Name

自适应布温科指标多空策略Adaptive-Botvenko-Indicator-Long-Short-Strategy

Author

ChaoZhang

Strategy Description

该策略基于布温科指标开发自动识别市场趋势并建立多空头寸。它集成了布温科指标、移动平均线和水平支撑线等技术指标,可以自动识别突破信号并建立头寸。

该策略的核心指标是布温科指标,它通过计算不同交易日收盘价的对数差值,判断市场趋势和重要支撑/阻力位。当指标上穿某一水平线时做多,下穿时做空。

此外,该策略集成了21日、55日等多根移动平均线组成的“EMA防护带”。根据这些均线的排序关系判断目前是多头市场、空头市场还是盘整市场,并相应限制做空或者做多操作。

通过布温科指标识别交易信号,移动平均线判断市场阶段,两者结合使用,可以避免不适当的头寸建立。

该策略最大的优势是可以自动识别市场的多空趋势,布温科指标对两个时间段价格的差值非常敏感,可以快速定位关键支撑阻力;与此同时,移动平均线的排序又可以有效判断目前所处的行情,是看多还是看空。

这种结合快速指标与趋势指标的思路,使得策略可以快速定位买卖点,同时防止不适当的买卖。这就是该策略的最大优势。

该策略的风险主要来自两个方面,一是布温科指标本身对价格变动非常敏感,可能会产生许多不必要的交易信号;二是移动平均线在横盘时会排序混乱,导致头寸建立混乱。

针对第一点风险,可以适当调整布温科指标参数,增加指标计算周期,减少不必要交易;针对第二点风险,可以增加更多移动平均线,使得判断趋势更加准确。

该策略的主要优化方向是参数调整与过滤条件增加。

针对布温科指标,可以尝试不同周期参数,找到最佳参数组合;针对移动平均线,可以继续加入更多均线,形成更完整的趋势判断体系。此外还可以加入波动率指标、交易量指标等过滤条件,降低虚假信号。

通过参数与条件的综合调整,可以进一步提升策略的稳定性与盈利能力。

该自适应布温科多空策略成功结合了快速指标与趋势指标,可以自动识别市场关键点并建立正确头寸。它的优点是快速定位与防止不适当头寸建立的能力。下一步可以通过参数与条件优化,进一步提升策略稳定性与盈利水平。

||

This strategy is developed based on the Botvenko indicator to automatically identify market trends and establish long/short positions. It integrates Botvenko indicator, moving averages and horizontal support lines to automatically recognize breakout signals and establish positions.

The core indicator of this strategy is the Botvenko indicator. By calculating the logarithmic difference between closing prices on different trading days, it judges the market trend and important support/resistance levels. It goes long when the indicator crosses above a certain level line and goes short when it crosses below.

In addition, the strategy integrates an "EMA Protection Belt" consisting of 21-day, 55-day and other moving averages. It determines whether the current state is a bull market, bear market or consolidation market based on the sorting relationship of these moving averages, and accordingly restricts short or long operations.

By identifying trading signals with Botvenko indicator and judging market stages with moving averages, inappropriate position establishment can be avoided when used in combination.

The biggest advantage of this strategy is that it can automatically identify the long/short trends of the market. The Botvenko indicator is very sensitive to the difference between prices over two time periods and can quickly locate key support/resistance levels. At the same time, the sorting of moving averages can effectively judge whether it is currently better to be long or short.

This idea of combining fast indicators and trend indicators enables the strategy to quickly locate entry and exit points while preventing inappropriate buying and selling. This is the biggest advantage.

The risks of this strategy mainly come from two aspects. First, the Botvenko indicator itself is very sensitive to price changes, which may generate many unnecessary trading signals. Second, the sorting of moving averages can get messy during sideways moves, leading to messy position establishment.

To address the first risk, parameters of the Botvenko indicator can be adjusted to increase the calculation cycle and reduce unnecessary trades. For the second risk, more moving averages can be added to make trend judgement more accurate.

The main optimization directions are parameter tuning and adding filter conditions.

