Name

DEMA交叉趋势追踪策略DEMA-Crossover-Trend-Following-Strategy

Author

ChaoZhang

Strategy Description

该策略基于双指数移动平均线(DEMA)的交叉作为交易信号,采用趋势追踪方式,自动设置止损和止盈。策略优点是交易信号清晰,止损止盈设置灵活,能够有效控制风险。

-

计算快线DEMA(8日)、慢线DEMA(24日)和辅助线DEMA(可配置)。

-

当快线上穿慢线产生金叉信号时,做多;当快线下穿慢线产生死叉信号时,做空。

-

添加交易信号过滤,只有当辅助线的当日值高于前一日时,才生成信号,避免假突破。

-

采用趋势追踪止损机制,止损线会随价格走势进行调整,确保止损点锁定部分利润。

-

同时设置固定比例止损和止盈,控制单笔交易最大损失和盈利。

-

交易信号清晰,容易判断进出场时机。

-

双DEMA算法更平滑,避免被过度优化,信号更可靠。

-

辅助线过滤增加信号判断效果,减少假信号。

-

采用趋势追踪止损,可以锁定部分利润,有效控制风险。

-

设置固定比例止损止盈,控制单笔交易最大损失,避免超出风险范围。

-

在震荡行情中,可能产生频繁交易,容易posure增大,造成策略亏损。

-

设置固定止损比例过大,在异常行情中可能触发大额止损。

-

DEMA交叉信号滞后,在快速行情中买入靠近行情高点,会增加亏损风险。

-

在部署实盘时,滑点成本会对盈利性造成影响,需要调整止盈止损参数。

-

可以根据市场情况调整DEMA参数,寻找最佳平衡点。

-

在实盘中要考虑滑点成本,适当扩大固定止损范围。

-

可以增加其他辅助判断指标,如MACD等,增强信号效果。

-

可以设置追踪止损步进值,优化止损逻辑。

该策略利用DEMA的趋势判断能力,结合趋势追踪机制控制风险,在Determine trend direction的交易策略体系中是非常典型的代表。总体来说,该策略信号清晰,止损止盈设置合理,是一种容易掌握、风险可控的交易策略。在实盘中结合滑点成本优化和辅助指标判断,可以获得较好的投资回报。

||

This strategy is based on the crossover of double exponential moving average (DEMA) as trading signals and adopts a trend following approach with automated stop loss and take profit setting. The advantages of this strategy are clear trading signals, flexible stop loss/take profit configuration and effective risk control.

-

Calculate fast DEMA line (8-day), slow DEMA line (24-day) and auxiliary DEMA line (configurable).

-

When fast line crosses above slow line and a gold cross signal is generated, go long. When fast line crosses below slow line and a dead cross signal is generated, go short.

-

Add signal filter that signals are only triggered when the current value of auxiliary line is higher than previous day, avoiding false breakout.

-

Adopt trend following stop loss mechanism where stop loss line keeps adjusting based on price movement, locking in partial profits.

-

At the same time set fixed percentage stop loss and take profit to limit maximum loss and profit per trade.

-

Clear trading signals, easy to determine entry and exit timing.

-

Double DEMA algorithm is smoother, avoids overfitting, more reliable signals.

-

Auxiliary line filter improves signal accuracy, reducing false signals.

-

Trend following stop loss locks in partial profits, effectively controlling risks.

-

Fixed percentage stop loss/take profit limits maximum loss per trade, avoids exceeding risk tolerance.

-

Frequent trading could occur in ranging market, increasing exposure and causing losses.

-

Overly large fixed stop loss percentage may trigger unwanted big stop loss in extreme price swings.

-

DEMA crossover signals lag and long entries at peak may increase loss risks in fast-moving market.

-

In live trading slippage affects profitability, parameter tuning needed.

-

DEMA parameters can be optimized for different market conditions.

-

Consider widening fixed stop loss in live trading to account for slippage costs.

-

Other indicators like MACD can be added to improve signal quality.

