[Archived] - Introducing a Sector Duration Multiplier for Longer Term Sector Commitment #421

Replies: 65 comments 249 replies

-

|

how do we avoid a pump and dump scenarios on the filecoin price with this?

there is not enough fil circulating to fully x5 the whole network. if we have one big enough player buying fil early and aggressively as soon as this is announced we might see unpleasant price movements that make it feasible to buy, extend, terminate i think

if this is a good idea - i do not know [edit] in fact that player wouldn't even need to actually extend - the FOMO this creates might be already enough |

Beta Was this translation helpful? Give feedback.

-

|

will this change the min deal duration from 6 to 12 month too? if not - when is re-snapping planned so miners are not forced to keep "dead data" sectors proving (at least 6 month, 4.5 years in the worst case) just because it is more profitable than not doing so not everyone wants to store for 5 years and for most of the data out there it makes no sense to store them for long periods of time making long term commitments to keep sectors available, storage sealed shouldn't come with in flexibility in how data can be stored in these sectors. there is data out there that MUST be deleted after a certain period - re-snapping would give us a pseudo proof of deletion in some wired way |

Beta Was this translation helpful? Give feedback.

-

|

Summary of Storage Provider questions and concerns raised in the EMEA SPWG meeting 1st August 2022.

Summary of CryptoEcon & PL comments:

|

Beta Was this translation helpful? Give feedback.

-

|

I would like to propose a modification to the proposal, dealing with increased The current proposal increases the maximum sector commitment length from 1.5 to 5 years. It does it by increasing the ProposalThe core of the proposal is to separate the period of validity of a proof from the period of commitment for a sector. This leaves the 1.5-year sector extension process in place to maintain proof validity, but allows SPs to commit to longer periods. The existing sector A new sector property is introduced called

The proof refresh window creates a trade-off: the larger the window, the more refreshes can happen in a singular batch, but more frequently each proof must be refreshed. The proof expiration is not freely chosen by the SP, but takes a value that is derived and quantised from the sector’s activation epoch. Storage Provider can at any point call RefreshProofEpiration(SectorSelector) requesting a refreshed proof expiration. This call only results in an actual refresh of the ProofExpiration if called within ProofRefereshWindowof the ProofExpiration. In case of a PoRep bug, the It also has the following benefits:

Limitations of this mechanism include:

For more technical details please see this document. |

Beta Was this translation helpful? Give feedback.

-

|

This is Hasan from DLTx |

Beta Was this translation helpful? Give feedback.

-

|

Do we have modelling on the network QAP after this upgrade? |

Beta Was this translation helpful? Give feedback.

-

|

I do not see any new SP's drawn to a place where they need to lock up x50 6FIL per TiB onto a harddrive to then sell that same storage for "free". This is not an healthy place to be in and we will become a staking protocol. Whoever has the most cash, wins. The reason why FIL+ works is because of a few things:

If you make it as easy as "lengthening a lifecycle" to get an x5, everyone who has the funds will do it because it is the easiest way to increase your block reward immediately. You say "great for long term commitment" and I say "everyone not able to compete will cease to exist". Hence no "decentralisation", isn't that why we are all here for? Do not mistake wishful thinking with simple economics: miners will be FORCED to get the x5 to stay competitive. Because of the decreased FIL/TiB revenue, miners who do not upgrade will go bankrupt. Small to medium sized miners need to lend more than 300%-500% of their initial Filecoin capital to stay competitive. No lender is capable of doing this. The rich will only out-grow all others, keeping equal hardware and not doing any deals. Please show me the maths and research on the following subjects:

I can keep going since I have another 50+ questions about this. But let's please continue this conversation as we all seek a beter future for the Filecoin network. |

Beta Was this translation helpful? Give feedback.

-

|

Hi @vkalghatgi , @tmellan , Thank you for the detailed FIP, but impacts are quite difficult to perceive, I’m a small individual miner true Filecoin believer, I quit my job for Filecoin, and I'm very worry about this FIP. I would like to highlight Two points that doesn't seem to be taken into consideration in the FIP. Time and effort

I think it’s unfair in regards to the effort these guys have done until now, and I would like to hear just one telling me that dealing with storage deals was not x10 more time consuming than pledging CC all day long; with the great work from the lotus team today even my cat 🐱 can do CC. LendersWith this FIP how can we survive without lenders ? If that the new rule, we can probably deal with it, but that should become part of the protocol and give any miners equal access to Fil, otherwise, this is just giving an extreme power to lenders and and unfair competitiveness to large entities. In a more general manner you present the macroeconomic aspects, I think many of us would like to understand what is going to be the individual impacts. It would be great if you could forecast the impact on some personas like :

Please ensure that FIP is fair for small players, and respectful for the time and effort they already invest, Long live to Filecoin 🚀 |

Beta Was this translation helpful? Give feedback.

-

|

Hello, everyone! I have compiled a list of concerns/questions presented during SPWG-CN meeting on August 3rd. Please note that these are taken on the fly by @Fatman13 which may or may not reflect what the speaker meant as things may get lost in translation or internet connection. Thank you!

|

Beta Was this translation helpful? Give feedback.

-

|

When do extension, let’s say for just a short time like a couple of days, will still be allowed after this FIP? And will initial pledge be calculated every time even for a short sector extension? |

Beta Was this translation helpful? Give feedback.