For the Botvenko indicator, different period parameters can be tried to find the optimal combination. For moving averages, more of them can be added to form a more complete trend judgment system. In addition, volatility indicators, trading volume indicators etc. can also be introduced to filter out false signals.

Through comprehensive adjustments of parameters and filter conditions, the stability and profitability of the strategy can be further enhanced.

The adaptive Botvenko long/short strategy successfully combines fast and trend indicators to automatically identify key market points and establish correct positions. Its advantages lie in fast location and prevention of inappropriate positions. Next step is to further improve stability and profitability through parameter and condition optimization.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_string_1 | 0 | strategy direction: all |

| v_input_1 | 2005 | Backtest Start Year |

| v_input_2 | 7 | Backtest Start Month |

| v_input_3 | 16 | Backtest Start Day |

| v_input_4 | 2030 | Backtest Stop Year |

| v_input_5 | 12 | Backtest Stop Month |

| v_input_6 | 30 | Backtest Stop Day |

| v_input_float_1 | 0.0065 | sell level |

| v_input_float_2 | false | buy level |

| v_input_float_3 | -0.493 | long retry - too low |

| v_input_float_4 | 2 | long close up |

| v_input_float_5 | -1.5 | long close down |

| v_input_float_6 | 1.26 | short retry - too high |

| v_input_float_7 | -5 | dead - close the short |

| v_input_7 | 60 | Histogram Period |

Source (PineScript)

