Who regulates the regulators?

Regulating the tech industry won’t fix its ethical problems, it might make them worse. Mike Monteiro has written the most compelling argument I have seen for regulation. Regulation would address many of the kinds of ethical risks that have made headlines recently. But I think it would leave many risks in place and introduce new risks — a more systemic risk, in fact — that in the long term would actually expose the public and the industry to more potential downside that it currently faces. Regulation at scale requires rules that stipulate what is ethical and what is not, in the case of the discussion of the ethics.

Regulating the tech industry won’t fix its ethical problems, it might make them worse. Mike Monteiro has written the most compelling argument I have seen for regulation. Regulation would address many of the kinds of ethical risks that have made headlines recently. But I think it would leave many risks in place and introduce new risks — a more systemic risk, in fact — that in the long term would actually expose the public and the industry to more potential downside that it currently faces. Regulation at scale requires rules that stipulate what is ethical and what is not, in the case of the discussion of the ethics.

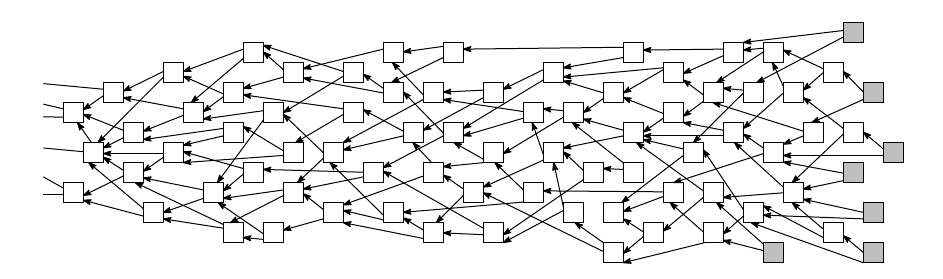

Blockchain oracles, or off-chain data providers, are key players in the blockchain ecosystem - wielding as much if not more power than miners and protocols developers. Often misunderstood and overlooked, they suffer from constant misuse and security vulnerabilities. Licensing and endorsing professional oracles is key to improving the overall health of the blockchain ecosystem.

Blockchain oracles, or off-chain data providers, are key players in the blockchain ecosystem - wielding as much if not more power than miners and protocols developers. Often misunderstood and overlooked, they suffer from constant misuse and security vulnerabilities. Licensing and endorsing professional oracles is key to improving the overall health of the blockchain ecosystem.

