Name

重要支点反转策略Significant-Pivot-Points-Reversal-Strategy

Author

ChaoZhang

Strategy Description

该策略是在传统的支点反转策略基础上进行优化,主要通过计算ATR并设置ATR过滤因子,来过滤掉一些无意义的支点,只交易那些真正重要的支点。

该策略的核心逻辑是计算出重要的高点支点和低点支点。计算高点支点的主要步骤是:

- 计算ATR,设置ATR过滤因子atr_mult。

- 遍历左侧一定数量的K线(由leftBars设置),如果高点支点高于任何一个左侧K线的高点+ATR*atr_mult,则该支点无效。

- 遍历右侧一定数量的K线(由rightBars设置),如果高点支点高于任何一个右侧K线的高点+ATR*atr_mult,则该支点无效。

- 如果高点支点经过上述检验仍然有效,则返回该高点作为重要的高点支点。

计算低点支点的逻辑与此类似。

获得重要支点后,当价格突破该重要高点支点时,做空;当价格突破该重要低点支点时,做多。

该策略的主要优势有:

- 通过ATR和atr_mult过滤参数,可以过滤掉无意义的小波动,只交易真正重要的支点,避免无谓的交易。

- ATR参数可以动态调整,在大幅波动市场中自动调整交易范围,避免过度交易。

- 支点反转策略本身就具有比较高的胜率和盈利率。

该策略的主要风险有:

- ATR参数设置不当可能过滤掉太多有效交易机会。如果ATR太大,有效支点也可能被过滤。

- 支点反转策略本身依然存在被套牢的风险,需要设置止损来控制风险。

- 反转类策略对交易成本比较敏感,需要合理设置止损和止盈。

为控制上述风险,可以从以下几个方面进行优化:

- 优化ATR参数,保证有足够的交易机会。

- 设置合理的止损止盈比例。

- 适当调整开仓手数,降低交易成本的影响。

该策略还可以从以下几个方向进行进一步优化:

-

结合其他指标判断市场趋势状态,避免反转交易出现在趋势行情中。可以考虑加入MACD,KDJ等指标。

-

增加机器学习算法,自动优化参数。可以使用genetic algorithm, random forest等方法寻找最优参数组合。

-

加入量化数据进行训练,找到最佳的ATR范围。增加历史数据可以提高参数选择的准确性。

-

可以考虑与其他策略组合使用,结合不同类型策略的优势。例如与趋势跟踪策略组合,在盘整中反转,在趋势中顺势。

该重要支点反转策略通过计算ATR并设置过滤因子的方法过滤无意义小波动,只在重要支点进行反转交易,可以有效提高策略的盈利水平。同时也增加了一定参数优化难度,需要从ATR范围、止损止盈比例等多个方面综合考虑找到最优参数。如果参数优化到位,该策略可以成为高效稳定的短线交易策略。

||

This strategy optimizes the traditional pivot points reversal strategy by calculating the ATR and setting ATR filters to eliminate insignificant pivot points, only trading on truly significant ones.

The core logic is to identify significant peak and trough pivot points. The key steps to calculate significant peak pivots are:

- Calculate ATR and set the ATR filter factor atr_mult.

- Traverse a certain number of bars on the left (set by leftBars), if the peak pivot is higher than any high + ATR*atr_mult on the left, the pivot is invalid.

- Traverse a certain number of bars on the right (set by rightBars), if the peak pivot is higher than any high + ATR*atr_mult on the right, the pivot is invalid.

- If the peak pivot remains valid after the above tests, return it as an important peak pivot.

The logic for calculating significant trough pivots is similar.

After obtaining the significant pivots, go short when price breaks an important peak pivot, and go long when it breaks an important trough pivot.

The main advantages of this strategy are:

- The ATR and atr_mult filter can eliminate insignificant fluctuations and only trade truly significant pivots, avoiding unnecessary trades.

- The dynamic ATR parameter can adjust the trading range automatically in volatile markets, preventing over-trading.

- Pivot points reversal itself has relatively high win rate and profitability.

The main risks are:

- Improper ATR parameters may filter out too many valid trades. If ATR is too high, valid pivots could be eliminated.

- Risk of being trapped still exists, need to set stop loss to control risk.

- Reversal strategies are sensitive to transaction costs, reasonable stop loss and take profit should be set.

To control the above risks, optimize from the following aspects:

- Optimize ATR parameters to ensure enough trading opportunities.

- Set reasonable stop loss and take profit ratios.

- Adjust position sizing to reduce transaction cost impact.

Further optimization directions include:

-

Combining with other indicators to determine market regime, avoiding trading reversals in trending markets. Consider MACD, KDJ etc.

-

Adding machine learning algorithms to auto-optimize parameters. Methods like genetic algorithms, random forest can be used to find optimum parameter sets.

-

Training models using quantitative data to find optimal ATR range. More historical data improves parameter selection accuracy.

-

Consider combining with other strategies, utilizing strengths of different strategy types. For example, combining with trend following strategy, reverse during ranging, trend-follow during sustained trends.

