Name

耐心追踪趋势跟随型策略Patient-Trend-Following-Strategy

Author

ChaoZhang

Strategy Description

[trans]

耐心追踪趋势策略是一种趋势跟随型策略。它利用移动平均线的指标组合判断趋势方向,并结合超买超卖指标CCI发出交易信号。该策略追求大趋势,在震荡行情中可以有效避免被套。

该策略使用21周期和55周期的EMA组合判断趋势方向。当短期EMA在长期EMA上方时定义为上升趋势,当短期EMA在长期EMA下方时定义为下降趋势。

CCI指标用于判断超买超卖情况。CCI上穿-100线为底部超卖讯号,下穿100线为顶部超买讯号。根据CCI指标的不同超买超卖线,策略分为三个交易信号强度级别。

在判断为上升趋势时,如果CCI指标发出强烈的底部超卖信号,就进行多头入场。判断为下降趋势时,如果CCI指标发出强烈的顶部超买信号,就进行空头入场。

止损线设置为SuperTrend指标,目标利润设置为固定的点数。

该策略主要有以下优势:

- 追踪大趋势,避免被套

- CCI指标可以有效判断反转点位

- SuperTrend止损线设置合理

- 固定止损与固定止盈,风险可控

该策略主要存在以下风险:

- 大趋势判断失误的概率

- CCI指标发出假信号的概率

- 止损点过浅或过深造成不必要止损的概率

- 固定止盈无法持续追踪趋势获利的概率

针对这些风险,我们可以通过调整EMA周期参数,CCI参数以及止损止盈点位来优化。同时引入更多指标进行策略信号验证也很有必要。

该策略的优化方向主要有:

1.测试更多指标的组合,寻找更优趋势判断以及信号验证指标。

2.利用ATR动态止损止盈,以更好地跟踪趋势和控制风险。

3.引入基于历史数据训练的机器学习模型来判断趋势概率。

4.针对不同品种参数进行调整优化。

耐心追踪趋势策略整体是一个非常实用的趋势跟随策略。它利用移动平均线判断大趋势方向,CCI指标发现反转点位信号,超级趋势止损线设定合理。通过参数调整与多指标组合验证,该策略可以进一步优化,值得长期实盘跟踪验证。

||

The Patient Trend Following Strategy is a trend following strategy. It uses a combination of moving averages to determine the trend direction and CCI oscillator to generate trading signals. This strategy pursues big trends and can effectively avoid whipsaws in ranging markets.

The strategy uses 21-period and 55-period EMA combination to define the trend direction. An uptrend is defined when the short EMA is above the long EMA. A downtrend is defined when the short EMA is below the long EMA.

The CCI indicator is used to detect overbought and oversold situations. CCI crossing above -100 signals bottom oversold condition and crossing below 100 signals top overbought condition. Different overbought and oversold levels of CCI produce trading signals with different confidence levels.

When an uptrend is determined, strong bottom oversold signals from CCI will trigger long entry orders. When a downtrend is determined, strong top overbought signals from CCI will trigger short entry orders.

The stop loss is set at SuperTrend lines. Take profit is fixed number of pips.

The main advantages of this strategy are:

- Following big trends, avoiding whipsaws

- CCI effectively detects reversal points

- Reasonable stop loss setting with SuperTrend

- Fixed stop loss and take profit, controllable risk

The main risks of this strategy are:

- Probability of incorrect big trend determination

- Probability of false signals from CCI

- Probability of unnecessary stop loss with improper stop loss levels

- Probability of missing trend profits with fixed take profit

To cope with these risks, parameters like EMA periods, CCI periods and stop loss/take profit levels can be optimized. Introducing more indicators for signal verification is also necessary.

The main optimization directions are:

-

Test more indicator combinations to find better trend and signal verification indicators.

-

Utilize dynamic stop loss and take profit with ATR to better follow trends and control risk.

-

Introduce machine learning models trained on historical data to judge trend probabilities.

-

Optimize parameters for different trading instruments.