-

|

Hello everyone, for this, I put forward some of my personal views, welcome to discuss:

|

Beta Was this translation helpful? Give feedback.

-

|

I see some concerns about this FIP driving up token price (as new players wanting to seal 5y CC try to amass FIL for collateral), to a level where current SP's would not be able to afford collateral. While it is impossible to predict what will happen to Token price, and it is a fruitless effort to try to predict this accurately, let's follow the assumption from these concerns and see if they are justified. The implicit (and not unreasonable) assumption is that token price would rise (proportionately?) with network QAP (as more SP's compete to amass FIL). Ok so let's assume this. In this case the collateral that needs to be paid for a sector is also inversely proportional to network QAP, so the amount in fiat that needs to be paid remains constant. Also the amount of block reward that the SP receives, is inversely proportional to the network QAP. So while they will receive a smaller piece of the pie as network QAP grows, assuming token price increases also, then their block reward remains unchanged too in terms of fiat. |

Beta Was this translation helpful? Give feedback.

-

|

Attention! Hi everyone, Taking into account many of the points raised regarding SP preferences, we've adapted two key elements of the proposal:

In addition, several points have come up repeatedly, and we attempt to address why we think these will not cause problems. The document is here: Thanks to all who can take the time to read, and especially those who can take the time to comment. This is a critical feedback loop for us. Pending community response, we'd like to include these changes to the current FIP draft. To help direct, please 👍 or 👎 to this post. Thanks all. cc @zixuanzh @vkalghatgi @anorth @jbenet @momack2 @Fatman13 @Kubuxu @f8-ptrk @kaitlin-beegle @geoff-vball @AxCortesCubero @misilva73 @jennijuju |

Beta Was this translation helpful? Give feedback.

-

|

I have an idea, If you really think circulation is a big problem and have to deal with immediately, instead of trying to find tons of reason to convince the SPs to be the only one to bear the cost, why doesn’t PL or the foundation burn some tokens they control just like CZ does for BNB? It seems like a least destructive nor controversial way to achieve the goal, you don’t even need a FIP and can do it immediately, problem solved! |

Beta Was this translation helpful? Give feedback.

-

|

Can someone explain to me with corresponding calculations why we can not do a 2x for a 5 year sector? |

Beta Was this translation helpful? Give feedback.

-

|

Have been getting questions and wanna leave a quick comment If an existing deal renewal or extension is necessary for this FIP, then please add that as a prerequisite to this FIP. And some core devs might prioritize coming up with a proper solution for that first. |

Beta Was this translation helpful? Give feedback.

-

|

We’re a Sydney based SP with 25PiB of proven capacity in the Filecoin network, as such we’re motivated to support activity that will boost the price of FIL and reduce volatility. Having said this, we are vehemently opposed to the artificial manipulation of FIL supply designed entirely to boost the price of FIL for the benefit of a select few significant holders of supply. The price manipulation is a short term fix to long term problem and we’d much rather PL focus their efforts on increasing demand for FIL by onboarding meaningful customers and improving the customer utility, stability and retrievability. The proposed FIP does: The proposed FIP does NOT: A 5 year FIL+ sector requires 50x the amount of capital to collateralise that sector (compared to a 1 year CC sector), where do you expect SPs to produce that amount of capital if they want to remain competitive? |

Beta Was this translation helpful? Give feedback.

-

|

As a non-SP, I'm for this FIP in principle but from what I understand / am hearing from folks on this thread I'm concerned about moving forward. Reading through a lot of other folks' concerns - a few things stick out (maybe these have been addressed, but it's honestly hard to keep track with this thread):

This strikes me as very weird reasoning. It's either the case: In both cases, timing of upgrades seems like an explicitly bad reason to try and push this forward - as its the importance of this FIP that will dictate on whether it eventually is accepted by the community. Given the state of the discussion, it seems there are many folks in the community who feel strongly against (not even the idea itself, just the current timing / incarnation) - and its not obvious all the concerns have good answers (see below).

Many of the lending programs today are limited in scale in terms of SPs they can concurrently support, and tend to target SPs who can accept large volumes of FIL (someone correct me if this is wrong!). This means the average smaller SP will not have access to capital to grow at the same rate as the larger SPs. I know there are a number of teams working on liquid staking like programs when the FVM launches (which hopefully will serve a broader range of SPs) - but until that's a reality, we're exacerbating a divide which will only worsen diversity on the network. At least for me, it feels like this is a clear issue with the FIP as it stands - and one that requires no modeling or theory. It is practically the case that there are not lending options accessible to all SPs - and until thats remedied making this sort of change will have a perverse effect on SP diversity. (Even if there were a new lender to appear who would work with every SP it also seems concerning that everyone would need to set up a multisig for owner accounts and the potential risk that might incur to the network. EDIT: been poitned to FIP29 as a potential answer on this point, though idk if any loan programs use it) Is there a reason then to implement this FIP before the FVM / permissionless lending markets are live? Am I missing some context here which should change the reasoning above? |

Beta Was this translation helpful? Give feedback.