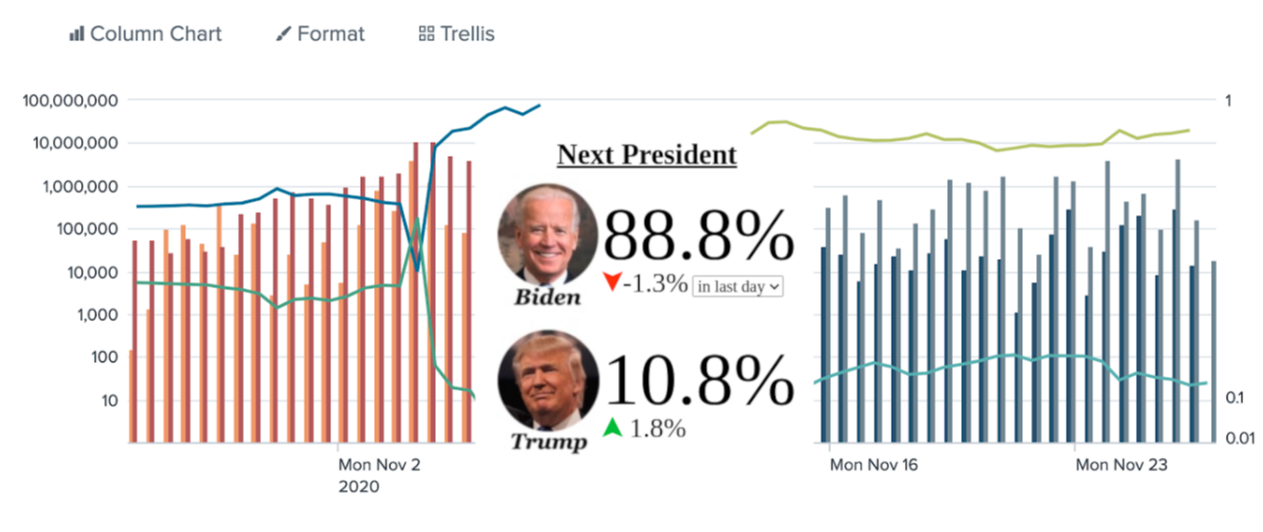

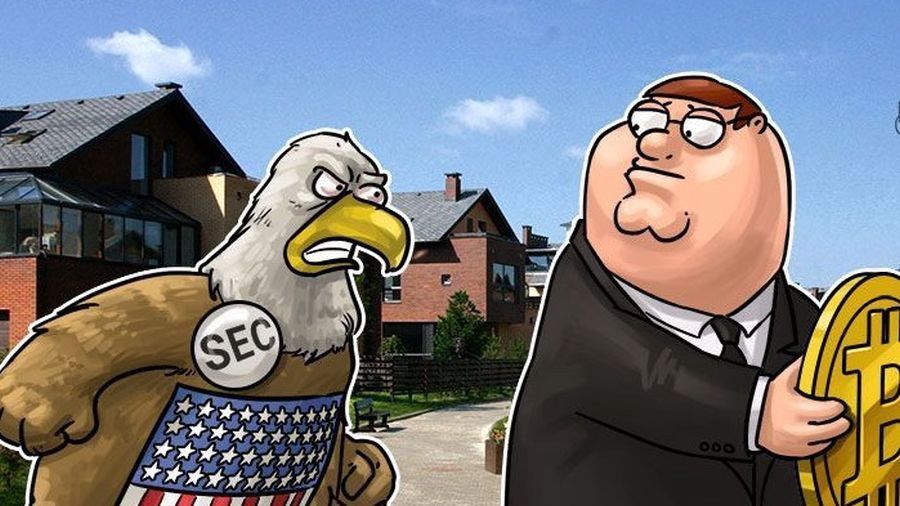

This article will discuss the current state of cryptocurrency regulation in the United States and how it could change in the future with more intervention

This article will discuss the current state of cryptocurrency regulation in the United States and how it could change in the future with more intervention

Tokenization of IP rights is something that is sure to come. Companies like Lexit, Molecule, the Open Innovation Platform DEIP are looking for ways to tokenize and liquidate IP rights for different reasons (like M&A or just to increase collaboration in innovation).

Tokenization of IP rights is something that is sure to come. Companies like Lexit, Molecule, the Open Innovation Platform DEIP are looking for ways to tokenize and liquidate IP rights for different reasons (like M&A or just to increase collaboration in innovation).

Fetch.ai is one of the Cosmos hubs within the Cosmos ecosystem that leverages the Cosmos SDK.

Fetch.ai is one of the Cosmos hubs within the Cosmos ecosystem that leverages the Cosmos SDK.

Cryptocurrencies have been under the microscope by regulators around the world. With South Korea pleading for an outright ban on cryptocurrency earlier this year, which is the third largest market for cryptocurrency now seems to be backtracking on cryptocurrency.

Cryptocurrencies have been under the microscope by regulators around the world. With South Korea pleading for an outright ban on cryptocurrency earlier this year, which is the third largest market for cryptocurrency now seems to be backtracking on cryptocurrency.

Ishan Pandey: Hi, welcome to our “Behind the Startup” series. Tell us about yourself and the story behind CoinZoom?

Ishan Pandey: Hi, welcome to our “Behind the Startup” series. Tell us about yourself and the story behind CoinZoom?

In the movie Alladin, Jafar wishes to be a genie because of their incredible might and power. Alladin proclaims, “You wanna be a genie? You got it!”

In the movie Alladin, Jafar wishes to be a genie because of their incredible might and power. Alladin proclaims, “You wanna be a genie? You got it!”

Coinbase Lawsuit Incoming!

Coinbase Lawsuit Incoming!

Despite all the talk of regulatory standards and bills, the questions of whether the cryptocurrency space really needs intervention has yet to be answered.

Despite all the talk of regulatory standards and bills, the questions of whether the cryptocurrency space really needs intervention has yet to be answered.