The Patient Trend Following Strategy is a very practical trend trading strategy overall. It defines big trend with moving averages and detects reversal signals with CCI oscillator, while setting reasonable stop loss levels using SuperTrend indicator. With further parameter tuning and more indicator combinations for signal verification, this strategy can be further optimized and is worth tracking in live trading.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | 21 | Short EMA |

| v_input_2 | 55 | Long EMA |

| v_input_3 | 20 | Overbought/sold detector period |

| v_input_4_close | 0 | Overbought/sold detector source: close |

| v_input_5 | 100 | Overbought level 1 |

| v_input_6 | 140 | Overbought level 2 |

| v_input_7 | 180 | Overbought level 3 |

| v_input_8 | -100 | Oversold level 1 |

| v_input_9 | -140 | Oversold level 2 |

| v_input_10 | -180 | Oversold level 3 |

| v_input_11 | 55 | ATR Period |

| v_input_12 | 5 | ATR Multiplier |

| v_input_13 | true | Take Wicks into Account ? |

| v_input_14 | true | Illuminate Trend |

| v_input_15 | 0.0002 | Spread |

| v_input_16 | true | Test longs |

| v_input_17 | true | Test shorts |

| v_input_18 | true | Test level 1 overbought/sold levels |

| v_input_19 | false | Test level 2 overbought/sold levels |

| v_input_20 | false | Test level 3 overbought/sold levels |

| v_input_21 | true | Use static target |

| v_input_22 | 400 | Static target in pips |

Source (PineScript)

