Name

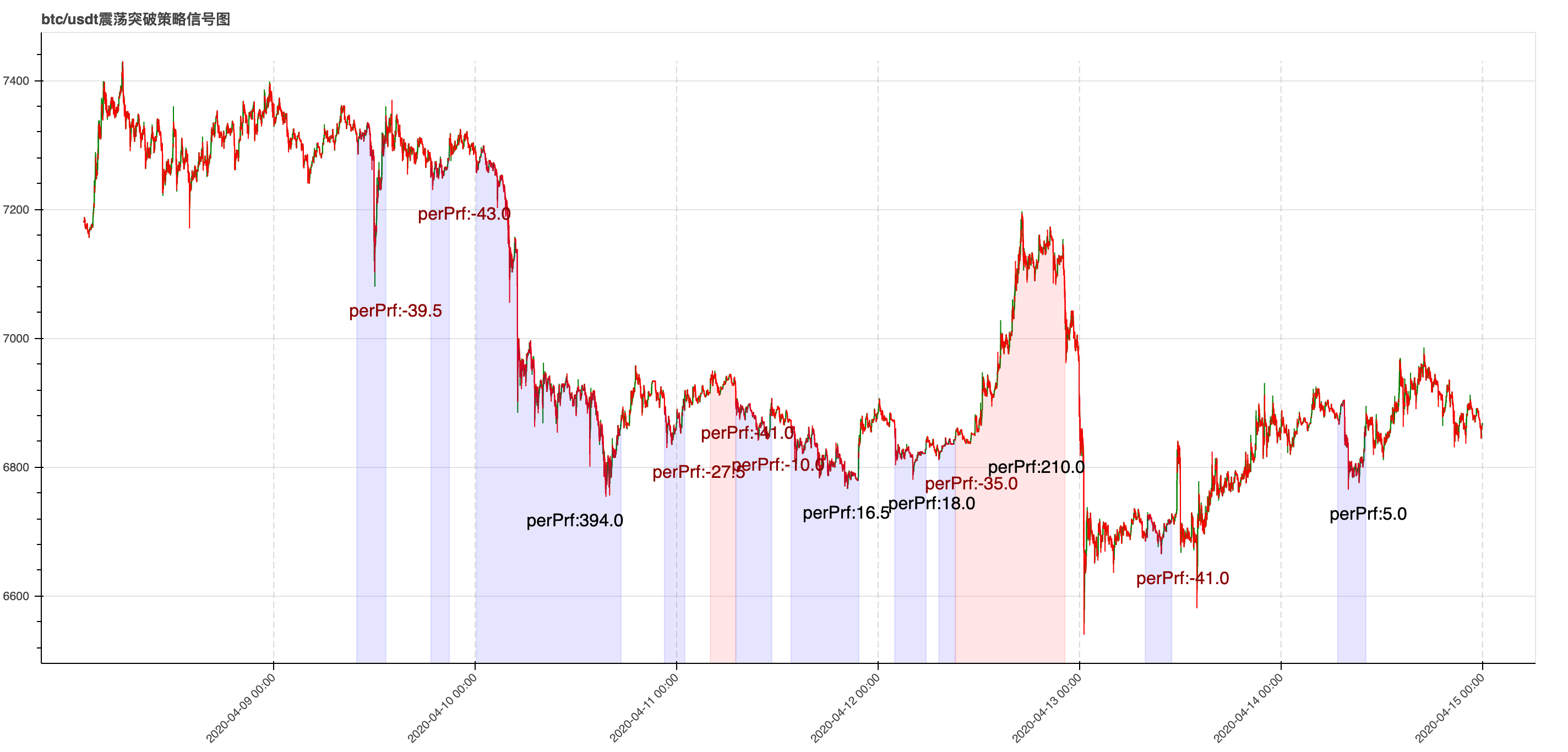

震荡突破策略

Author

巴啦啦小魔仙

Strategy Description

上轨:过去30根K线的最高价

下轨:过去30根K线的最低价

区间幅度:(上轨 - 下轨)/ (上轨 + 下轨)