This significant pivot reversal strategy filters out meaningless minor fluctuations by calculating ATR and setting filters. Only trading reversals on significant pivots can effectively improve strategy profitability. Meanwhile, it also increases parameter optimization difficulty. The optimal parameters need to be found by comprehensive consideration of ATR range, stop loss/take profit ratios etc. If optimized thoroughly, it can become a highly efficient and stable short-term trading strategy.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | 4 | PP Left Bars |

| v_input_2 | 2 | PP Right Bars |

| v_input_3 | 14 | ATR Length |

| v_input_4 | 0.1 | ATR Mult |

Source (PineScript)

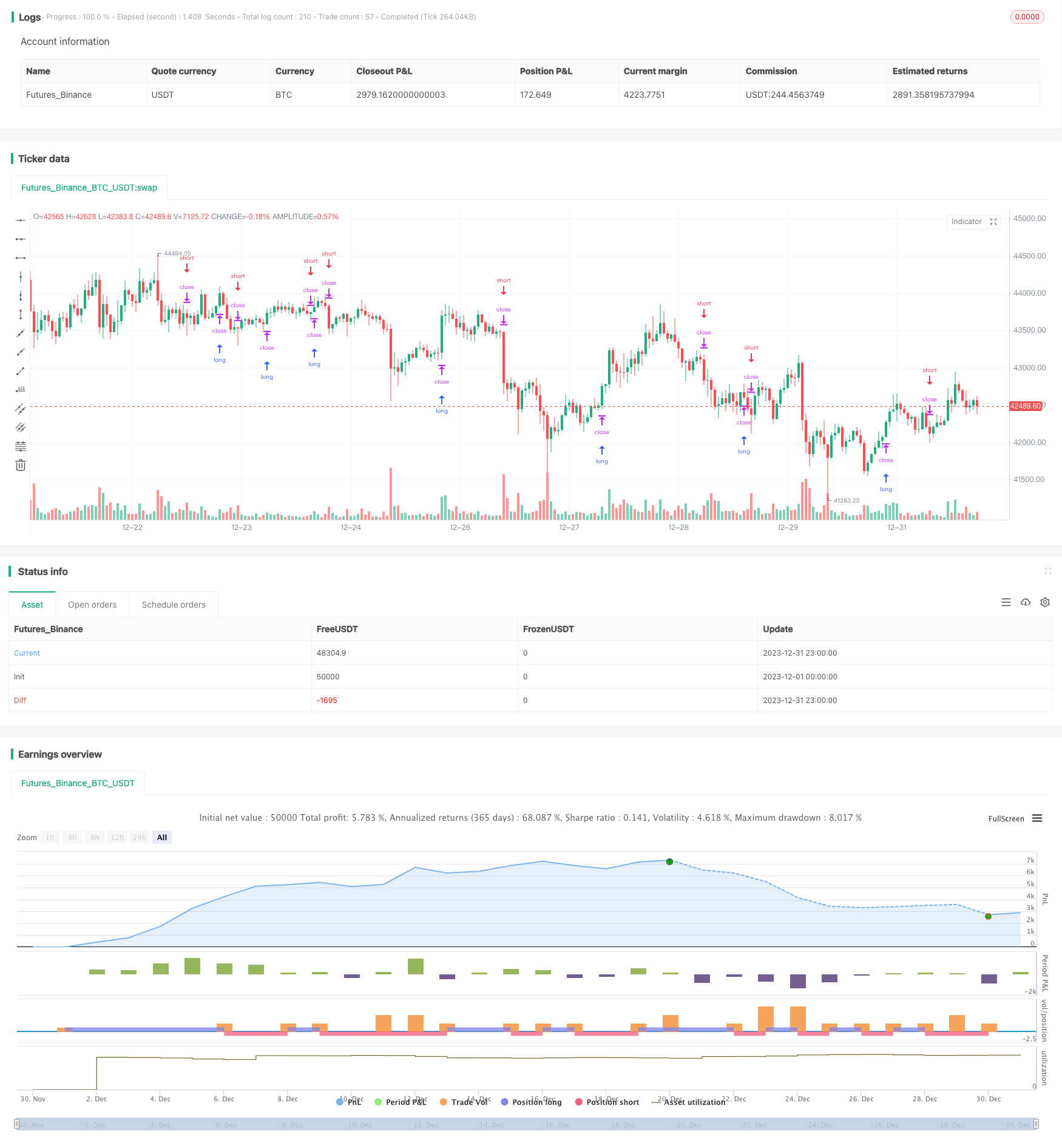

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("QuantNomad - Significant Pivot Reversal Strategy", shorttitle = "SPPS", overlay=true)

// Inputs

leftBars = input(4, title = 'PP Left Bars')

rightBars = input(2, title = 'PP Right Bars')

atr_length = input(14, title = 'ATR Length')

atr_mult = input(0.1, title = 'ATR Mult')

// Pivot High Significant Function

pivotHighSig(left, right) =>

pp_ok = true

atr = atr(atr_length)

for i = 1 to left

if (high[right] < high[right+i] + atr * atr_mult)

pp_ok := false

for i = 0 to right-1

if (high[right] < high[i] + atr * atr_mult)

pp_ok := false

pp_ok ? high[right] : na

// Pivot Low Significant Function

pivotLowSig(left, right) =>

pp_ok = true

atr = atr(atr_length)

for i = 1 to left

if (low[right] > low[right+i] - atr * atr_mult)

pp_ok := false

for i = 0 to right-1

if (low[right] > low[i] - atr * atr_mult)

pp_ok := false

pp_ok ? low[right] : na

swh = pivotHighSig(leftBars, rightBars)

swl = pivotLowSig (leftBars, rightBars)

swh_cond = not na(swh)

hprice = 0.0

hprice := swh_cond ? swh : hprice[1]

le = false

le := swh_cond ? true : (le[1] and high > hprice ? false : le[1])

if (le)

strategy.entry("PivRevLE", strategy.long, comment="PivRevLE", stop=hprice + syminfo.mintick)

swl_cond = not na(swl)

lprice = 0.0

lprice := swl_cond ? swl : lprice[1]

se = false

se := swl_cond ? true : (se[1] and low < lprice ? false : se[1])

if (se)

strategy.entry("PivRevSE", strategy.short, comment="PivRevSE", stop=lprice - syminfo.mintick)

Detail

https://www.fmz.com/strategy/440342

Last Modified

2024-01-29 14:58:15