Markets seem to be starting a new chapter in hopes of dovish Fed. Yet, there are no signs of crypto summer on the horizon.

Markets seem to be starting a new chapter in hopes of dovish Fed. Yet, there are no signs of crypto summer on the horizon.

FIPS 140 sets the standard for cryptography used in the United States, but it's got problems. Because of FIPS, we all have problems.

FIPS 140 sets the standard for cryptography used in the United States, but it's got problems. Because of FIPS, we all have problems.

Whistleblowers are employees who report their companies for misconduct. As cybersecurity becomes increasingly important, what role do whistleblowers play?

Whistleblowers are employees who report their companies for misconduct. As cybersecurity becomes increasingly important, what role do whistleblowers play?

This article reviews what kinds of compliance certifications and regulations exist, what they mean for developers, and how to begin the certification process.

This article reviews what kinds of compliance certifications and regulations exist, what they mean for developers, and how to begin the certification process.

Although experts and participants have long pointed out imperfections in the crypto industry, regulatory institutions have continued to delay decisions.

Although experts and participants have long pointed out imperfections in the crypto industry, regulatory institutions have continued to delay decisions.

A look at crypto exchanges, regulation and bank runs.

A look at crypto exchanges, regulation and bank runs.

Adhering to HIPAA regulations is a must - not an option for telemedicine providers! But what does this mean for you? Here's the scoop on the cruciality of HIPA.

Adhering to HIPAA regulations is a must - not an option for telemedicine providers! But what does this mean for you? Here's the scoop on the cruciality of HIPA.

NFT's disrupt the legacy art world by giving power directly to artists and buyers.

NFT's disrupt the legacy art world by giving power directly to artists and buyers.

This article talks about how projects can market and sell NFTs, building community and decentralized finance.

This article talks about how projects can market and sell NFTs, building community and decentralized finance.

Mario Nawfal goes over the World Economic Forum.

Mario Nawfal goes over the World Economic Forum.

This article talks about Bitcoin and its DeFi infrastructure.

This article talks about Bitcoin and its DeFi infrastructure.

Timechain, a decentralized exchange aggregator and permissionless lending and borrowing protocol introduced regulated AMM, Liquidity pools, farming.

Timechain, a decentralized exchange aggregator and permissionless lending and borrowing protocol introduced regulated AMM, Liquidity pools, farming.

The internet, by design, has enabled many forms of capture from data mining to market manipulation. So how do we build infrastructures which avoid capture?

The internet, by design, has enabled many forms of capture from data mining to market manipulation. So how do we build infrastructures which avoid capture?

The crypto ecosystem is currently facing mounting pressure from regulatory authorities.

The crypto ecosystem is currently facing mounting pressure from regulatory authorities.

This bill's chances of passing look stronger than its predecessors. But if the bill doesn’t pass, the industry may change on its own to address its own issues.

This bill's chances of passing look stronger than its predecessors. But if the bill doesn’t pass, the industry may change on its own to address its own issues.

DeFi can be an alternative system for traditional finance but how about we explore it's growth and the potential of the technology underpinning it.

DeFi can be an alternative system for traditional finance but how about we explore it's growth and the potential of the technology underpinning it.

Starting from January 10, 2020, the Fifth Anti Money Laundering Directive (5AMLD) takes effect. The Directive contains requirements for the mandatory verification for all cryptocurrency platforms clients following the KYC and AML standards, all users who make cryptocurrency transactions must pass verification.

Starting from January 10, 2020, the Fifth Anti Money Laundering Directive (5AMLD) takes effect. The Directive contains requirements for the mandatory verification for all cryptocurrency platforms clients following the KYC and AML standards, all users who make cryptocurrency transactions must pass verification.

As euphoria for new projects took off, it became clear that token creation was relatively easy and agile.

As euphoria for new projects took off, it became clear that token creation was relatively easy and agile.

Crypto exchanges, custodial wallets, and virtual asset service providers (VASPs) are required to follow stringent compliance rules and regulations, or face severe penalties.

Crypto exchanges, custodial wallets, and virtual asset service providers (VASPs) are required to follow stringent compliance rules and regulations, or face severe penalties.