如果区间幅度小于阈值a,价格向上突破上轨,买入开仓,价格跌破下轨平仓

如果区间幅度小于阈值a,价格向下突破上轨,卖出开仓,价格突破上轨平仓

如果你对该策略有兴趣,请+V:Irene11229 (点击我的主页,我将会持续更新更多策略,同时还可获得几大头部交易所的市场分析数据)

Source (python)

#!/usr/bin/env python3

# -*- coding: utf-8 -*-

import json

import time

import requests

from kumex.client import Trade

def check_response_data(response_data):

if response_data.status_code == 200:

try:

d = response_data.json()

except ValueError:

raise Exception(response_data.content)

else:

if d and d.get('s'):

if d.get('s') == 'ok':

return d

else:

raise Exception("{}-{}".format(response_data.status_code, response_data.text))

else:

raise Exception("{}-{}".format(response_data.status_code, response_data.text))

def get_kline(s, r, f, t, timeout=5, is_sandbox=False):

headers = {}

url = 'https://kitchen.kumex.com/kumex-kline/history'

if is_sandbox:

url = 'https://kitchen-sdb.kumex.com/kumex-kline/history'

uri_path = url

data_json = ''

p = []

if s:

p.append("{}={}".format('symbol', s))

if r:

p.append("{}={}".format('resolution', r))

if f:

p.append("{}={}".format('from', f))

if t:

p.append("{}={}".format('to', t))

data_json += '&'.join(p)

uri_path += '?' + data_json

response_data = requests.request('GET', uri_path, headers=headers, timeout=timeout)

return check_response_data(response_data)

class Shock(object):

def __init__(self):

# read configuration from json file

with open('config.json', 'r') as file:

config = json.load(file)

self.api_key = config['api_key']

self.api_secret = config['api_secret']

self.api_passphrase = config['api_passphrase']

self.sandbox = config['is_sandbox']

self.symbol = config['symbol']

self.resolution = int(config['resolution'])

self.valve = float(config['valve'])

self.leverage = float(config['leverage'])

self.size = int(config['size'])

self.trade = Trade(self.api_key, self.api_secret, self.api_passphrase, is_sandbox=self.sandbox)

if __name__ == "__main__":

shock = Shock()

while 1:

time_to = int(time.time())

time_from = time_to - shock.resolution * 60 * 35

data = get_kline(shock.symbol, shock.resolution, time_from, time_to, is_sandbox=shock.sandbox)

print('now time =', time_to)

print('symbol closed time =', data['t'][-1])

if time_to != data['t'][-1]:

continue

now_price = int(data['c'][-1])

print('closed price =', now_price)

# high_track

high = data['h'][-31:-1]

high.sort(reverse=True)

high_track = float(high[0])

print('high_track =', high_track)

# low_track

low = data['l'][-31:-1]

low.sort()

low_track = float(low[0])

print('low_track =', low_track)

# interval_range

interval_range = (high_track - low_track) / (high_track + low_track)

print('interval_range =', interval_range)

order_flag = 0

# current position qty of the symbol

position_details = shock.trade.get_position_details(shock.symbol)

position_qty = int(position_details['currentQty'])

print('current position qty of the symbol =', position_qty)

if position_qty > 0:

order_flag = 1

elif position_qty < 0:

order_flag = -1

if order_flag == 1 and now_price < low_track:

order = shock.trade.create_limit_order(shock.symbol, 'sell', position_details['realLeverage'],

position_qty, now_price)

print('order_flag == 1,order id =', order['orderId'])

order_flag = 0

elif order_flag == -1 and now_price > high_track:

order = shock.trade.create_limit_order(shock.symbol, 'buy', position_details['realLeverage'],

position_qty, now_price)

print('order_flag == -1,order id =', order['orderId'])

order_flag = 0

if interval_range < shock.valve and order_flag == 0:

if now_price > high_track:

order = shock.trade.create_limit_order(shock.symbol, 'buy', shock.leverage, shock.size, now_price)

print('now price > high track,buy order id =', order['orderId'])

order_flag = 1

if now_price < high_track:

order = shock.trade.create_limit_order(shock.symbol, 'sell', shock.leverage, shock.size, now_price)

print('now price < high track,sell order id =', order['orderId'])

order_flag = -1Detail

https://www.fmz.com/strategy/207155

Last Modified

2021-03-04 10:13:22