-

Fine tune tracking stop loss stepping value to improve logic.

This strategy leverages DEMA's trend detection capability and combines it with trend following risk control methodologies. It is a very typical example in the Determine Trend Direction strategy system. In general this is a strategy with clear signals, sensible stop loss/profit taking configuration and controllable risks. When optimized for slippage costs and added with supplemental indicators in live trading, it can achieve good investment returns.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1_close | 0 | Source Data: close |

| v_input_2 | 8 | Length DEMA #1 |

| v_input_3 | 24 | Length DEMA #2 |

| v_input_4 | false | Length DEMA #3 |

| v_input_5 | false | Usar Trailing Stop? |

| v_input_6 | 9 | (?Stop Loss & Take Profit Settings)Stop Loss Long % |

| v_input_7 | 6 | Stop Loss Short % |

| v_input_8 | 25 | Take Profit Long % 1 |

| v_input_9 | 6 | Take Profit Short % 1 |

| v_input_10 | true | (?BackTest Period)Start Date |

| v_input_11 | true | Start Month |

| v_input_12 | 2018 | Start Year |

| v_input_13 | 31 | End Date |

| v_input_14 | 12 | End Month |

| v_input_15 | 2031 | End Year |

Source (PineScript)

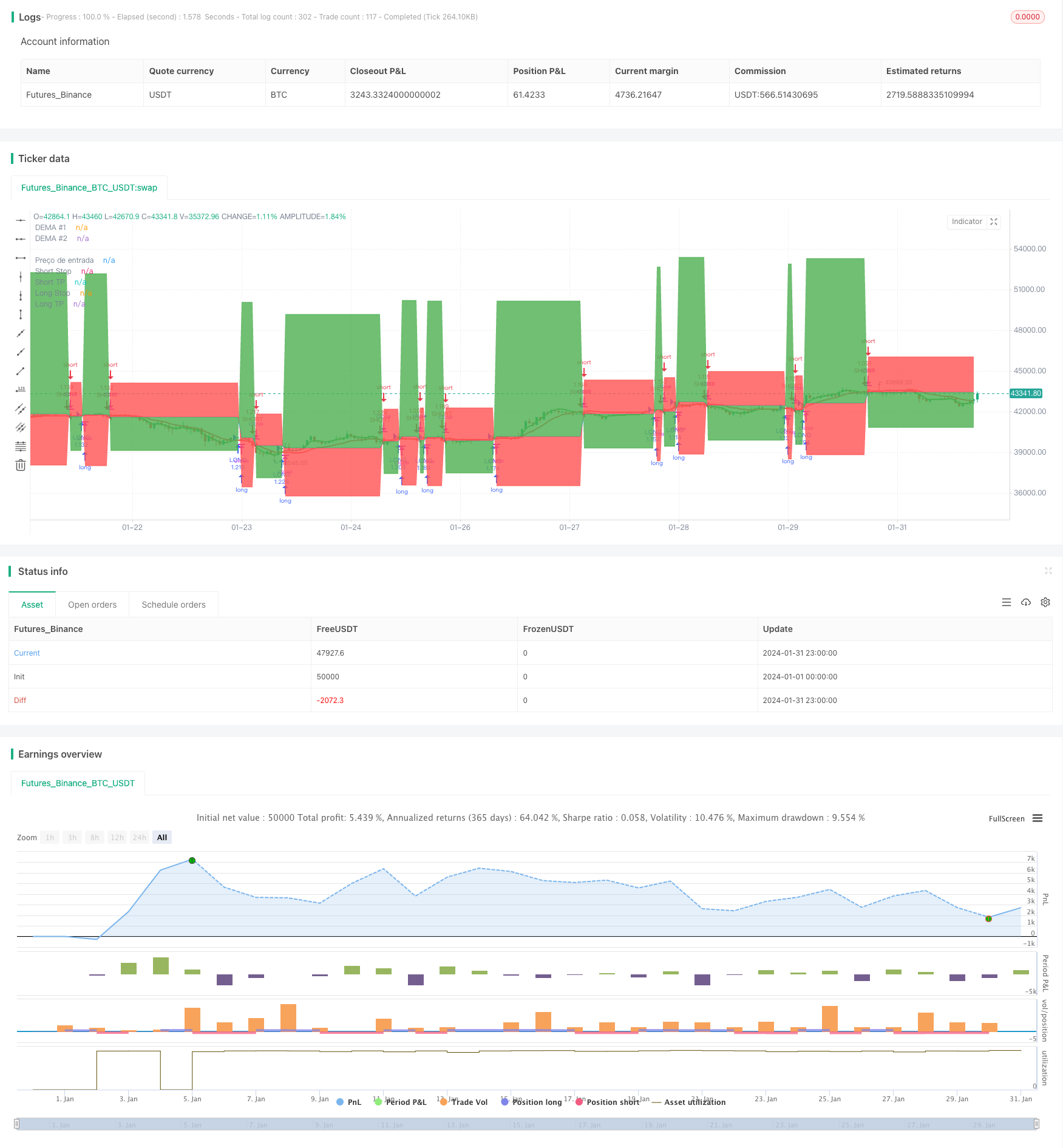

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © zeguela

//@version=4

strategy(title="ZEGUELA DEMABOT", commission_value=0.063, commission_type=strategy.commission.percent, initial_capital=100, default_qty_value=90, default_qty_type=strategy.percent_of_equity, overlay=true, process_orders_on_close=true)

// Step 1. Script settings

// Input options

srcData = input(title="Source Data", type=input.source, defval=close)

// Length settings

len1 = input(title="Length DEMA #1", type=input.integer, defval=8, minval=1)

len2 = input(title="Length DEMA #2", type=input.integer, defval=24, minval=0)