As cryptocurrencies become more widely used, the US government is now looking to tax them, now using the 1099-B tax form to do it. Here's what you need to know

As cryptocurrencies become more widely used, the US government is now looking to tax them, now using the 1099-B tax form to do it. Here's what you need to know

Since digital assets were launched, they have received intense attention from retail and institutional investors globally and have achieved notable adoption milestones. This progress has occurred even with the different approaches taken by regulators who are still refining laws for digital assets across global jurisdictions.

Since digital assets were launched, they have received intense attention from retail and institutional investors globally and have achieved notable adoption milestones. This progress has occurred even with the different approaches taken by regulators who are still refining laws for digital assets across global jurisdictions.

As regulators drag their feet on rules surrounding airdrops and tokens, founders look beyond U.S. borders

As regulators drag their feet on rules surrounding airdrops and tokens, founders look beyond U.S. borders

Astar Network has broken a world record by publishing a national newspaper advertising with the largest brands in a single ad.

Astar Network has broken a world record by publishing a national newspaper advertising with the largest brands in a single ad.

A security is a traditional financial instrument, such as equity, debt, or real assets. It represents ownership in (or the rights to ownership in) the aforementioned categories. Securities are also typically exclusive, rather than inclusive, because the process of buying and trading something like equity or debt is slow and expensive.

A security is a traditional financial instrument, such as equity, debt, or real assets. It represents ownership in (or the rights to ownership in) the aforementioned categories. Securities are also typically exclusive, rather than inclusive, because the process of buying and trading something like equity or debt is slow and expensive.

SEC is interested in one of the most popular NFT collections Bored Ape Yacht Club. Will it be a high-profile precedent for the entire art market of NFT.

SEC is interested in one of the most popular NFT collections Bored Ape Yacht Club. Will it be a high-profile precedent for the entire art market of NFT.

Writing about the current situation in DeFi space, regulations for its users, and the LTO solution using Verifiable credentials and decentralized identifiers.

Writing about the current situation in DeFi space, regulations for its users, and the LTO solution using Verifiable credentials and decentralized identifiers.

In the last few years, there have been many instances where Bitcoin and cryptocurrency have been accepted as a form of currency and payment.

In the last few years, there have been many instances where Bitcoin and cryptocurrency have been accepted as a form of currency and payment.

Regulators and those in software companies have often struggled to find peace with each other, as unlike previous technologies, the software moves exponentially faster and works under new business models that previous regulations did not account for. That is why Zuckerberg, who tried to avoid regulations in the past by being more transparent than incumbents, has been asking regulators to take a “more active role” and work together towards regulating the internet.

Regulators and those in software companies have often struggled to find peace with each other, as unlike previous technologies, the software moves exponentially faster and works under new business models that previous regulations did not account for. That is why Zuckerberg, who tried to avoid regulations in the past by being more transparent than incumbents, has been asking regulators to take a “more active role” and work together towards regulating the internet.

If the recent uncertainty in the crypto market has caused you some losses in your investments, chances are you might benefit from them.

If the recent uncertainty in the crypto market has caused you some losses in your investments, chances are you might benefit from them.

how is crypto regulated and what legal challenges do businesses and crypto enthusiasts face

how is crypto regulated and what legal challenges do businesses and crypto enthusiasts face

Crypto is here, crypto is there, crypto soon will be everywhere. The only problem is that the larger the industry, the greater attention from regulators.

Crypto is here, crypto is there, crypto soon will be everywhere. The only problem is that the larger the industry, the greater attention from regulators.

It is easier to understand why something acts as a solution, than understand why it acts as a problem.

It is easier to understand why something acts as a solution, than understand why it acts as a problem.

In this article, we will look at how the 409a valuation for the market value of a company's stock can be managed using methods such as the backstop method.

In this article, we will look at how the 409a valuation for the market value of a company's stock can be managed using methods such as the backstop method.

SEC chairman Gary Gensler was sworn in as a Securities and Exchange Commission member on February 3rd, 2021. Many considered him Bitcoin-friendly and great for crypto as a whole.

SEC chairman Gary Gensler was sworn in as a Securities and Exchange Commission member on February 3rd, 2021. Many considered him Bitcoin-friendly and great for crypto as a whole.