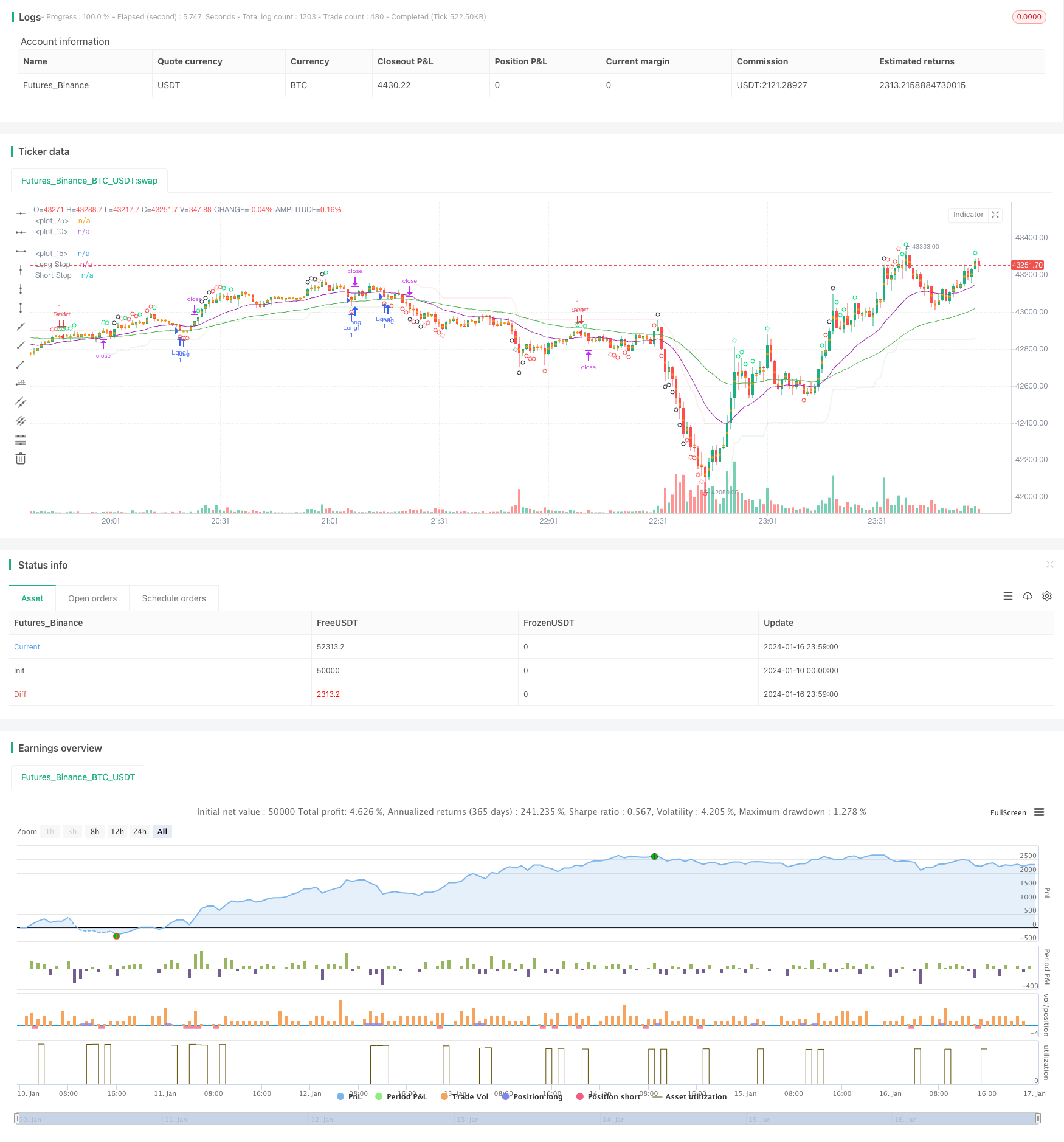

/*backtest

start: 2024-01-10 00:00:00

end: 2024-01-17 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © greenmask9

//@version=4

strategy("Patient Trendfollower (7) Strategy", overlay=true)

// 21 EMA

emalength = input(21, title="Short EMA")

emashort = ema(close, emalength)

plot(emashort, color = color.purple, linewidth=1)

// 55 EMA

emalength2 = input(55, title="Long EMA")

ema = ema(close, emalength2)

plot(ema, color = color.green, linewidth=1)

//CCI calculation and inputs

lengthcci = input(20, minval=1, title="Overbought/sold detector period")

src = input(close, title="Overbought/sold detector source")

ma = sma(src, lengthcci)

ccivalue = (src - ma) / (0.015 * dev(src, lengthcci))

//CCI plotting

ccioverbought = input(defval=100, title="Overbought level 1")

ccioverbought2 = input(defval=140, title="Overbought level 2")

ccioverbought3 = input(defval=180, title="Overbought level 3")

ccioversold = input(defval=-100, title="Oversold level 1")

ccioversold2 = input(defval=-140, title="Oversold level 2")

ccioversold3 = input(defval=-180, title="Oversold level 3")

cciOB = (ccivalue >= ccioverbought and ccivalue < ccioverbought2)

plotshape(cciOB, title= "Overbought", location=location.abovebar, color=color.lime, transp=0, style=shape.circle)

cciOS = (ccivalue <= ccioversold and ccivalue > ccioversold2)

plotshape(cciOS, title= "Oversold", location=location.belowbar, color=color.lime, transp=0, style=shape.circle)

cciOB2 = (ccivalue >= ccioverbought2 and ccivalue < ccioverbought3)

plotshape(cciOB2, title= "Overbought", location=location.abovebar, color=color.red, transp=0, style=shape.circle)

cciOS2 = (ccivalue <= ccioversold and ccivalue > ccioversold3)

plotshape(cciOS2, title= "Oversold", location=location.belowbar, color=color.red, transp=0, style=shape.circle)

cciOB3 = (ccivalue >= ccioverbought3)

plotshape(cciOB3, title= "Overbought", location=location.abovebar, color=color.black, transp=0, style=shape.circle)

cciOS3 = (ccivalue <= ccioversold3)

plotshape(cciOS3, title= "Oversold", location=location.belowbar, color=color.black, transp=0, style=shape.circle)

//Supertrend

length = input(title="ATR Period", type=input.integer, defval=55)

mult = input(title="ATR Multiplier", type=input.float, step=0.1, defval=5.0)

wicks = input(title="Take Wicks into Account ?", type=input.bool, defval=true)

illuminate = input(title="Illuminate Trend", type=input.bool, defval=true)

atr = mult * atr(length)

longStop = hl2 - atr

longStopPrev = nz(longStop[1], longStop)

longStop := (wicks ? low[1] : close[1]) > longStopPrev ? max(longStop, longStopPrev) : longStop

shortStop = hl2 + atr

shortStopPrev = nz(shortStop[1], shortStop)

shortStop := (wicks ? high[1] : close[1]) < shortStopPrev ? min(shortStop, shortStopPrev) : shortStop

dir = 1

dir := nz(dir[1], dir)

dir := dir == -1 and (wicks ? high : close) > shortStopPrev ? 1 : dir == 1 and (wicks ? low : close) < longStopPrev ? -1 : dir

longColor = color.new(color.green, 90)

shortColor = color.new(color.red, 90)

noneColor = color.new(color.white, 100)

longStopPlot = plot(dir == 1 ? longStop : na, title="Long Stop", style=plot.style_linebr, linewidth=2, color=longColor)

shortStopPlot = plot(dir == 1 ? na : shortStop, title="Short Stop", style=plot.style_linebr, linewidth=2, color=shortColor)

midPricePlot = plot(ohlc4, title="", style=plot.style_circles, linewidth=0)

longFillColor = illuminate ? (dir == 1 ? longColor : noneColor) : noneColor

shortFillColor = illuminate ? (dir == -1 ? shortColor : noneColor) : noneColor

fill(midPricePlot, longStopPlot, title="Long State Filling", color=longFillColor)

fill(midPricePlot, shortStopPlot, title="Short State Filling", color=shortFillColor)