-

|

I’d like to present my summary evaluation of this proposal as it stands today (partially in response to @Fatman13's request, partly to agitate for action). I am not a member of the CEL team or an author of the proposal, but highly motivated to realise a robust, useful, and growing Filecoin network. This is my opinion, though I have drawn some ideas from the discussion here. I disclose that I am also a FIP editor (an administrative role), but here I am wearing only the hat of community member and core dev. I think something like this proposal would be good for the network, and I’d like to see it implemented. But the current form has a number of specific issues that, in my opinion, must be addressed before we can be confident it is a safe, beneficial, and equitable change to make. The right goals & directionally good mechanismsThe proposal is well intentioned. I understand the primary goals to be improving the stability of the storage commitments underlying the network as well as the stability and predictability of storage provider returns. I think these are good goals[1]. It aims to do so by allowing longer-term commitments to storage, allocating a greater share of the block reward stream to those longer commitments, and adjusting the pledge lock target upwards to bring balance to supply flows. There is also an ethos argument that the network should skew rewards towards longer term commitments. I am reasonably convinced that these mechanisms will achieve the goals. [1] What is the tradeoff for these goals? It’s a bit implicit, but greater stability will come at the expense of absolute commitments. The goals prefer to lower variance and accept a slightly lower total commitment than otherwise. The network will deny SPs optionality for short sector lifetimes, which makes committed storage slightly less valuable to them in aggregate, and so they’ll commit less of it. The most marginal (i.e. least stable) SPs will cease to participate. I think this is a fine tradeoff for the network to make, given the current 18EiB storage commitment. In the long term, stability will lead to greater aggregate utility. Major issuesThe following are major issues with the current proposal. Each one of them is a blocking issue to my support. However, I think all of them could be addressed. If they were, I think this the proposal would present clear benefits with reasonable risks. Pre-commit deposit risk modellingThe proposal notes that PCD will increase in line with the maximum potential lifetime reward of a sector. Merely noting this is not sufficient. We need to see an analysis of expected returns given assumptions about prove-commit failure rate: perhaps the observed network-wide rate, and some multiple of that for an individual SP’s risk model. The risk is aggravated by batching, which is necessary for high-throughput or high-base-fee onboarding. It is not clear to me that lower-quality sectors (CC or short-duration) are even above FIL-on-FIL water, here, or at what point batching becomes untenable. Action: SP return projections must take this into account. It’s possible that a compensating mechanism will be required to keep CC and batching viable. PoRep security impactThis proposal increases the maximum sector commitment to 5 years, which breaks the existing (somewhat implicit) security policy and mechanism for a fault in PoRep. The FIP notes this but does not propose a mitigation or state that its implementation should be conditional one. The FIP authors have attempted to dismiss this issue as being a separate issue and not coupled to their proposal. In my view, a policy and mechanism to address potential PoRep flaws is a pre-requisite to breaking our existing one. @Kubuxu and I have spent some time trying to design a mechanism that could decouple the validity duration of a proof from the commitment duration of a sector. We hope to contribute this in order to unblock the sector duration multiplier proposal. The FIP should state this as a prerequisite. See #415 Action: The FIP should state the pre-requisite and authors should contribute to the policy analysis. Inequality of access for existing sectors with FIL+ dealsThe proposed mechanism is agnostic to deals, but current limits on capability of the built-in deal market mean that, for existing sectors, those already hosting verified deals can't be extended immediately to fully exploit the multiplier, while CC sectors can. The raw byte power attributable to the sector could be multiplied, but the FIL+ boosted power would be countered by the QA power’s “spreading out” effective. This means existing CC sectors can increase their proportion of total power and hence rewards by some multiple. Assuming any significant uptake of extension of CC sectors, the share of per-sector reward to existing FIL+ sectors could fall significantly faster than without this proposal. This issue applies only to existing sectors, not new ones. But of course existing sectors account for 100% of committed storage provider participants. The problem is the inflexibility of existing deals, so the proposal being agnostic to deals has real implications. This problem goes away in 1.5y when all such deals have expired. I am working on some improvements to the flexibility of FIL+ datacap and deals, but even if they land simultaneously, I am not confident they adequately address the issue. Most likely, extension of existing FIL+ deals would be at client discretion and require action and (small) cost on their part. SPs would experience divergent outcomes depending on their luck of their specific clients. I could be convinced otherwise by evidence that clients representing, say, ¾ of current verified deal bytes stand ready and willing to extend their deals when possible, or SPs clearly confident of that. Or a FIL+ notary vote that they will mint new datacap to extend any and all existing deals. I think the option of awarding duration multipliers only to newly-sealed sectors should be investigated more thoroughly. Even with that restriction, the future rewards of existing FIL+ sectors would fall, but at least their providers would be on equal footing to seal more, high-multiple sectors. Ramping the maximum duration very slowly (18m) could also reduce the impact (because the old deals will expire). I would love to see other ideas to restore equality. I’m aware the CEL team’s position is to advocate for applying the multiplier at extension because to apply it only to new sectors “risks us seeing much smaller positive effects” and “will be an incentive to let sectors expire” (… in order to seal and commit new ones). I don’t find this convincing, and certainly not more powerful than the inequality against the network’s most utility-aligned SPs. Especially since more muted effects would reduce the risk of many uncertainties and shortcomings, and I’ve seen no modelling. In short, I don’t think they tried to make the idea work because they haven’t been forced to. Action: Authors should model and publish the best possible version of a change that applies only to new sectors. Show analysis for early-termination incentives, and propose mechanisms to mitigate them. Pretend it were against the law to change the policy for existing sectors: what’s the best you can do? Support for FIP-0045 ([draft](#432)) is also welcome. The FIP also needs to fix simple policy numbers like max deal duration ShortcomingsThe following are significant shortcomings or weaknesses that I would like to see addressed, but don’t quite rise to the level of a blocking issue to me. They are risks that I am unhappy about. Uncertain short-term dynamicsThe proposal appears to prompt an immediate drop in per-sector profitability-on-pledge (according to published charts), and there’s also some incentive to delay extending sectors until the pledge-per-QAP requirement falls. There may also be an incentive to terminate the oldest existing sectors to re-use the pledge for new commitments that gain a greater return on hardware cost (but lower return-on-pledge?). These all point towards a short-term drop in onboarding rate or even total power. (My guess is that this is more likely than a rapid increase in QA power, but see “Rollout shock” for that one). Some of these dynamics might counter each other, and other system properties may also act as negative feedback, but I haven’t seen any attempt at dynamical system modelling to understand the instabilities, feedback loops etc, that might be in play. I’m willing to take the long term projections as given, but in a system like this with reflexive dynamics on token price, the long term could be seriously undermined by a short term feedback loop. A 3-6 month ramp on the maximum sector duration/multiplier could significantly mute any unpredicted dynamics. Denying multiplier on extension of existing sectors would also constrain any such effects. Or I’d welcome other solutions. Action: Analyse and show best version of a ramp on the multiplier. Analyse and show best version of applying only to new sectors. Show dynamic modelling to demonstrate self-healing behaviour without other mitigations. Rollout shockIf CC sector extensions can enjoy full multiplier, there is a positive feedback loop for one or more large SPs attempting to gain a dramatic increase in power. A provider/consortium that did have the capital could pack blocks with extensions and censor extensions of other providers. If they gain any momentum, their increased power would increase the rate at which they could pack blocks and the effectiveness of censoring others: a positive feedback loop that increases the effectiveness of their attack. This is independent of the consensus risk analysed and noted below. I think this scenario is less likely than the one above in which onboarding decreases, but “less likely” isn’t an appropriate level of assurance for a billion-dollar blockchain. Rollout shock would be effectively prevented by a ramp on the maximum sector duration/multiplier. Or I’d welcome other solutions. Action: Analyse and show best version of a ramp on multiplier. Develop alternative solutions to consensus risk due to rollout shock. Moving towards proof-of-stake securityThis proposal shifts the basis for consensus power sharply towards money rather than physical storage. I am not comfortable that PoS networks are sufficiently validated as a secure foundation for trustless collaboration (although eagerly await learnings over the next few years as Ethereum and other networks mature). This seems to be an unintentional side-effect of the proposal; it’s certainly not stated as a goal nor invited as a topic for discussion. I wish there were proposals for ways to achieve the goals of stability and predictability without relying so much on stake.

