Name

自适应移动止损均线交易策略Adaptive-Moving-Stop-Line-Trading-Strategy

Author

ChaoZhang

Strategy Description

本策略的核心思想是利用T3均线和ATR自适应移动止损来捕捉趋势上的进出场点,属于趋势跟踪类策略。当价格突破T3均线时产生交易信号,并在突破点使用ATR值设置止损位和止盈位,实现自动止损止盈。

该策略主要由T3均线指标、ATR指标和ATR移动止损机制组成。

T3均线是一种具有平滑性的移动平均线,可以减少曲线的滞后性,使其更快地对价格变动做出反应。当价格从均线下方向上突破时,产生买入信号;当价格从均线上方向下突破时,产生卖出信号。

ATR指标用于计算市场波动程度和设置止损位。ATR值越大,表示市场波动越大,此时需要设置更宽的止损;ATR值越小,表示市场波动越小,可以设置更窄的止损。

ATR移动止损机制,是根据ATR值实时调整止损线的位置,使止损线能够跟随价格运行并保持在合理范围内。这样既防止止损距离过近被震出,也防止止损距离过宽无法有效控制风险。

综合利用T3指标判断方向、ATR指标计算波动性和ATR移动止损机制,该策略实现了较为高效的趋势捕捉和风险控制。

该策略具有以下优势:

-

T3均线的应用提高了捕捉趋势的准确性。

-

ATR指标动态计算市场波动率,止损位和止盈位更合理。

-

ATR移动止损机制,使止损线能够实时跟随价格运行,有效控制风险。

-

整合指标判断和止损机制,实现自动化趋势跟踪交易。

-

可以通过webhook连接外部交易平台,实现自动化下单。

该策略也存在一些风险:

-

T3均线参数设置不当,可能错过较优趋势机会。可以测试不同周期的参数,找到最优参数。

-

ATR值计算不准确,止损距离过大或过小,无法有效控制风险。可以结合市场波动率特征调整ATR周期参数。

-

在剧烈波动中,止损线可能被突破导致过度亏损。可以设置合理的总亏损线,避免单笔亏损过大。

-

双向反复行情中,可能出现止损频繁被触发的情况。可以适当放宽ATR移动止损的距离。

该策略可以从以下几个方面进行优化:

-

对T3均线参数进行优化,找到最合适的平滑周期。

-

测试不同的ATR周期参数,计算出最能反映市场波动率的ATR值。

-

优化ATR移动止损距离的弹性区间,防止止损过于敏感。

-

添加适当过滤条件,避免双向震荡市的频繁交易。

-

结合趋势判断指标,提高获利方向的判断准确率。

-

利用机器学习方法自动优化参数。

本策略整合运用T3均线判断趋势方向、ATR指标计算止损止盈和ATR移动止损机制调整止损距离,实现对趋势的自动跟踪与高效风险控制,是一种可靠的趋势跟踪策略。在实际应用中,仍需要不断测试与优化,找到最适合当前市场环境的参数组合,从而获得较好的策略效果。

||

The core idea of this strategy is to use the T3 moving average and ATR adaptive trailing stop to capture entry and exit points along the trend. It belongs to the trend following strategies. Trading signals are generated when price breaks through the T3 line, and stop loss and take profit levels are set using the ATR value at the breakout point to achieve automatic stop loss and take profit.

The strategy consists of the T3 indicator, ATR indicator and ATR trailing stop mechanism.

The T3 moving average is a smoothed moving average that can reduce the lag of the curve and make it respond faster to price changes. A buy signal is generated when the price breaks through the moving average from below. A sell signal is generated when the price breaks through from above.

The ATR indicator is used to calculate the degree of market volatility and set stop loss levels. The larger the ATR value, the greater the market volatility, and a wider stop loss should be set. The smaller the ATR value, the smaller the market volatility, and a narrower stop loss can be set.

The ATR trailing stop mechanism adjusts the stop loss line position based on ATR values in real time, so that the stop loss line can follow the price movement and remain within a reasonable range. This prevents the stop loss from being too close and knocked out easily, and also prevents the stop loss from being too wide to effectively control risks.

By utilizing the T3 to determine direction, ATR to calculate volatility and the ATR trailing stop mechanism, this strategy achieves relatively efficient trend catching and risk control.

The advantages of this strategy include:

-

The application of the T3 line improves the accuracy of catching trends.

-

The ATR indicator dynamically calculates market volatility, making stop loss and take profit levels more reasonable.