The outcome of the CMA's investigation into the Meta Giphy acquisition could set a precedent for future deals in the tech sector.

The outcome of the CMA's investigation into the Meta Giphy acquisition could set a precedent for future deals in the tech sector.

It's high time we call for ethical and regulatory oversight in AI. Transparency in AI may take some time, but it is going to be of crucial importance.

It's high time we call for ethical and regulatory oversight in AI. Transparency in AI may take some time, but it is going to be of crucial importance.

For all its lofty goals and vague formulations, the AIA clearly sets up startups and SMEs for algorithmic success. They can – and should – rise to the occasion.

For all its lofty goals and vague formulations, the AIA clearly sets up startups and SMEs for algorithmic success. They can – and should – rise to the occasion.

The right to be forgotten, that is set out in the new General Data Protection Regulation (GDPR) of the European Union (EU), mainly in article 17 and that already have come into force on 28th May 2017, nowadays empowers any person to correct or even delete his personal data and information that affects him (person) and stop being treated if this personal data are no longer necessary for the purposes collected or if a person has not withdrawn his consent.

The right to be forgotten, that is set out in the new General Data Protection Regulation (GDPR) of the European Union (EU), mainly in article 17 and that already have come into force on 28th May 2017, nowadays empowers any person to correct or even delete his personal data and information that affects him (person) and stop being treated if this personal data are no longer necessary for the purposes collected or if a person has not withdrawn his consent.

We believe that regulating the blockchain space is the only way to push these ideas into the mainstream, but we also understand that it’s not that simple.

We believe that regulating the blockchain space is the only way to push these ideas into the mainstream, but we also understand that it’s not that simple.

As the world moves forward, those working with AI — meaning almost all of us — need to take the ethical matter into our own hands.

As the world moves forward, those working with AI — meaning almost all of us — need to take the ethical matter into our own hands.

OCC stressed the importance of cooperation and coordination with major crypto intermediaries to fully comprehend the threats with the crypto industry.

OCC stressed the importance of cooperation and coordination with major crypto intermediaries to fully comprehend the threats with the crypto industry.

HashKey Capital, Singapore Pte. Ltd.made the announcement at the Singapore Fintech Festival 2022 that it had received preliminary approval from the MAS.

HashKey Capital, Singapore Pte. Ltd.made the announcement at the Singapore Fintech Festival 2022 that it had received preliminary approval from the MAS.

Many experts and public service officers are not absolutely happy or impressed with the blockchain technology appearance in the modern world. It has many opponents and skeptics, including financial regulators, who are not inclined to rush things faster as possible.

Many experts and public service officers are not absolutely happy or impressed with the blockchain technology appearance in the modern world. It has many opponents and skeptics, including financial regulators, who are not inclined to rush things faster as possible.

Recently, in some Blockhain projects born mostly by the brand new teams from around the world that are going to make an ICO, it has become very fashionable to show up or rather be brazenly proud that their project token easily and freely pass such a terrible and hated by everyone - The Howey Test.

Recently, in some Blockhain projects born mostly by the brand new teams from around the world that are going to make an ICO, it has become very fashionable to show up or rather be brazenly proud that their project token easily and freely pass such a terrible and hated by everyone - The Howey Test.

Discover how IT process automation help in improving business productivity.

Discover how IT process automation help in improving business productivity.