Underestimating a complex adaptive systemFilecoin is a complex adaptive system. It is not generally possible to predict the effect of some changes to the system, because second- or third-order effects might dominate and agents will change their behaviour in response to a changing environment. There is non-trivial risk that the system has been mis-characterised. Changes aimed at stability could end up reducing network stability, or increasing fragility. Perhaps the storage commitments will be more stable, but the system more vulnerable to external shocks? Perhaps stable profits will deceive SPs, and they’ll take less risk-mitigation measures as a result? How would a major SP failure affect the network perception? How does this compare with a simple POW system, which is less stable but more anti-fragile? We can’t predict these, and the authors have stayed clear of predicting any outcomes (see uncertain system dynamics and rollout shock, above). But working with such a system requires a “probe, sense, respond” engagement rather than a “sense, analyze, respond” approach that would suit a complicated but predictable system. This proposal seems like a significant step change based on a belief that the system is understandable. There is some risk of an adverse outcome. The authors have justified the large step change with (paraphrasing) “SPs need stability, we don’t want to change often”, but also downplayed with risk with “we can change it later if it doesn’t work out”. Pick one. A more incremental approach, or at least a ramped rollout, could help buffer us from getting it wrong. Nevertheless, I don’t consider this a blocking issue, just a pre-mortem. Buying an expensive optionThis proposal achieves stability by inducing SPs to make longer commitments. The network essentially pays the SP a premium to give up the option of dropping a sector. (The SP can pay termination fee to buy the option back). 5x reward seems like a very expensive option. We don’t know whether this scale of incentive is necessary to shift the average commitment duration higher (i.e what the right price for the option is). The authors have offered no analysis of multiplier slopes below 1.0 so the community have no ability to compare the projected outcomes. The one-shot nature leaves little scope for “price” discovery. The size and step-nature of the change introduce many of the risks above. I don’t consider this blocking, just an unfortunate over-payment. Weak justification for raising minimum sector durationThe proposal raise the minimum sector commitment from 6 months to 1 year. While it does align with the goals, there’s no evidence it’s necessary after introducing a massive incentive to longer durations. The only argument for this that I think holds any water is the ethos one: “because we think it’s right”. Arguments that sectors expiring every six months need to find new sealing power to compensate are flawed: a 6-month sector can be extended without resealing. Arguments about client demand are similarly orthogonal to the issue. I don’t consider this blocking, just unnecessary rules that exclude a market segment. Missing concrete numbers for pledge, reward, etcSPs have requested concrete numbers for the pledge, day reward etc derived from the network conditions today. The proposal should show the current values, and the values immediately after the proposal was adopted, and, if relevant, the range of values as they would change in the future. This is a reasonable request from SPs which should be answered. The PCD values are already given. Action: Give actual numbers in the FIP Closed-source modelling and simulationThe FIP authors have presented some analysis documents, including charts of projections and simulations. They have not provided the code for these models so no-one in the community can check their correctness, or use them to answer questions other than the ones that the authors wish to publish. The authors are understandably reluctant to present projections that have anything to do with token price, but others can use their code to make their own. The source code for and data inputs to analysis should be provided to network participants to verify. Preferably checked into the FIPs repo. Resolved or non-issuesThe following are issues that have been brought up, but I think are adequately addressed already.

|

Beta Was this translation helpful? Give feedback.

