len1)

rsi4 = down1 == 0 ? 100 : up1 == 0 ? 0 : 100 - (100 / (1 + up1 / down1))

//15 min RSI

src = close, len = input(9, minval=1, title="15M RSI Length")

up = rma(max(change(src), 0), len)

down = rma(-min(change(src), 0), len)

rsi15 = down == 0 ? 100 : up == 0 ? 0 : 100 - (100 / (1 + up / down))

//MACD Settings

source = close

fastLength = input(12, minval=1, title="MACD Fast"), slowLength=input(26,minval=1, title="MACD Slow")

signalLength=input(9,minval=1, title="MACD Signal")

fastMA = ema(source, fastLength)

slowMA = ema(source, slowLength)

macd = fastMA - slowMA

signal = ema(macd, signalLength)

// Stops and Profit inputs

inpTakeProfit = input(defval = 1000, title = "Take Profit", minval = 0)

inpStopLoss = input(defval = 0, title = "Stop Loss", minval = 0)

inpTrailStop = input(defval = 400, title = "Trailing Stop", minval = 0)

inpTrailOffset = input(defval = 0, title = "Trailing Stop Offset", minval = 0)

// Stops and Profit Targets

useTakeProfit = inpTakeProfit >= 1 ? inpTakeProfit : na

useStopLoss = inpStopLoss >= 1 ? inpStopLoss : na

useTrailStop = inpTrailStop >= 1 ? inpTrailStop : na

useTrailOffset = inpTrailOffset >= 1 ? inpTrailOffset : na

//Specific Time to Trade

myspecifictradingtimes = input('0500-1600', title="My Defined Hours")

longCondition1 = time(timeframe.period, myspecifictradingtimes) != 0

longCondition2 = rsi4 <= 80

longCondition3 = k4 >= d4 and k4 <= 80

longCondition4 = ema(close, 80) >= ema(close, 162)

allLongerLongs = longCondition1 and longCondition2 and longCondition3 and longCondition4

longCondition5 = rsi15 <= 80

longCondition6 = k >= d and k <= 80 and fastMA >= slowMA

longCondition7 = ema(close, 5) >= ema(close, 10)

allLongLongs = longCondition5 and longCondition6 and longCondition7

if crossover(close, ema(close, 5)) and allLongerLongs and allLongLongs

strategy.entry("Long", strategy.long, comment="LongEntry")

shortCondition1 = time(timeframe.period, myspecifictradingtimes) != 0

shortCondition2 = rsi4 >= 20

shortCondition3 = k4 <= d4 and k4 >= 20

shortCondition4 = ema(close, 80) <= ema(close, 162)

allShorterShorts = shortCondition1 and shortCondition2 and shortCondition3 and shortCondition4

shortCondition5 = rsi15 >= 20

shortCondition6 = k <= d and k >= 20 and fastMA <= slowMA

shortCondition7 = ema(close, 5) <= ema(close, 10)

allShortShorts = shortCondition5 and shortCondition6 and shortCondition7

if crossunder(close, ema(close,5)) and allShorterShorts and allShortShorts

strategy.entry("Short", strategy.short, comment="ShortEntry")

strategy.exit("Exit Long", from_entry = "Long", profit = useTakeProfit, loss = useStopLoss, trail_points = useTrailStop, trail_offset = useTrailOffset)

strategy.exit("Exit Short", from_entry = "Short", profit = useTakeProfit, loss = useStopLoss, trail_points = useTrailStop, trail_offset = useTrailOffset)

Detail

https://www.fmz.com/strategy/440509

Last Modified

2024-01-31 11:01:45