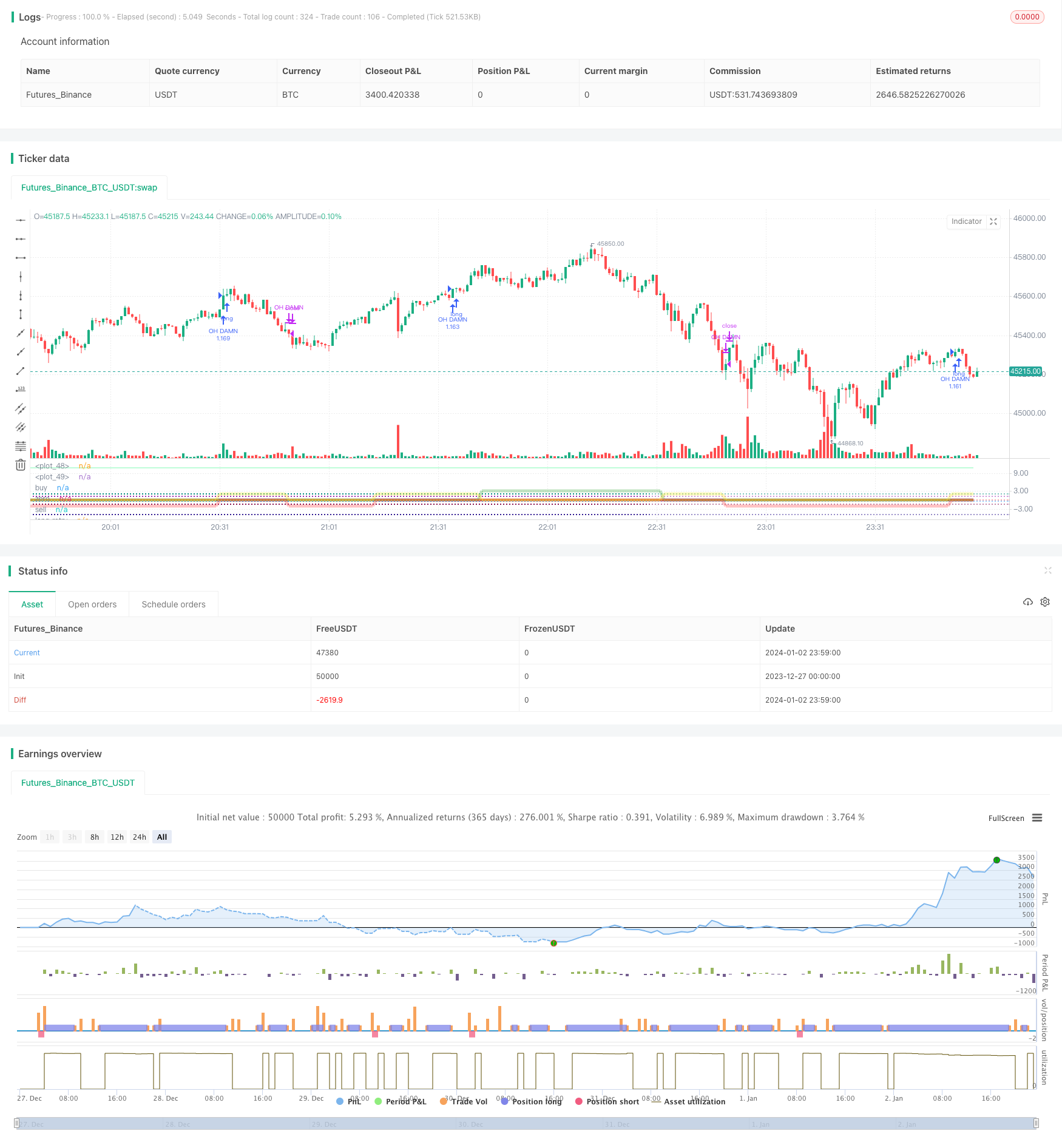

/*backtest

start: 2023-12-27 00:00:00

end: 2024-01-03 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © boftei

//@version=5

strategy("Boftei's Strategy", overlay=false, pyramiding=1, default_qty_type= strategy.percent_of_equity, default_qty_value = 100, calc_on_order_fills=false, margin_long = 100, margin_short = 100, slippage=0, commission_type=strategy.commission.percent, commission_value = 0, initial_capital = 40, precision = 6)

strat_dir_input = input.string("all", "strategy direction", options=["long", "short", "all"])

strat_dir_value = strat_dir_input == "long" ? strategy.direction.long : strat_dir_input == "short" ? strategy.direction.short : strategy.direction.all

strategy.risk.allow_entry_in(strat_dir_value)

//////////////////////////////////////////////////////////////////////

//DATA

testStartYear = input(2005, "Backtest Start Year")

testStartMonth = input(7, "Backtest Start Month")

testStartDay = input(16, "Backtest Start Day")

testPeriodStart = timestamp(testStartYear,testStartMonth,testStartDay,0,0)

//Stop date if you want to use a specific range of dates

testStopYear = input(2030, "Backtest Stop Year")

testStopMonth = input(12, "Backtest Stop Month")

testStopDay = input(30, "Backtest Stop Day")

testPeriodStop = timestamp(testStopYear,testStopMonth,testStopDay,0,0)

testPeriod() =>

time >= testPeriodStart and time <= testPeriodStop ? true : false

//////////////////////////////////////////////////////////////////////

sell = input.float(0.0065, "sell level")

buy = input.float(0, "buy level")

long1 = input.float(-0.493, "long retry - too low")

long2 = input.float(2, "long close up")

long3 = input.float(-1.5, "long close down")

short1 = input.float(1.26, "short retry - too high")

short2 = input.float(-5, "dead - close the short")

///< botvenko script

nn = input(60, "Histogram Period")

float x = 0

float z = 0

float k = 0

y = math.log(close[0]) - math.log(close[nn])

if y>0

x := y

else

k := y

//---------------------------------------------

plot(y > 0 ? x: 0, color = color.green, linewidth = 4)

plot(y <= 0 ? k: 0, color = color.maroon, linewidth = 4)

plot(y, color = color.yellow, linewidth = 1)

co = ta.crossover(y, buy)

cu = ta.crossunder(y, sell)

retry_long = ta.crossunder(y, long1)

deadline_long_up = ta.crossover(y, long2)

deadline_long_down = ta.crossunder(y, long3)

retry_short = ta.crossover(y, short1)

deadline_short = ta.crossunder(y, short2)

hline(buy, title='buy', color=color.green, linestyle=hline.style_dotted, linewidth=2)