-

|

Arock supports the FIP. We believe that it benifits the Filecoin ecosystem. The FIP is not forcing Fil miners to stake/pledge more FIL, just an option to do so, and it is rewarding miners that are locked in for a longer period. But we should adjust the rewarding system to scale according to amount of stake and duration of the sector, with a proper formula, rather than a fixed multiplier. FIL+ locking period is not decided by miners, data providers will define how long it should be stored. With the multiplier, there will be more long term real data storage demand, more LDN application, less notary collusion. From my personal point of view, this proposal should be approved as early as possible but implemented after the FVM upgrading. We expect that there will be some DeFI dapps on chain once it is supported, for FIL holders to lend, and for miners to borrow FIL to pledge, with an open interest rate for everyone to calculate and make decision. It could also benifit the actual network utilization. FVM upgrading, retrieval, CDN market and other development in near future need a stable network and FIL price. Less token circulation in current market situation will be more friendly for user adoption. |

Beta Was this translation helpful? Give feedback.

-

|

Sharing a conversation I had with SPs. I'm not a SP. I am just a community member, who is 100% devoted to the growth of Filecoin.

|

Beta Was this translation helpful? Give feedback.

-

|

We open sourced our model here (https://github.com/lyswifter/FIP36_simulation-mild_growth_assumption) to simulate Filecoin network dynamics post FIP36, specificly what’s the SP’s ROI looks like at any time of points in next 6 years by assuming The ROI doesn’t include operation and hardware costs, nor gas fees because that’s variant SP by SP, it’s just fil based return, concretely, 365 days of block reward divides pledge, you need to dedicate the gas fee, collateral and fiat cost from the aggregated block reward by yourself based on your own cost structure. In short, you might see much lower ROI in your real business operation than the model tells you. This model is written by python Jupiter notebook, if you don’t have experience but still want to try it, you can download Anaconda and use “jupyter notebook” command to start it, and you will find tons of online guides to make the learning curve not intimidate at all. Caveat! This notebook should not be viewed as financial decisions by any means, there might be defects of simulating Filecoin consensus or false assumptions of network parameters and etc. Although it’s worth to mention that with two months of emulation from Jun 17 to Aug 22, it’s pretty close between the model output and network data (block rewards and circulation). Again, you are free to modify any part of the model, especially the part in “## Assumptions we can modify” code block, and re-run the notebook to check how that impact SP’s ROI. By changing these assumptions and compare the results, we have observations as below: 1, SP ROI will continue to drop and will be in below 20% fil based APY range after FIP36 Since this APY is only about (block reward)/pledge, so with 20% to 30% fil-based APY SP will enter “bleeding zone”), assuming in real operation, SP still need to deduce the cost of collateral(30%ish loaning rate at this moment) cost of gas (0.6% of pledge for 50x sector to 30% of pledge for 1X sector), hardware and datacenter cost, fixed cost (team, network, etc) Based on above 4 observations, we infer that Advise: If you see any discrepancies between this model and the Filecoin consensus, or suggestions to improve the model, please let me know. |

Beta Was this translation helpful? Give feedback.

-

Filecoin Network Macro Commentary

|

Beta Was this translation helpful? Give feedback.

-

|

If PL and FF had generated meaningful demand for the product through functionality, stability and customer engagement then we would not have this problem. Fixing circulating supply issue artificially through market manipulation at the expense of SP's is not the solution. The only winners here are those holding massive amounts of FIL, the Filecoin Foundation, Protocol Labs and their direct investors. If PL was not selling down / distributing their massive interest in FIL then perhaps the price would have held up a little better before today. |

Beta Was this translation helpful? Give feedback.

-

|

The support for this FIP will come down to how it will be deployed day 1 and the clarity of goals/ outcomes. |

Beta Was this translation helpful? Give feedback.

-

|

It's been a long time since we had such a lively debate. |

Beta Was this translation helpful? Give feedback.

-

|

After the great infrastructural leap forward, the secondary market has seen a large number of equipment sold off. The current market conditions are such that every de-encapsulation of physical data is essentially an increase in fixed expenditure. There is a situation where the more you encapsulate, the more you lose. For every 1TB of data encapsulated, there are electricity costs, maintenance costs and software maintenance costs. This is a calculation that is better than not expanding in size. However, by retaining the current scale, we are unable to expand our profitability fundamentals. It is a game dilemma. The launch of FIP-421 breaks the current dilemma. Effective combination of capital flexibility and stockpiling of assets is utilised. Realised performance of SP on ecologically bullish long-term options while adjusting for secondary market idle capital. Lay the foundation for long term development of FIL Eco. We are in favor of this FIP |

Beta Was this translation helpful? Give feedback.