-

The ATR trailing stop mechanism enables the stop loss line to follow the price movement in real time for effective risk control.

-

Integrates indicators and stop loss mechanisms to achieve automated trend tracking trading.

-

Can connect to external trading platforms via webhook for automated order execution.

There are also some risks with this strategy:

-

Improper T3 parameter settings may miss better trend opportunities. Different cycle parameters can be tested to find the optimal values.

-

Inaccurate ATR value calculation may lead to stop loss distance being too large or too small to effectively control risk. The ATR cycle parameter can be adjusted combined with market volatility characteristics.

-

In violent fluctuations, the stop loss line may be broken resulting in excessive losses. A reasonable total loss line can be set to avoid excessive losses per trade.

-

Frequent stop loss triggering may occur in whipsaw markets. Appropriately widening the ATR trailing stop distance can help.

The strategy can be optimized in the following aspects:

-

Optimize the T3 parameter to find the most suitable smoothing cycle.

-

Test different ATR cycle parameters to calculate the ATR value that best reflects market volatility.

-

Optimize the flexible range of the ATR trailing stop distance to prevent over-sensitive stops.

-

Add appropriate filters to avoid frequent trading in whipsaw markets.

-

Incorporate trend judging indicators to improve directional profitability accuracy.

-

Use machine learning methods to automatically optimize parameters.

This strategy integrates the use of the T3 line to determine trend direction, ATR indicator to calculate stops/targets and ATR trailing stop mechanism to adjust stop distance. It achieves automated trend tracking and efficient risk control. It is a reliable trend following strategy. In practical applications, continuous testing and optimization is still needed to find the most suitable parameter combinations for current market conditions, thereby obtaining better strategy results.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | 100 | T3 |

| v_input_2 | true | Key Value. "This changes the sensitivity" |

| v_input_3 | 50 | ATR Period |

| v_input_4 | true | Signals from Heikin Ashi Candles |

| v_input_5 | true | Risk Reward Ratio |

Source (PineScript)