len3 = input(title="Length DEMA #3", type=input.integer, defval=0, minval=0)

// Step 2. Calculate indicator values

// Function that calculates the DEMA

DEMA(series, length) =>

if (length > 0)

emaValue = ema(series, length)

2 * emaValue - ema(emaValue, length)

else

na

// Calculate the DEMA values

demaVal1 = DEMA(srcData, len1)

demaVal2 = DEMA(srcData, len2)

demaVal3 = DEMA(srcData, len3)

// Step 3. Determine indicator signals

// See if there's a DEMA crossover

demaCrossover = if (len2 > 0) and (len3 > 0)

crossover(demaVal1, demaVal2) and (demaVal3 > demaVal3[1])

else

if (len2 > 0) and (len3 == 0)

crossover(demaVal1, demaVal2)

else

if (len3 > 0) and (len2 == 0)

crossover(demaVal1, demaVal3)

else

crossover(close, demaVal1)

// Check if there's a DEMA crossunder

demaCrossunder = if (len2 > 0) and (len3 > 0)

crossunder(demaVal1, demaVal2) and (demaVal3 < demaVal3[1])

else

if (len2 > 0) and (len3 == 0)

crossunder(demaVal1, demaVal2)

else

if (len3 > 0) and (len2 == 0)

crossunder(demaVal1, demaVal3)

else

crossunder(close, demaVal1)

// Step 4. Output indicator data

// Plot DEMAs on the chart

plot(series=demaVal1, color=color.green, linewidth=2, title="DEMA #1")

plot(series=demaVal2, color=color.red, linewidth=2, title="DEMA #2")

plot(series=demaVal3, color=color.fuchsia, linewidth=2, title="DEMA #3")

//TRAILING STOP CODE

a = input(title="Usar Trailing Stop?", type=input.bool, defval=false)

stopPerlong = input(9.0, title='Stop Loss Long %', type=input.float, group="Stop Loss & Take Profit Settings") / 100

stopPershort = input(6.0, title='Stop Loss Short %', type=input.float, group="Stop Loss & Take Profit Settings") / 100

take1Perlong = input(25.0, title='Take Profit Long % 1', type=input.float, group="Stop Loss & Take Profit Settings") / 100

take1Pershort = input(6.0, title='Take Profit Short % 1', type=input.float, group="Stop Loss & Take Profit Settings") / 100