-

|

It's a very weak move, trying to use an economic method to cover the failure of building ecology/applications. Filecoin fails to attract clients/users to onboard their data onto mainnet. That's the reason why sectors growth is sluggish. The only way to solve this problem is to give more effort/reward to build the ecology, a popular application will be much more impactful to FIL price than a Ponzi FIP. TBH, even at this price, SP can still make a profit if sealing 100% FIL+ deals. SPs who spend too much on sealing machines and can not seal FIL+ deals are suffering. Those SPs are not here to provide storage service but make quick money, and they are leaving. That's not a bad thing for the community in the long run. Also, a 5-year pledge from now ensures Filecoin foundation and PL buyers of unfinished products. It won't be good stimulation for these 15% FIL holders who are also the main contributor. Onboard FVM, build applications and attract more users, that's what we should do. |

Beta Was this translation helpful? Give feedback.

-

|

The FIP Authors for FIP0036 have submitted a new PR, based on ongoing community feedback. In order to support discussion around this draft, and for ease of access, this thread will be locked. For updates and continued community conversation, please feel free to weigh in on the updated thread. |

Beta Was this translation helpful? Give feedback.

-

Authors: @AxCortesCubero, @jbenet, @misilva73, @momack2, @tmellan, @vkalghatgi, @zixuanzh

Important Notice! Taking into account many of the points raised regarding SP preferences and general community feedback, we propose revising two key elements of the proposal

Please see here for further information.

Overview

Simple Summary

Problem Motivation

Currently, storage providers do not receive any additional compensation or incentive for committing longer term sectors (whether that be CC or storage deals) to the network. The protocol places equal value on 180 to 540 day sectors in terms of storage mining rewards. However, in making an upfront commitment to longer term sectors, storage providers take on additional operational risks (more can go wrong in a longer time period), and lock rewards for longer. Furthermore, in committing longer term sectors/deals, storage providers demonstrate their long-term commitment to the mission and growth of the Filecoin Network, and are more aligned with client preference for persistent storage. Therefore, the added value of longer-term sector commitments, coupled with the compounded operational/liquidity risks storage providers incur for longer term sectors should be compensated for in the form of increased rewards.

From a macroeconomic perspective, incentives to seal for longer durations affect the circulating supply dynamics of the network, since collateral is locked for longer. As the network exists in its current state, the percentage of FIL locked on the network is more likely to decline. This FIP looks to introduce more favorable percentage locked value dynamics, while simultaneously ensuring that this increase in locking contributes to network utility, stable circulating supply dynamics, and SP profitability and optionality.

Per the economic preference to increase the percentage value locked, we also propose adjusting the Initial Consensus Pledge Mutliplier to 40%. The intention is to create long-term aligned total value locked (TVL) dynamics to support stable and predictable conditions for storage provider (SP) returns. We further discuss the problem/change motivation, and explore impacts on SP profitability and network macroeconomics in the CEL analysis brief here.

The motivation to increase the minimum and maximum sector durations is decreased sector turnover and improved network stability. Given that the network expects to grow, having sectors that expire every 6 months means that the network potentially needs to find new sealing throughput to compensate for the loss of power from expiration. This hinders the network as it continues to scale.

Another perspective is that block rewards are high now but exponentially decreasing, and these high early rewards should be used to incentivize participation that’s long-term aligned. 6 months is not long-term. In particular it's short over the scale we need stability in the supply dynamics. Increasing the minimum duration from 6 months to 1 year doubles the minimum level of commitment, and smooths out locking dynamics by stretching inflow-outflow over a longer time period, all while impacting relatively few storage providers as sector durations for CC and FIL+ are both substantially above the minimum on average.

Finally, the new maximum limit of 5 years gives SPs the option to express a long-term commitment to the network which was previously not possible with the maximum sector duration length of 540 days, and also receive commensurate rewards.

Specification

Sector Duration Multiplier

The current sector quality multiplier follows from the spec here. The notion of Sector Quality distinguishes between sectors with heuristics indicating the presence of valuable data.

Sector Quality Adjusted Power is a weighted average of the quality of its space and it is based on the size, duration and quality of its deals.

The formula for calculating Sector Quality Adjusted Power (or QAP, often referred to as power) makes use of the following factors:

dealSpaceTime: sum of theduration*sizeof each dealverifiedSpaceTime: sum of theduration*sizeof each verified dealbaseSpaceTime(spacetime without deals):sectorSize*sectorDuration - dealSpaceTime - verifiedSpaceTimeBased on these the average quality of a sector is:

The Sector Quality Adjusted Power is:

Proposed Protocol Change:

Introduce a multiplier based on sector duration

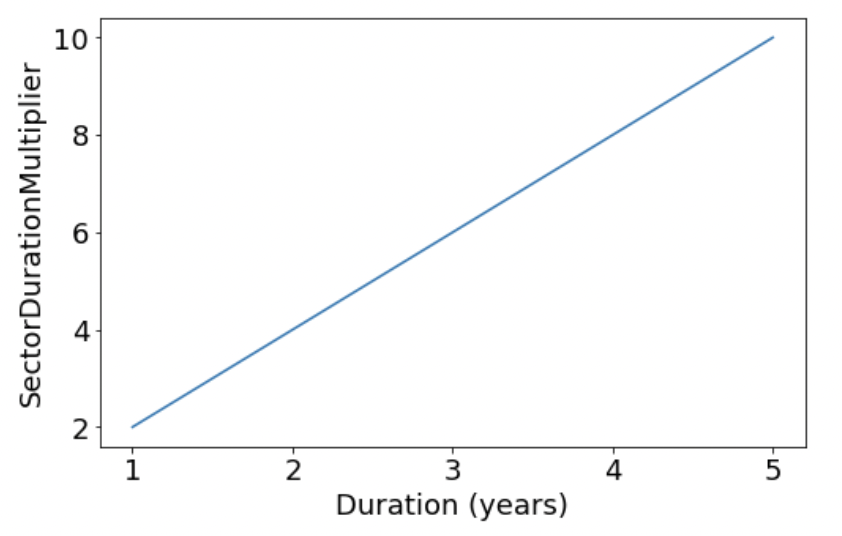

This SectorDurationMultiplier function proposed is linear with slope 2. See below for the function proposed.

The rationale to select this linear slope 2 function is based on a principle that the selected parameters should maximize the effectiveness of the duration incentive, subject to SP’s collateral availability constraints, while taking into account micro and macroeconomic consequences with minimal added implementation complexity. Further analysis/simulation is shown in the analysis brief CEL prepared linked above.

Therefore, the new suggested Sector Quality Adjusted Power is:

Change to Minimum Sector Commitment

We propose a minimum sector commitment of 1 year (360 days). This is a 180-day increase from the current minimum of 6 months (180 days). This will not change the mechanics of sector pre-commit and proving, it will just adjust the minimum sector commitment lifetime to 1-year.

Change to Maximum Sector Commitment

We propose a maximum sector commitment of 5 years. This is an increase from the current maximum sector commitment of 540 days. Note, the protocol currently sets a maximum sector lifetime to 5 years (i.e sectors can be extended up to 5 years). This FIP would not adjust that. So, the maximum sector commitment of 5 years would now equal the maximum sector lifetime. Therefore, upon sector-extension, the maximum sector-extension of up to 5-years remains the same.

Change to PreCommitDeposit

With this FIP, sectors can get higher quality and expect higher expected rewards than currently possible. This has an impact on the value of the PreCommit Deposit (PCD). From the security point of view, PCD has to be large enough in order to consume the expected gain of a provider that is able to pass the PoRep phase with an invalid replica (i.e. gaining block rewards without storing). The recent FIP0034 sets the PCD to 20 days of expected reward for a sector of quality 10 (max quality). We now need to increase this to 20 days of expected reward for a sector of quality 100 (the new max quality) to maintain the status quo about PoRep security.

Initial Pledge Calculation

The change we propose to status quo Initial Pledge Calculations is the change to the SectorInitialConsensusPledge calculation as detailed below.

The protocol defines Sector Initial Pledge as:

Currently,

We propose changing the calculation to a multiplier of 50%:

Impact on Fault and Termination Fees

We currently propose no change to status quo Fault and Termination Fee calculations. Fees continue to be based on expected daily block rewards. In the future it may be valuable to re-examine the 90 day duration for the termination fee.

Design Rationale

Supporting Longer-Term Commitments

The current maximum commitment of 1.5 years limits the ability for SPs to make a long-term commitment to the network (or get rewarded for it). We expect that increasing the maximum allowable commitment of 5 years, while also introducing thoughtful incentives to seal sectors for longer, can increase the stability of storage and predictability of rewards for SP’s. This is further discussed in the sections below.

Incentivizing Longer Term Commitments

Longer term commitments are incentivized by a rewards multiplier. The multiplier increases the amount of FIL expected to be won per sector per unit time based on the duration the sector is committed for.

The proposed rewards multiplier is linear in duration. This means sectors recieve rewards at a rate linearly proportional to duration.

Example:

The rationale is that operational burden and risk to storage providers increases with duration, and it is fair that they’re commensurately rewarded for this.

To maintain protocol incentives that are robust to consistent storage, the amount of collateral temporarily locked for the duration of the sector must also increase. Sector sealing gas costs do not increase with the multiplier. This means longer durations have higher capital efficiency, which further incentives longer commitments.

The form of the duration incentive multiplier is linear with slope 2. The factors behind this specific design choice to incentivize longer commitments are:

Refusing Shorter-Term Commitments

Currently the minimum sector duration is six months. A new minimum duration of one year is proposed. The rationale is based on three factors:

Furthermore, there is empirical evidence from the duration of sectors sealed that most storage providers support sectors greater than one year. Increasing the minimum from six months to one year will discourage only the most short-term-aligned storage providers.

Improving Stability of Rewards

A stable investing environment is needed to support long-term storage businesses. A high double-digit percentage return on pledge locked is not sufficient alone. To this end a sustained and substantial amount of locked supply is also needed.

In reality the percentage of available supply locked has been decreasing since September 2021. While current token emission rate is exponentially decreasing with time, the percentage of available supply locked is expected to continue to decline, at least until the linear vesting schedule completes, based on current locking inflow-outflows and network transaction fees.

This environment can be improved however. The first way to improve it is by increasing the 30% multiplier in the InitialConsensusPledge to 40%. This is a moderate increase that provides a solid long-term improvement in percentage of available supply locked. The second way is a corollary of the duration multiplier incentive. Longer sectors mean collateral is locked for longer. All else equal, at equilibrium this means the total amount of locked collateral is consistently higher. Simulations confirm both effects together can target a percentage of available supply locked that is sufficiently high and sustained to substantially improve the long-term storage business environment. See Supplementary Information for a detailed summary of the supporting simulation analysis

Rebalancing SP Profitability

Return on investment from pledged collateral provided by the storage rewards are currently substantial, with Filecoin-denominated returns in high double digits. Yet Filecoin-denominated returns are only part of what is needed to support successful long-term storage.