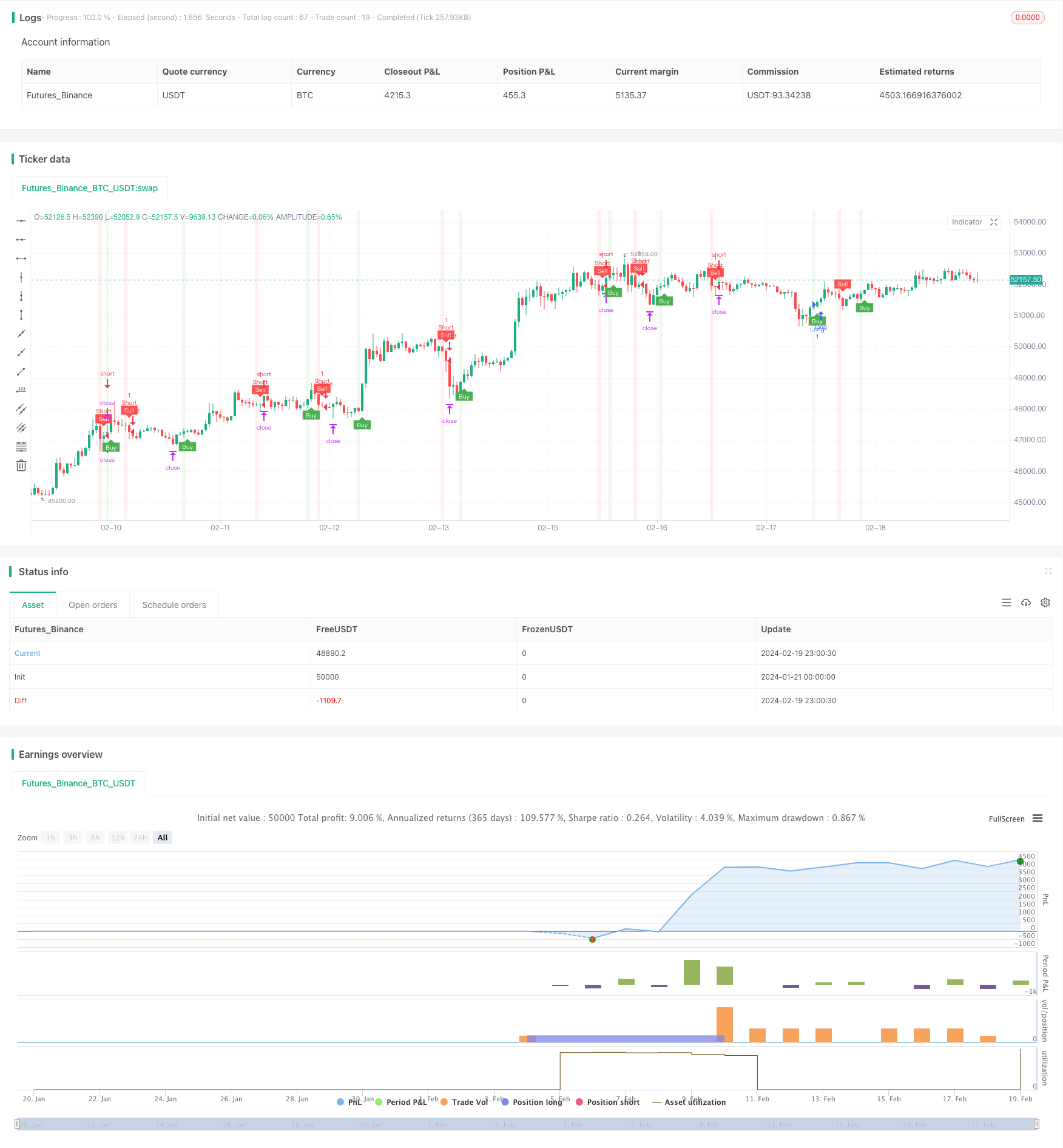

/*backtest

start: 2024-01-21 00:00:00

end: 2024-02-20 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy(title='UT Bot Alerts (QuantNomad) Strategy', overlay=true)

T3 = input(100)//600

// Input for Long Settings

// Input for Long Settings

xPrice3 = close

xe1 = ta.ema(xPrice3, T3)

xe2 = ta.ema(xe1, T3)

xe3 = ta.ema(xe2, T3)

xe4 = ta.ema(xe3, T3)

xe5 = ta.ema(xe4, T3)

xe6 = ta.ema(xe5, T3)

b3 = 0.7

c1 = -b3*b3*b3

c2 = 3*b3*b3+3*b3*b3*b3

c3 = -6*b3*b3-3*b3-3*b3*b3*b3

c4 = 1+3*b3+b3*b3*b3+3*b3*b3

nT3Average = c1 * xe6 + c2 * xe5 + c3 * xe4 + c4 * xe3

//plot(nT3Average, color=color.white, title="T3")

// Buy Signal - Price is below T3 Average

buySignal3 = xPrice3 < nT3Average

sellSignal3 = xPrice3 > nT3Average

// Inputs

a = input(1, title='Key Value. "This changes the sensitivity"')

c = input(50, title='ATR Period')

h = input(true, title='Signals from Heikin Ashi Candles')

riskRewardRatio = input(1, title='Risk Reward Ratio')

xATR = ta.atr(c)

nLoss = a * xATR

src = h ? request.security(ticker.heikinashi(syminfo.tickerid), timeframe.period, close, lookahead=barmerge.lookahead_off) : close

xATRTrailingStop = 0.0

iff_1 = src > nz(xATRTrailingStop[1], 0) ? src - nLoss : src + nLoss

iff_2 = src < nz(xATRTrailingStop[1], 0) and src[1] < nz(xATRTrailingStop[1], 0) ? math.min(nz(xATRTrailingStop[1]), src + nLoss) : iff_1

xATRTrailingStop := src > nz(xATRTrailingStop[1], 0) and src[1] > nz(xATRTrailingStop[1], 0) ? math.max(nz(xATRTrailingStop[1]), src - nLoss) : iff_2

pos = 0

iff_3 = src[1] > nz(xATRTrailingStop[1], 0) and src < nz(xATRTrailingStop[1], 0) ? -1 : nz(pos[1], 0)

pos := src[1] < nz(xATRTrailingStop[1], 0) and src > nz(xATRTrailingStop[1], 0) ? 1 : iff_3

xcolor = pos == -1 ? color.red : pos == 1 ? color.green : color.blue

ema = ta.ema(src, 1)

above = ta.crossover(ema, xATRTrailingStop)

below = ta.crossunder(ema, xATRTrailingStop)

buy = src > xATRTrailingStop and above

sell = src < xATRTrailingStop and below

barbuy = src > xATRTrailingStop

barsell = src < xATRTrailingStop

plotshape(buy, title='Buy', text='Buy', style=shape.labelup, location=location.belowbar, color=color.new(color.green, 0), textcolor=color.new(color.white, 0), size=size.tiny)