hline(0, title='zero', color=color.white, linestyle=hline.style_dotted, linewidth=1)

hline(sell, title='sell', color=color.red, linestyle=hline.style_dotted, linewidth=2)

hline(long1, title='long retry', color=color.blue, linestyle=hline.style_dotted, linewidth=2)

hline(long2, title='overbought', color=color.teal, linestyle=hline.style_dotted, linewidth=2)

hline(long3, title='oversold', color=color.maroon, linestyle=hline.style_dotted, linewidth=2)

hline(short1, title='short retry', color=color.purple, linestyle=hline.style_dotted, linewidth=2)

hline(short2, title='too low to short - an asset may die', color=color.navy, linestyle=hline.style_dotted, linewidth=2)

////////////////////////////////////////////////////////////EMAprotectionBLOCK

ema_21 = ta.ema(close, 21)

ema_55 = ta.ema(close, 55)

ema_89 = ta.ema(close, 89)

ema_144 = ta.ema(close, 144)

//ema_233 = ta.ema(close, 233)

// ema_377 = ta.ema(close, 377)

long_st = ema_21>ema_55 and ema_55>ema_89 and ema_89>ema_144 //and ema_144>ema_233 and ema_233>ema_377

short_st = ema_21<ema_55 and ema_55<ema_89 and ema_89<ema_144 //and ema_144<ema_233 and ema_233<ema_377

g_v = long_st == true?3:0

r_v = short_st == true?-2:0

y_v = long_st != true and short_st != true?2:0

plot(math.log(ema_21), color = color.new(#ffaf5e, 50))

plot(math.log(ema_55), color = color.new(#b9ff5e, 50))

plot(math.log(ema_89), color = color.new(#5eff81, 50))

plot(math.log(ema_144), color = color.new(#5effe4, 50))

//plot(math.log(ema_233), color = color.new(#5e9fff, 50))

//plot(math.log(ema_377), color = color.new(#af5eff, 50))

plot(long_st == true?3:0, color = color.new(color.green, 65), linewidth = 5)

plot(short_st == true?-2:0, color = color.new(color.red, 65), linewidth = 5)

plot(long_st != true and short_st != true?2:0, color = color.new(color.yellow, 65), linewidth = 5)

////////////////////////////////////////////////////////////EMAprotectionBLOCK

if (co and testPeriod() and (g_v == 3 or y_v == 2))

strategy.close("OH BRO", comment = "EXIT-SHORT")

strategy.close("OH DUDE", comment = "EXIT-SHORT")

strategy.entry("OH DAMN", strategy.long, comment="ENTER-LONG 'co'")

if (retry_long and testPeriod() and (g_v == 3 or y_v == 2))

strategy.close("OH DAMN", comment = "EXIT-LONG")

strategy.entry("OH BRUH", strategy.long, comment="ENTER-LONG 'retry_long'")

if (cu and testPeriod() and (r_v == -2 or y_v == 2))

strategy.close("OH DAMN", comment = "EXIT-LONG")

strategy.close("OH BRUH", comment = "EXIT-LONG")

strategy.entry("OH BRO", strategy.short, comment="ENTER-SHORT 'cu'")

if (retry_short and testPeriod() and (r_v == -2 or y_v == 2))

strategy.close("OH BRO", comment = "EXIT-SHORT")

strategy.entry("OH DUDE", strategy.short, comment="ENTER-SHORT 'retry_short'")

if (deadline_long_up and testPeriod() or r_v == -2 and testPeriod())

strategy.close("OH DAMN", comment = "EXIT-LONG 'deadline_long_up'")

if (deadline_long_down and testPeriod())

strategy.close("OH DAMN", comment = "EXIT-LONG 'deadline_long_down'")

if (deadline_short and testPeriod() or g_v == 3 and testPeriod())

strategy.close("OH BRO", comment = "EXIT-SHORT 'deadline_short'")

// (you can use strategy.close_all(comment = "close all entries") here)

Detail

https://www.fmz.com/strategy/437663

Last Modified

2024-01-04 16:09:30