Name

突破型分形策略Fractal-Breakout-Strategy

Author

ChaoZhang

Strategy Description

该策略是一种判断价格趋势的长线趋势跟踪策略。它通过计算历史价格的分形点,判断最后一个分形点的突破来决定建仓。同时,它通过计算最后N个分形点的平均价来判断趋势方向,当趋势转向时平仓。

- 计算价格的分形点。分形点定义为当天的最高价高于前两天和后两天的最高价。

- 记录最后一个分形点的价格作为阻力。

- 当关闭价格突破最后一个分形点时,认为阻力被突破,建立做多仓位。

- 计算最后N个分形点的平均价格来判断趋势,当平均价格上涨时为看涨趋势,下跌时为看跌趋势。

- 如果在做多仓位时,平均分形点价格转为下跌,则平仓。

这种基于分形点判断趋势的策略,最大的优势是能有效过滤市场噪音,判断更长线的趋势方向。相比简单的移动平均线等指标,它对突发异常波动的抵抗能力更强。

另外,该策略判断建仓和平仓标准非常明确,不会出现频繁交易的问题。这也使得它特别适合长线持有。

这种策略最大的风险在于分形点本身判断的概率性。分形点无法百分百预判价格必然反转,也就是说判断错误的概率依然存在。当出现错判时,将面临亏损的风险。

此外,分形点判断的时间跨度较长,不能适应高频交易。如果追求短线交易,这种策略也不太适合。

考虑到分形点判断的误差概率,我们可以通过以下几个方法优化:

-

结合其他指标确认,如布林线通道、移动平均线等,避免单一分形点判断错误。

-

调整分形点的参数,如判断的前后周期数量,来优化分形点的判断。

-

增加止损策略,在亏损扩大到一定程度时止损。

该突破型分形策略整体来说非常适合判断长线趋势,也十分适合长线投资者使用。我们只需要在确保判断准确率的前提下,适当调整参数,增加其他过滤指标,就可以大幅优化该策略,使其成为量化Decision的重要组成部分。

||

This is a trend-following long line tracking strategy that judges the trend based on price fractals. It decides to open positions based on the breakthrough of the latest fractal point. At the same time, it judges the trend direction by calculating the average price of the last N fractal points and closes positions when the trend changes.

-

Calculate the fractal points of prices. The fractal point is defined as the highest price today that is higher than the highest prices of the previous two days and the next two days.

-

Record the price of the last fractal point as resistance.

-

When the closing price breaks through the last fractal point, it is considered that the resistance has been broken and a long position has been established.

-

Calculate the average price of the last N fractal points to determine the trend. When the average price rises, it is a bullish trend, and when it falls, it is a bearish trend.

-

If the average fractal point price turns down during the long position, close the position.

The biggest advantage of this fractal-based trend judgment strategy is that it can effectively filter market noise and determine longer-term trend directions. Compared with simple moving average lines and other indicators, it has greater resistance to sudden abnormal fluctuations.

In addition, the criteria for opening and closing positions of this strategy are very clear, which avoids frequent trading. It also makes it particularly suitable for long-term holdings.

The biggest risk of this strategy lies in the probabilistic nature of the fractal points themselves. Fractals cannot fully predict whether prices will definitely reverse, that is, the probability of misjudgment still exists. When misjudgments occur, it will face the risk of losses.

In addition, the time span for judging fractal points is long and cannot adapt to high frequency trading. If you pursue short-term trading, this strategy may not be suitable.

Considering the probability of misjudgment of fractal points, we can optimize in the following ways:

-

Combine with other indicators such as Bollinger Bands, moving averages, etc. to avoid misjudgments based solely on fractal points.

-

Adjust the parameters of fractal points, such as the number of periods before and after judgment, to optimize fractal point judgments.

-

Add stop loss strategies to stop losses when losses expand to a certain extent.