//entries

uptrend = emashort>ema and dir == 1

upsignal = ccivalue<=ccioversold and ccivalue>ccioversold2

upsignal2 = ccivalue<=ccioversold2 and ccivalue>ccioversold3

upsignal3 = ccivalue<=ccioversold3

downtrend = emashort<ema and dir == -1

downsignal = ccivalue>=ccioverbought and ccivalue<ccioverbought2

downsignal2 = ccivalue>=ccioverbought2 and ccivalue<ccioverbought3

downsignal3 = ccivalue>=ccioverbought3

//adapts to the current bar, I need to save the bars number when the condition for buy was true, static number is spread

spread = input (0.00020, title="Spread")

upstoploss = longStop - spread

downstoploss = shortStop + spread

strategy.initial_capital = 50000

ordersize=floor(strategy.initial_capital/close)

testlong = input(title="Test longs", type=input.bool, defval=true)

testshort = input(title="Test shorts", type=input.bool, defval=true)

//new

degree = input(title="Test level 1 overbought/sold levels", type=input.bool, defval=true)

degree2 = input(title="Test level 2 overbought/sold levels", type=input.bool, defval=false)

degree3 = input(title="Test level 3 overbought/sold levels", type=input.bool, defval=false)

statictarget = input(title="Use static target", type=input.bool, defval=true)

statictargetvalue = input(title="Static target in pips", type=input.integer, defval=400)

//timetrade = input(title="Open trades only withing specified time", type=input.bool, defval=true)

//timtrade = input()

//přidat možnost TP podle ATR a sl podle ATR

buy1 = uptrend and upsignal and strategy.opentrades==0 and testlong and degree

x1 = barssince (buy1)

if (buy1)

//bodlo by zakázat atrtarget v tomto případě

if (statictarget)

strategy.entry("Long1", strategy.long, ordersize)

strategy.exit( "Exitlong", from_entry="Long1" , profit=statictargetvalue,stop=upstoploss[x1])

buy2 = uptrend and upsignal2 and strategy.opentrades==0 and testlong and degree2

x2 = barssince (buy2)

if (buy2)

//bodlo by zakázat atrtarget v tomto případě

if (statictarget)

strategy.entry("Long2", strategy.long, ordersize)

strategy.exit( "Exitlong", from_entry="Long2" , profit=statictargetvalue,stop=upstoploss[x2])

buy3 = uptrend and upsignal3 and strategy.opentrades==0 and testlong and degree3

x3 = barssince (buy3)

if (buy3)

//bodlo by zakázat atrtarget v tomto případě

if (statictarget)

strategy.entry("Long3", strategy.long, ordersize)

strategy.exit( "Exitlong", from_entry="Long3" , profit=statictargetvalue,stop=upstoploss[x3])

sell1 = downtrend and downsignal and strategy.opentrades==0 and testshort and degree

y1 = barssince (sell1)

if (sell1)

if (statictarget)

strategy.entry("Sell1", strategy.short, ordersize)

strategy.exit( "Exitshort", from_entry="Sell1" , profit=statictargetvalue,stop=downstoploss[y1])

sell2 = downtrend and downsignal2 and strategy.opentrades==0 and testshort and degree2

y2 = barssince (sell2)

if (sell2)

if (statictarget)

strategy.entry("Sell2", strategy.short, ordersize)

strategy.exit( "Exitshort", from_entry="Sell2" , profit=statictargetvalue,stop=downstoploss[y2])

sell3 = downtrend and downsignal3 and strategy.opentrades==0 and testshort and degree3

y3 = barssince (sell3)

if (sell3)

if (statictarget)

strategy.entry("Sell3", strategy.short, ordersize)

strategy.exit( "Exitshort", from_entry="Sell3" , profit=statictargetvalue,stop=downstoploss[y3])

Detail

https://www.fmz.com/strategy/439207

Last Modified

2024-01-18 12:40:11