plotshape(sell, title='Sell', text='Sell', style=shape.labeldown, location=location.abovebar, color=color.new(color.red, 0), textcolor=color.new(color.white, 0), size=size.tiny)

barcolor(barbuy ? color.new(color.green, 90) : na)

barcolor(barsell ? color.new(color.red, 90) : na)

var float entryPrice = na

var float takeProfitLong = na

var float stopLossLong = na

var float takeProfitShort = na

var float stopLossShort = na

if buy and buySignal3

entryPrice := src

takeProfitLong := entryPrice + nLoss * riskRewardRatio

stopLossLong := entryPrice - nLoss

takeProfitShort := na

stopLossShort := na

if sell and sellSignal3

entryPrice := src

takeProfitShort := entryPrice - nLoss * riskRewardRatio

stopLossShort := entryPrice + nLoss

takeProfitLong := na

stopLossLong := na

// Strategy order conditions

acct = "Sim101"

ticker = "ES 12-23"

qty = 1

OCOMarketLong = '{ "alert": "OCO Market Long", "account": "' + str.tostring(acct) + '", "ticker": "' + str.tostring(ticker) + '", "qty": "' + str.tostring(qty) + '", "take_profit_price": "' + str.tostring(takeProfitLong) + '", "stop_price": "' + str.tostring(stopLossLong) + '", "tif": "DAY" }'

OCOMarketShort = '{ "alert": "OCO Market Short", "account": "' + str.tostring(acct) + '", "ticker": "' + str.tostring(ticker) + '", "qty": "' + str.tostring(qty) + '", "take_profit_price": "' + str.tostring(takeProfitShort) + '", "stop_price": "' + str.tostring(stopLossShort) + '", "tif": "DAY" }'

CloseAll = '{ "alert": "Close All", "account": "' + str.tostring(acct) + '", "ticker": "' + str.tostring(ticker) + '" }'

strategy.entry("Long", strategy.long, when=buy and buySignal3, alert_message=OCOMarketLong)

strategy.entry("Short", strategy.short, when=sell and sellSignal3, alert_message=OCOMarketShort)

// Setting the take profit and stop loss for long trades

strategy.exit("Take Profit/Stop Loss", "Long", stop=stopLossLong, limit=takeProfitLong,alert_message=CloseAll)

// Setting the take profit and stop loss for short trades

strategy.exit("Take Profit/Stop Loss", "Short", stop=stopLossShort, limit=takeProfitShort,alert_message=CloseAll)

// Plot trade setup boxes

bgcolor(buy ? color.new(color.green, 90) : na, transp=0, offset=-1)

bgcolor(sell ? color.new(color.red, 90) : na, transp=0, offset=-1)

longCondition = buy and not na(entryPrice)

shortCondition = sell and not na(entryPrice)

// var line longTakeProfitLine = na

// var line longStopLossLine = na

// var line shortTakeProfitLine = na

// var line shortStopLossLine = na

// if longCondition

// longTakeProfitLine := line.new(bar_index, takeProfitLong, bar_index + 1, takeProfitLong, color=color.green, width=2)

// longStopLossLine := line.new(bar_index, stopLossLong, bar_index + 1, stopLossLong, color=color.red, width=2)

// // label.new(bar_index + 1, takeProfitLong, str.tostring(takeProfitLong, "#.#####"), color=color.green, style=label.style_none, textcolor=color.green, size=size.tiny)

// // label.new(bar_index + 1, stopLossLong, str.tostring(stopLossLong, "#.#####"), color=color.red, style=label.style_none, textcolor=color.red, size=size.tiny)

// if shortCondition

// shortTakeProfitLine := line.new(bar_index, takeProfitShort, bar_index + 1, takeProfitShort, color=color.green, width=2)

// shortStopLossLine := line.new(bar_index, stopLossShort, bar_index + 1, stopLossShort, color=color.red, width=2)

// // label.new(bar_index + 1, takeProfitShort, str.tostring(takeProfitShort, "#.#####"), color=color.green, style=label.style_none, textcolor=color.green, size=size.tiny)

// // label.new(bar_index + 1, stopLossShort, str.tostring(stopLossShort, "#.#####"), color=color.red, style=label.style_none, textcolor=color.red, size=size.tiny)

alertcondition(buy, 'UT Long', 'UT Long')

alertcondition(sell, 'UT Short', 'UT Short')

Detail

https://www.fmz.com/strategy/442400

Last Modified

2024-02-21 16:07:20