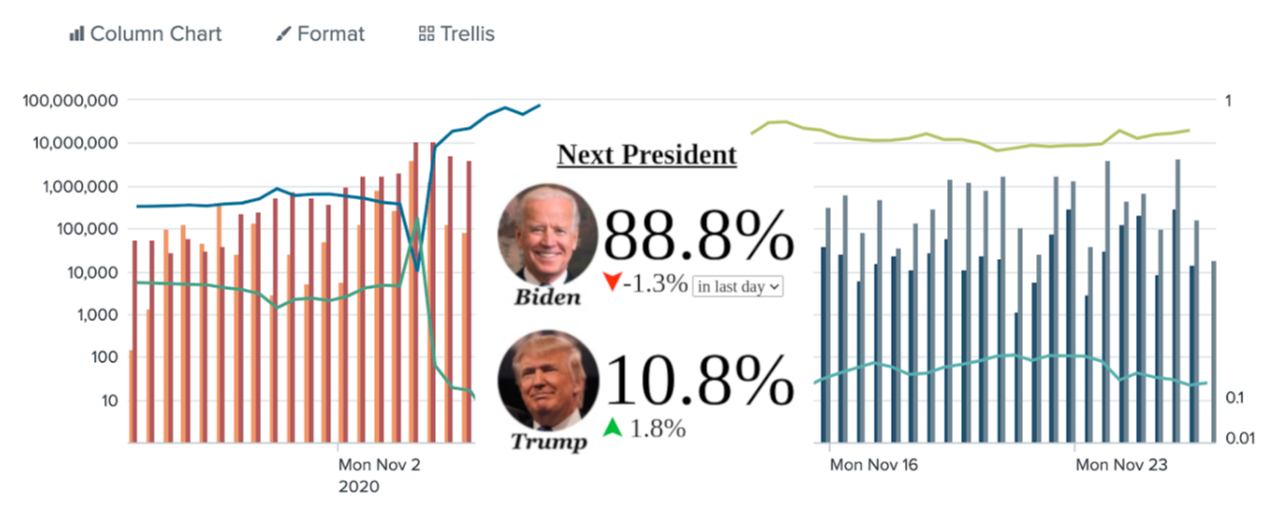

Andrew Yang is a 2020 presidential candidate who has earned sizable grassroots support from left-leaning cryptocurrency enthusiasts, and neoliberal technophiles; as well as a significant section of both professional and independent media organisations.

Andrew Yang is a 2020 presidential candidate who has earned sizable grassroots support from left-leaning cryptocurrency enthusiasts, and neoliberal technophiles; as well as a significant section of both professional and independent media organisations.

SMIC (Semiconductor Manufacturing International Corporation) became another Chinese company restricted by the US. In the global supply chain, collateral damages caused by these restrictions may go far beyond what people can think of.

SMIC (Semiconductor Manufacturing International Corporation) became another Chinese company restricted by the US. In the global supply chain, collateral damages caused by these restrictions may go far beyond what people can think of.

For bitcoiners, it is something of a parlor game to think of ways Bitcoin could be killed.

For bitcoiners, it is something of a parlor game to think of ways Bitcoin could be killed.

As a result, the rushed RBI 2018 proposed ban on crypto trading left the Indian traders uncertain about the future for over two years.

As a result, the rushed RBI 2018 proposed ban on crypto trading left the Indian traders uncertain about the future for over two years.

In the last decade, the VPN market has been steadily growing, and this growth was spiked even further in 2020. Two main reasons contributed to an even more expansive use of VPN software: 1) Covid-19, quarantine, and work from home set the needs for home network security; 2) cybercrime has been on the rise and cybersecurity became a more common issue.

In the last decade, the VPN market has been steadily growing, and this growth was spiked even further in 2020. Two main reasons contributed to an even more expansive use of VPN software: 1) Covid-19, quarantine, and work from home set the needs for home network security; 2) cybercrime has been on the rise and cybersecurity became a more common issue.

This is a written recap of a discussion organized by Dominicans on Wall Street, a non-profit organization, between legal experts, venture capitalists, and government officials. The author has no vested interest in any of the projects mentioned and does not offer investment advice.

This is a written recap of a discussion organized by Dominicans on Wall Street, a non-profit organization, between legal experts, venture capitalists, and government officials. The author has no vested interest in any of the projects mentioned and does not offer investment advice.

Why is it so hard to regulate algorithms in the United States?

Why is it so hard to regulate algorithms in the United States?

The world has come a long way in terms of its relationship with technology and knowledge. It’s almost universal that people are often afraid of new inventions that are supposed to improve their lives. We feel threatened by what’s out of our intellectual grasp.

The world has come a long way in terms of its relationship with technology and knowledge. It’s almost universal that people are often afraid of new inventions that are supposed to improve their lives. We feel threatened by what’s out of our intellectual grasp.

The insular nature of the crypto-industry can often discourage potential investors, but digital assets are at an adoptive inflection point. Regulation can help.

The insular nature of the crypto-industry can often discourage potential investors, but digital assets are at an adoptive inflection point. Regulation can help.