Simulations indicate a better balance between current and future rewards can be achieved through the proposed changes. The proposals adjust the Filecoin-denominated minting-based returns to a more sustainable level in the immediate term, while the long-term trajectory is unchanged. This enables improving the percentage locked supply to stabilize the business environment for long-term network success. See Supplementary Information for further details for percentage return on invested collaterals from mining reward.

Impact on Initial Pledge

The initial pledge per raw byte power will increase. This is by design. It intends to increase the percentage of available supply locked.

The initial pledge per quality adjusted power, which is the relevant measure for storage provider’s return on pledge invested, may be marginally higher than current to begin with, but will decrease with time. See Supplementary Information for plausible trajectories across different new average duration scenarios.

Impact on Pre-Commit Deposit

FIP-0034 sets the pre-commit deposit to a fixed value regardless of sector content. From the security point of view, PCD has to be large enough in order to cover the expected gain of a provider that is able to pass the PoRep phase with an invalid replica (i.e. gaining block rewards without storing). The recent FIP0034 sets the PCD to 20 days of expected reward for a sector of quality 10 (max quality). We now need to increase this to 20 days of expected reward for a sector of quality 100 (the new max quality) to maintain the status quo about PoRep security.

As of end of July 2022, the calculations are roughly:

Note:

Backwards Compatibility

This policy would apply at Sector Extension and Upgrade for existing sectors.

Test Cases

N/A

Security Considerations

Risks of Faulty Proof-of-Replication

The existing 1.5 year sector duration limit in effect provides a built-in rotation mechanism that can be used to turn over power in the event we discover a flaw in PoRep. Increasing the maximum commitment to 5 years weakens this mechanism. Alternative policies have been suggested. This is something the community must be aware of and agree on.

Risks to Consensus

The proposed rewards multiplier increases potential risk to consensus. The main consideration is how long it would take for a colluding consortium of storage providers to exceed threshold values of consensus power.

Analysis indicates a malicious consortium would need consistent access to high levels of FIL+, and near-exclusive access to the maximum rewards multiplier, for a substantial period of time, for a viable attack.

Example:

The network currently has 18 EiB of quality adjusted power.

Consider the scenario of 50 PiB/day onboarding, with 5% attributed to FIL+, and that this is sustained for several months.

Now if the malicious consortium can acquire 50% of FIL+ deals and commit sectors for 5 years to gain the maximum duration multiplier, and all other storage power maintain the lowest possible duration sectors of 1 year, then in a single day, the adversarial colluding group is expected to gain 0.7% of consensus power. This follows from:

where

advFILplusPctis the fraction of FILplus deals available that are acquired by the adversary,FILplusMultiplieris the 10x FIL+ power multiplier,durationMultiplieris the maximum 5 year duration multiplier (5 * 2),powerOnboardingis the byte power onboarded, andFILplusPctis the fraction of the power that is FIL+.If this scenario is maintained, the adversarial group is expected to exceed 33% of consensus power within 140 days.

Factors that mitigate this risk are that it’s unlikely a single group could achieve 50% of FIL+ power consistently, and unlikely that the adversarial group exclusively takes up the longer duration sectors with enhanced power multipliers.

A limitation is that the above calculation assumes the malicious party is starting from 0% of consensus power. If they already control 10%, time to 33% is reduced to approximately 100 days.

Rollout Shock

Rollout shock could occur if SPs race to extend their commitments and gain a further 10x multiplier. This could be mitigated by gradually increasing the maximum multiplier 1x to 5x during an initial period (e.g. first three months)

Product & Incentive Considerations

As discussed in the problem motivation section, this FIP introduces incentives to further align the cryptoeconomic schema of the Filecoin Network with intended goals of the network to provide useful and reliable storage. We introduce the idea that longer term sectors represent a long-term investment and commitment to the Filecoin ecosystem, and therefore should be rewarded proportionally with greater block reward shares.

Note, we also introduce the possibility for storage providers to receive additional multipliers from committing CC for longer. Even this has added value insofar as it represents a commitment to the ecosystem long term that should be rewarded.

From a product perspective, we see strong support for a network more aligned with longer-term stable storage. From a recent (< 3 week old) snapshot of all LDN applications, the responses fall into the buckets below. Almost half (47%) of all applicants want long-term or "permanent" storage.

We recognize that this proposal may not align with a small fraction of SP’s who exclusively prefer shorter commitments to the network, but contend that from an ecosystem perspective, this policy on aggregate makes most participants better off. Note, regular deals can still be accepted for less than sector duration, so there should be minimal loss to flexibility for onboarding clients.

For smaller SP’s, introducing this policy could help improve their competitiveness and ability to capture network block rewards, Under this proposal, returns on tokens put up as collateral scale linearly for all SP’s (regardless of size), whereas only larger ones are able to take advantage of economies of scale for hardware. This proposal, if anything, should benefit smaller SP’s because they can still get rewards boost/multipliers without prohibitively expensive hardware costs, and termination risks associated with FIL+ data.

Implementation

TBD

Beta Was this translation helpful? Give feedback.

All reactions