// Determine stop loss price

longStopPrice = strategy.position_avg_price * (1 - stopPerlong)

shortStopPrice = strategy.position_avg_price * (1 + stopPershort)

longTake1Price = strategy.position_avg_price * (1 + take1Perlong)

shortTake1Price = strategy.position_avg_price * (1 - take1Pershort)

// Determine trail stop loss prices

longStopPriceTrail = 0.0

longStopPriceTrail := if (strategy.position_size > 0)

stopValue = close * (1 - stopPerlong)

max(stopValue, longStopPriceTrail[1])

else

0

// Determine trailing short price

shortStopPriceTrail = 0.0

shortStopPriceTrail := if (strategy.position_size < 0)

stopValue = close * (1 + stopPershort)

min(stopValue, shortStopPriceTrail[1])

else

999999

//calcular qual stop usar

longStop = a ? longStopPriceTrail : longStopPrice

shortStop = a ? shortStopPriceTrail : shortStopPrice

//calcula o valor do stop e TP pra lançar no alerta

longStopEntrada = close * (1 - stopPerlong)

shortStopEntrada = close * (1 + stopPershort)

longTPEntrada = close * (1 + take1Perlong)

shortTPEntrada = close * (1 - take1Pershort)

//armazena o preço de entrada e valor do SL e TP

price_entryL = 0.0

price_entryL := na(price_entryL) ? na : price_entryL[1]

price_entryS = 0.0

price_entryS := na(price_entryS) ? na : price_entryS[1]

stopL = 0.0

stopL := na(stopL) ? na : stopL[1]

stopS = 0.0

stopS := na(stopS) ? na : stopS[1]

takeL = 0.0

takeL := na(takeL) ? na : takeL[1]

takeS = 0.0

takeS := na(takeS) ? na : takeS[1]

if (demaCrossover)

price_entryL := close

stopL := close * (1 - stopPerlong)

takeL := close * (1 + take1Perlong)

if (demaCrossunder)

price_entryS := close

stopS := close * (1 + stopPershort)

takeS := close * (1 - take1Pershort)

resultadoL = ((close - price_entryL)/price_entryL) * 100

resultadoLexit = "(SL = 1% e TP = 0,5%)"

resultadoS = ((price_entryS - close)/price_entryS) * 100

resultadoSexit = "(SL = 1% e TP = 0,5)%"

// Make input options that configure backtest date range

_startDate = input(title="Start Date", type=input.integer,

defval=1, minval=1, maxval=31, group="BackTest Period")

_startMonth = input(title="Start Month", type=input.integer,

defval=1, minval=1, maxval=12, group="BackTest Period")

_startYear = input(title="Start Year", type=input.integer,

defval=2018, minval=1800, maxval=2100, group="BackTest Period")

_endDate = input(title="End Date", type=input.integer,

defval=31, minval=1, maxval=31, group="BackTest Period")

_endMonth = input(title="End Month", type=input.integer,

defval=12, minval=1, maxval=12, group="BackTest Period")

_endYear = input(title="End Year", type=input.integer,

defval=2031, minval=1800, maxval=2100, group="BackTest Period")

// Look if the close time of the current bar

// falls inside the date range

_inDateRange = (time >= timestamp(syminfo.timezone, _startYear,

_startMonth, _startDate, 0, 0)) and

(time < timestamp(syminfo.timezone, _endYear, _endMonth, _endDate, 0, 0))

//Alert configuration

_alertMessageOpenLong="OpenLong"

_alertMessageCloseLong="CloseLong"

_alertmessageExitLong="ExitLong - TP/SL"

_alertMessageOpenShort="OpenShort"

_alertMessageCloseShort="CloseShort"

_alertMessageExitShort="ExitShort - TP/SL"

if (_inDateRange)