Wars can be fought in the real world but there is also a virtual battlefield - and it is just as harmful. The Lawful Access to Encrypted Data Act is the latest attempt to access people's encrypted data and it serves as another reinforcement.

Wars can be fought in the real world but there is also a virtual battlefield - and it is just as harmful. The Lawful Access to Encrypted Data Act is the latest attempt to access people's encrypted data and it serves as another reinforcement.

Crypto adoption is poised on a knife-edge, with regulation and laws prepared to push it either way in a moment’s notice. So far, we have seen countries around the world take a rather tolerant stance towards the crypto world, allowing exchanges and payment providers to operate freely. But it looks as if the tide is beginning to turn.

Crypto adoption is poised on a knife-edge, with regulation and laws prepared to push it either way in a moment’s notice. So far, we have seen countries around the world take a rather tolerant stance towards the crypto world, allowing exchanges and payment providers to operate freely. But it looks as if the tide is beginning to turn.

The most important part of the investors' trust in crypto assets is their legal regulation. Now, we have several types of countries according to crypto regulations. The first ones include only El Salvador, where Bitcoin is a legal tender. The second ones unite countries where there’s a legal basis to buy/sell/margin trade/issue new tokens, and so on. The last ones are like China, where crypto activities are strictly forbidden. Many South-East Asia countries focus on providing a legal field for crypto companies to work and managing issuing crypto assets. The regulation authorities look for tax deductions of both individuals and companies if they make profits, trading crypto assets. Also, the countries pay much attention to anti-terrorist financing activities.

The most important part of the investors' trust in crypto assets is their legal regulation. Now, we have several types of countries according to crypto regulations. The first ones include only El Salvador, where Bitcoin is a legal tender. The second ones unite countries where there’s a legal basis to buy/sell/margin trade/issue new tokens, and so on. The last ones are like China, where crypto activities are strictly forbidden. Many South-East Asia countries focus on providing a legal field for crypto companies to work and managing issuing crypto assets. The regulation authorities look for tax deductions of both individuals and companies if they make profits, trading crypto assets. Also, the countries pay much attention to anti-terrorist financing activities.

In 2017, the Initial Coin Offering (ICO) exploded onto the global scene and upended the traditional method of funding an early-stage business. For a while, many believed that we were witnessing the dawn of a more egalitarian financial era; one where anyone with a good idea and the ability to make it a reality could access easy money and a shot at success. As it turned out, it was too good to be true.

In 2017, the Initial Coin Offering (ICO) exploded onto the global scene and upended the traditional method of funding an early-stage business. For a while, many believed that we were witnessing the dawn of a more egalitarian financial era; one where anyone with a good idea and the ability to make it a reality could access easy money and a shot at success. As it turned out, it was too good to be true.

Crypto-investors have recently expressed concern over the price fluctuations of Bitcoin. Please find below the Kyrrex forecasts on the present state of Bitcoin, the causes for price volatility, and expectations for future changes.

Crypto-investors have recently expressed concern over the price fluctuations of Bitcoin. Please find below the Kyrrex forecasts on the present state of Bitcoin, the causes for price volatility, and expectations for future changes.

The ongoing saga of US cryptocurrency and blockchain regulation seems to be never-ending. It first became a hot topic in light of the ICO boom of 2017 and 2018, as the SEC started to zero in on the likelihood of unregulated sales of securities. Since the recent bull run on Bitcoin and Facebook’s subsequent Libra announcement, crypto regulation is once again a heated talking point for the US regulators. However, although discussions continue to rumble on, there’s still no firm end in sight.

The ongoing saga of US cryptocurrency and blockchain regulation seems to be never-ending. It first became a hot topic in light of the ICO boom of 2017 and 2018, as the SEC started to zero in on the likelihood of unregulated sales of securities. Since the recent bull run on Bitcoin and Facebook’s subsequent Libra announcement, crypto regulation is once again a heated talking point for the US regulators. However, although discussions continue to rumble on, there’s still no firm end in sight.

Back in February this year, outspoken Bitcoin maximalist Tim Draper gave an interview to Fox Business. During the interview, he predicted that cryptocurrencies would go mainstream within the next five years. Of course, Draper is known for his notoriously bullish forecasts, having previously called Bitcoin hitting $250k by 2023. However, his five-year timeline for crypto going mainstream may end up being conservative, based on the significant forward momentum in 2019 so far.