The Fractal Breakout Strategy is very suitable for judging long-term trends overall and is very suitable for use by long-term investors. As long as we properly adjust the parameters appropriately, add other filtering indicators on the premise of ensuring the accuracy of judgment, we can greatly optimize this strategy and make it an important part of quantitative Decision.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | 3 | Always exit each trade after this amount of bars later (Most important strategy setting) |

| v_input_2_hl2 | 0 | Price type to determine the last fractal top and the fractal breakout, the default is (high+low)/2: hl2 |

| v_input_3 | true | Use Fractal price average of the last 3 fractals instead of the last 2 fractals? |

| v_input_4 | true | Use the price of the last bar to prevent repainting? |

| v_input_5 | true | Highlight fractal tops in blue and color all other bars in gray? |

| v_input_6 | true | Draw a colored line based on the fractal tops? |

Source (PineScript)

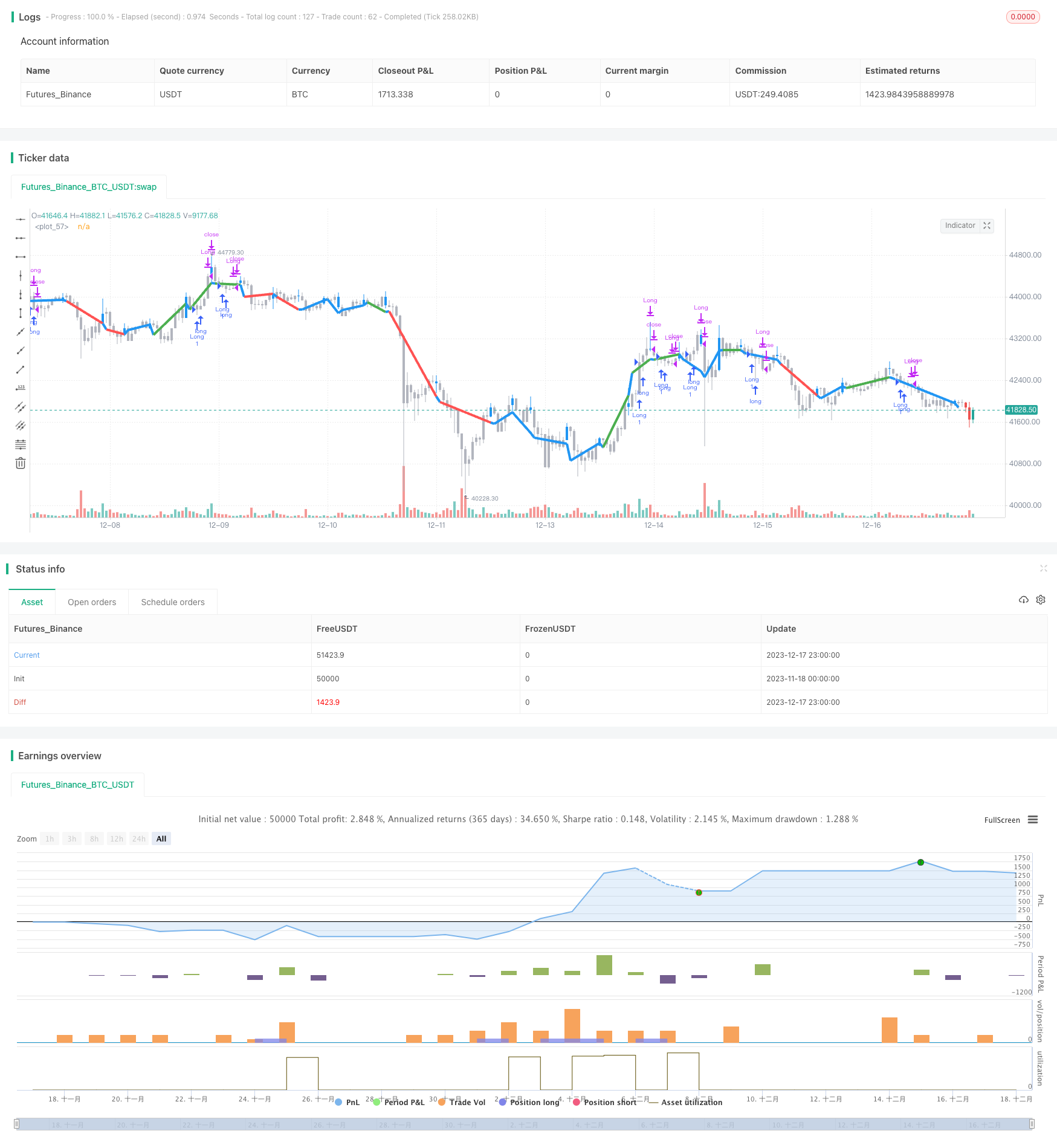

/*backtest

start: 2023-11-18 00:00:00

end: 2023-12-18 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

strategy("Fractal Breakout Strategy (by ChartArt)", shorttitle="CA_-_Fractal_Breakout_Strat", overlay=true)

// ChartArt's Fractal Breakout Strategy

//

// Version 1.0

// Idea by ChartArt on April 24, 2016.

//

// This long only strategy determines the last fractal top

// and enters a trade when the price breaks above the last

// fractal top. The strategy also calculates the average

// price of the last 2 (or 3) fractal tops to get the trend.

//

// The strategy exits the long trade when the average of the

// fractal tops is falling (when the trend is lower highs).

// And the user can manually set a delay of this exit.

//

// In addition the fractals tops can be colored in blue

// and a line can be drawn based on the fractal tops.

// This fractal top line is colored by the fractal trend.

//

// List of my work:

// https://www.tradingview.com/u/ChartArt/

//

// __ __ ___ __ ___

// / ` |__| /\ |__) | /\ |__) |

// \__, | | /~~\ | \ | /~~\ | \ |

//

//

// input

n_time = input(title='Always exit each trade after this amount of bars later (Most important strategy setting)', defval=3)

price = input(hl2,title='Price type to determine the last fractal top and the fractal breakout, the default is (high+low)/2')

// fractal calculation

fractal_top = high[2] > high[3] and high[2] > high[4] and high[2] > high[1] and high[2] > high[0]

fractal_price = valuewhen(fractal_top, price, 1)

use_longer_average = input(true,title='Use Fractal price average of the last 3 fractals instead of the last 2 fractals?')

fractal_average = use_longer_average?(fractal_price[1] + fractal_price[2] + fractal_price[3] ) / 3 : (fractal_price[1] + fractal_price[2]) / 2

fractal_trend = fractal_average[0] > fractal_average[1]

no_repainting = input(true,title='Use the price of the last bar to prevent repainting?')

fractal_breakout = no_repainting?price[1] > fractal_price[0]:price[0] > fractal_price[0]

// highlight fractal tops

show_highlight = input(true,title='Highlight fractal tops in blue and color all other bars in gray?')

highlight = fractal_top?blue:silver

barcolor(show_highlight?highlight:na,offset=-2)

show_fractal_top_line = input(true,title='Draw a colored line based on the fractal tops?')

fractal_top_line = change(fractal_top) != 0 ? price : na

fractal_top_line_color = change(fractal_price) > 0 and fractal_breakout == true ? green : change(fractal_price) < 0 and fractal_breakout == false ? red : blue

plot(show_fractal_top_line?fractal_top_line:na,offset=-2,color=fractal_top_line_color,linewidth=4)

// strategy

trade_entry = fractal_trend and fractal_breakout

trade_exit = fractal_trend[n_time] and fractal_trend == false

if (trade_entry)

strategy.entry('Long', strategy.long)

if (trade_exit)

strategy.close('Long')

Detail

https://www.fmz.com/strategy/435893

Last Modified

2023-12-19 15:32:57