//ENTER SOME SETUP TRADES FOR TSL EXAMPLE

if (demaCrossover)

strategy.entry("LONG", strategy.long, comment = _alertMessageOpenLong)

if (demaCrossunder)

strategy.entry("SHORT", strategy.short, comment = _alertMessageOpenShort)

//EXIT TRADE @ TSL

if strategy.position_size > 0

strategy.exit("TP/SL", "LONG", stop=longStop, limit=longTake1Price, comment=_alertmessageExitLong, alert_message=_alertmessageExitLong)

if strategy.position_size < 0

strategy.exit("TP/SL", "SHORT", stop=shortStop, limit=shortTake1Price, comment =_alertMessageExitShort, alert_message=_alertMessageExitShort)

//Look & Feel - Plot stop loss and take profit areas

p1=plot(strategy.position_avg_price, color=color.blue, style=plot.style_linebr, linewidth=1, title="Preço de entrada")

p2=plot(series=strategy.position_size > 0 ? longStop : na, color=color.red, style=plot.style_linebr, linewidth=1, title="Long Stop")

p3=plot(series=strategy.position_size > 0 ? longTake1Price : na, color=color.green, style=plot.style_linebr, linewidth=1, title="Long TP")

p4=plot(series=strategy.position_size < 0 ? shortStop : na, color=color.red, style=plot.style_linebr, linewidth=1, title="Short Stop")

p5=plot(series=strategy.position_size < 0 ? shortTake1Price : na, color=color.green, style=plot.style_linebr, linewidth=1, title="Short TP")

fill(p1, p2, color=color.red)

fill(p1, p3, color=color.green)

fill(p1, p4, color=color.red)

fill(p1, p5, color=color.green)

// Insert label with value

stopLossOnLong = "Stop Loss = " + tostring(longStop)

stopLossOnShort = "Stop Loss = " + tostring(shortStop)

takeprofitOnLong = "Take Profit = " + tostring(longTake1Price)

takeprofitOnShort = "Take Profit = " + tostring(shortTake1Price)

precoentrada = "Entrada = " + tostring(strategy.position_avg_price)

var label FinalLabelpriceL = na

var label FinalLabelpriceS = na

var label slFinalLabelL = na

var label slFinalLabelS = na

var label slFinalLabelTPL = na

var label slFinalLabelTPS = na

//Draw entry and stop loss lines and labels

if strategy.position_size > 0

//write the price above the end of the stoploss line

slFinalLabelL := label.new(bar_index, longStop, stopLossOnLong, style=label.style_none, size=size.normal, textcolor=color.red)

slFinalLabelTPL := label.new(bar_index, longTake1Price, takeprofitOnLong, style=label.style_none, size=size.normal, textcolor=color.green)

FinalLabelpriceL := label.new(bar_index, strategy.position_avg_price, precoentrada, style=label.style_none, size=size.normal, textcolor=color.blue)

// Delete previous label when there is a consecutive new high, as there's no line plot in that case.

if strategy.position_size > 0[1]

label.delete(slFinalLabelL[1])

label.delete(slFinalLabelTPL[1])

label.delete(FinalLabelpriceL[1])

if strategy.position_size < 0

//write the price above the end of the stoploss line

slFinalLabelS := label.new(bar_index, shortStop, stopLossOnShort, style=label.style_none, size=size.normal, textcolor=color.red)

slFinalLabelTPS := label.new(bar_index, shortTake1Price, takeprofitOnShort, style=label.style_none, size=size.normal, textcolor=color.green)

FinalLabelpriceS := label.new(bar_index, strategy.position_avg_price, precoentrada, style=label.style_none, size=size.normal, textcolor=color.blue)

// Delete previous label when there is a consecutive new high, as there's no line plot in that case.

if strategy.position_size < 0[1]

label.delete(slFinalLabelS[1])

label.delete(slFinalLabelTPS[1])

label.delete(FinalLabelpriceS[1])

// Exit open market position when date range ends

if (not _inDateRange)

strategy.close_all()

Detail

https://www.fmz.com/strategy/442366

Last Modified

2024-02-21 14:10:51