Back in February this year, outspoken Bitcoin maximalist Tim Draper gave an interview to Fox Business. During the interview, he predicted that cryptocurrencies would go mainstream within the next five years. Of course, Draper is known for his notoriously bullish forecasts, having previously called Bitcoin hitting $250k by 2023. However, his five-year timeline for crypto going mainstream may end up being conservative, based on the significant forward momentum in 2019 so far.

The Federal Trade Commission (FTC) has guidelines regarding influencer marketing. Be informed and follow the rules - that's our advice.

The Federal Trade Commission (FTC) has guidelines regarding influencer marketing. Be informed and follow the rules - that's our advice.

What's the future of cryptocurrency? With all eyes focused on the global economic climate and a tumultuous recent history for crypto, it's anything but clear.

What's the future of cryptocurrency? With all eyes focused on the global economic climate and a tumultuous recent history for crypto, it's anything but clear.

Diving deeper into the regulatory scope of the crypto industry.

Diving deeper into the regulatory scope of the crypto industry.

With recreational and medical marijuana legalisation efforts comes great business opportunity, and unsolved problems. As of today, recreational and medical marijuana legalisation efforts have succeeded in multiple jurisdictions across the world, and counting. On the list is Luxembourg to become the first European country to join the ranks of Canada and U.S. in relaxing weed laws.

With recreational and medical marijuana legalisation efforts comes great business opportunity, and unsolved problems. As of today, recreational and medical marijuana legalisation efforts have succeeded in multiple jurisdictions across the world, and counting. On the list is Luxembourg to become the first European country to join the ranks of Canada and U.S. in relaxing weed laws.

In this interview with Marcus Fetherston from Eightcap, we talk about CFDs, derivatives, and regulations.

In this interview with Marcus Fetherston from Eightcap, we talk about CFDs, derivatives, and regulations.

This article discusses how financial regulators can regulate smart contracts in such a way that the adoption of the blockchain is feasible. I will argue that to regulate cryptocurrencies without destroying it, fungibility must be maintained, and it must be treated as money.

This article discusses how financial regulators can regulate smart contracts in such a way that the adoption of the blockchain is feasible. I will argue that to regulate cryptocurrencies without destroying it, fungibility must be maintained, and it must be treated as money.

Even public companies with a strong code of conduct, an exemplary tone at the top, robust internal controls, and a culture of compliance may face allegations of misconduct that can lead to an investigation by the Division of Enforcement of the US Securities and Exchange Commission (the SEC or the Commission).

Even public companies with a strong code of conduct, an exemplary tone at the top, robust internal controls, and a culture of compliance may face allegations of misconduct that can lead to an investigation by the Division of Enforcement of the US Securities and Exchange Commission (the SEC or the Commission).

Looking back at the events that unfolded in 2022, it was quite obvious that regulators would take a serious stance on crypto activities sooner rather than later

Looking back at the events that unfolded in 2022, it was quite obvious that regulators would take a serious stance on crypto activities sooner rather than later

Double standards in SEC. The opinion of Kiyosaki.

Double standards in SEC. The opinion of Kiyosaki.

The key thing about these NFTs, regardless of the metaverse, is that they have a value outside the game and can be transferred to anyone on the blockchain.

The key thing about these NFTs, regardless of the metaverse, is that they have a value outside the game and can be transferred to anyone on the blockchain.

Joshua Marriage from Australia is a dissident technology enthusiast interested in bitcoin fungibility, the Big Brothers of Blockchain, and the need for surveillance-free satoshis, who's been nominated in the Noonies Decentralization Award Category. Read on for Joshua's Noonies interview, right below the ad break.

Joshua Marriage from Australia is a dissident technology enthusiast interested in bitcoin fungibility, the Big Brothers of Blockchain, and the need for surveillance-free satoshis, who's been nominated in the Noonies Decentralization Award Category. Read on for Joshua's Noonies interview, right below the ad break.

In this thread, the Slogging community discussed EU regulation on charging cable equalization and its impacts on innovation.

In this thread, the Slogging community discussed EU regulation on charging cable equalization and its impacts on innovation.